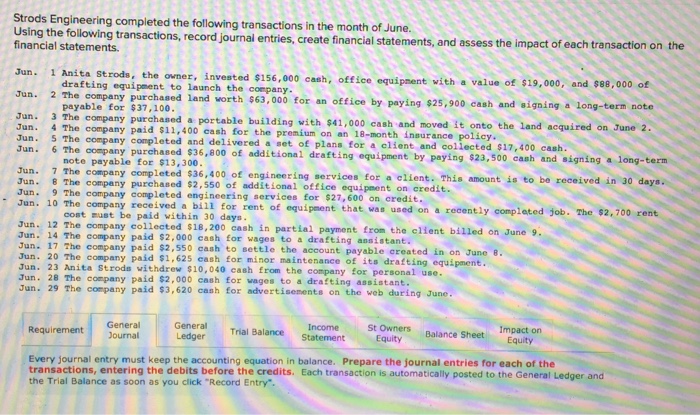

g completed the following transactions in the month of June. Using the following transactions, record financial statements journal entries, create financial statements, and assess the impact of each transaction on the Jun. 1 Anita Strods, the owner, invested $156,00 0 cash, office equipment with a value of $19,000, and $88,000 of drafting equipment to launch the coepany payable for $37,100 The company paid $11,400 cash for the premium on an 18-month insurance poli parchoa.d land worth 963,000 for an oftice bypy ng 925,900 cash and aigning a long-term note Jun. 2 The Jun. 3 The Jun. 4 Jun. S The Jun. 6 The company purchased a portable building with $41,000 cash and moved it onto the land acquired on June 2 company completed and delivered a set of plans for a client and collected $17,400 cash company purchased $36,800 of addi tional drafting equipment by paying $23,500 cash and signing a long-term ring services for a client. This amount is to be received in 30 days. note payable Eor $13,300 Jun. 7 The company comp Jun. 8 The company purchased $2,550 of additional office equipment on credit. un. 9 The company completed engineering services for $27,600 on credit. company received a bi11 for rent of equipment that was used on a recently complated job. The 52,700 rent cost must be paid within 30 days The company collected $18,200 cash in partial payment from the client billed on June 9. Jun. 14 The company paid $2,000 cash for wages to a drafting assistant. Jun. 17 The company paid $2,550 cash to settle the account payable created in on June 8. Jun. 20 The company paid $1,625 cash for minor maintenance of its drafting equipment. Jun. 23 Anita Strods withdrew $10,040 cash from the company for personal use. Jun. 28 The company paid $2,000 cash for vages to a drafting assistant. Jun. 29 The company paid $3,620 cash for advertisements on the web during June St Owners Balance Sheet Equity General Trial Balance Statement Ledger Income Requirement General Every journal entry must keep the accounting equation in balance. Prepare the journal entries for each of the transactions, entering the debits before the credits. Each transaction is automatically posted to the General Ledger and the Trial Balance as soon as you click "Record Entry