Answered step by step

Verified Expert Solution

Question

1 Approved Answer

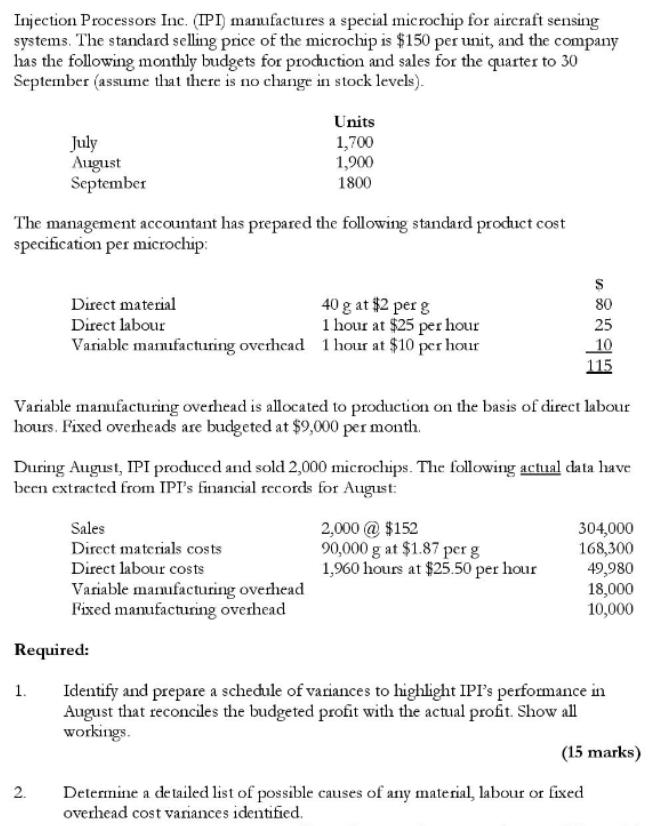

Injection Processors Inc. (IPI) manufactures a special microchip for aireraft sensing systems. The standard selling price of the microchip is $150 per unit, and

Injection Processors Inc. (IPI) manufactures a special microchip for aireraft sensing systems. The standard selling price of the microchip is $150 per unit, and the company has the following monthly budgets for procuction and sales for the quarter to 30 September (assume that there is no change in stock levels). Units July August September 1,700 1,900 1800 The management accountant has prepared the following standard product cost specification per microchip: 40 g at $2 per g 1 hour at $25 per hour Variable mamufacturing overhcad 1 hour at $10 per hour Direct material 80 Direct labour 25 10 115 Variable manufacturing overhead is allocated to production on the basis of direct labour hours. Fixed overheads are budgeted at $9,000 per month. During August, IPI produced and sold 2,000 microchips. The following actual clata have been extracted from IPI's financial records for August: 2,000 @ $152 90,000 g at $1.87 per g 1,960 hours at $25.50 per hour Sales 304,000 168,300 49,980 18,000 10,000 Direct materials costs Direct labour costs Variable manufacturing overhead Fixed manufacturing overhead Required: Identify and prepare a schedule of variances to highlight IPI's performance in August that reconciles the budgeted profit with the actual profit Show all workings. 1. (15 marks) Determine a detailed list of possible causes of any material, labour or fixed overhead cost variances identified. 2.

Step by Step Solution

★★★★★

3.52 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

1 Flexible Budget Performance report is shown as follows Amounts in Injection Processors Inc Flexible Budget Performance Report For the quarter Ended September 30 1 2 13 3 4 35 5 Budget Amounts Per Un...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started