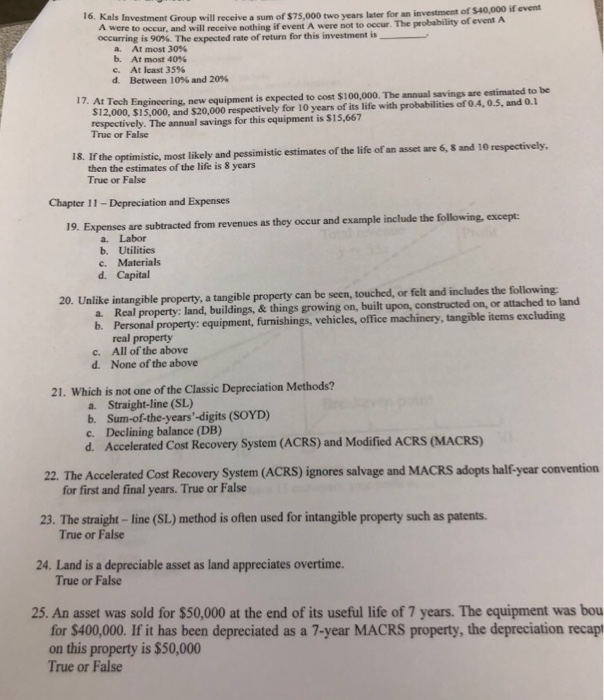

Kals Investment Group will receive a sum of $75,000 two years later for an investment of $40,000 if event occurring is 90%The expected rate ofretum for this investment is to occur, and will receive nothing if event A were not to occur. The probability of event A a. b. c. d. At most 30% At most 40% At least 35% Between 105' and 20% At Tech Engincering, new equipment is expected to cost $100,000. The annual savings are estimated to be $12,000, $15,000, and $20,000 respectively for 10 years of its life with probabilities of 0.4, 0.5, and o.1 respectively. The annual savings for this equipment is $15,667 17. True or False 18. If the optimistic, most likely and pessimistic estimates of the life of an asset are 6, 8 and 10 respectively. then the estimates of the life is 8 years True or False Chapter 11-Depreciation and Expenses 19. Expenses are subtracted from revenues as they occur and example include the following, except: a. Labor b. Utilities c. Materials d. Capital 20. Unlike intangible property, a tangible property can be seen, touched, or felt and includes the following Real property: land, buildings, & things growing on, built upon, constructed on, or attached to land Personal property: equipment, furnishings, vehicles, office machinery, tangible items excluding real property All of the above None of the above a. b. c. d. 21. Which is not one of the Classic Depreciation Methods? Straight-line (SL) Sum-of-the-years'-digits (SOYD) Declining balance (DB) Accelerated Cost Recovery System (ACRS) and Modified ACRS (MACRS) a. b. c. d. 2. The Accelerated Cost Recovery System (ACRS) ignores salvage and MACRS adopts half year convention for first and final years. True or False 23. The straight- line (SL) method is often used for intangible property such as patents True or False 24. Land is a depreciable asset as land appreciates overtime True or False 25. An asset was sold for $50,000 at the end of its useful life of 7 years. The equipment was bou for $400,000. If it has been depreciated as a 7-year MACRS property, the depreciation recapt on this propert is $50,000 True or False