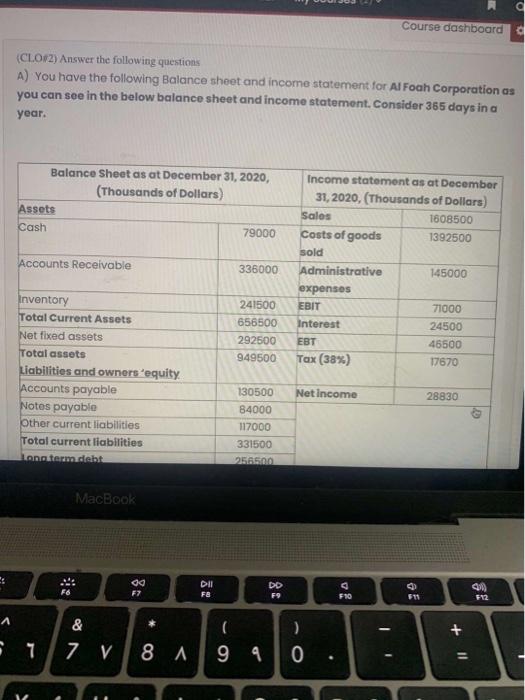

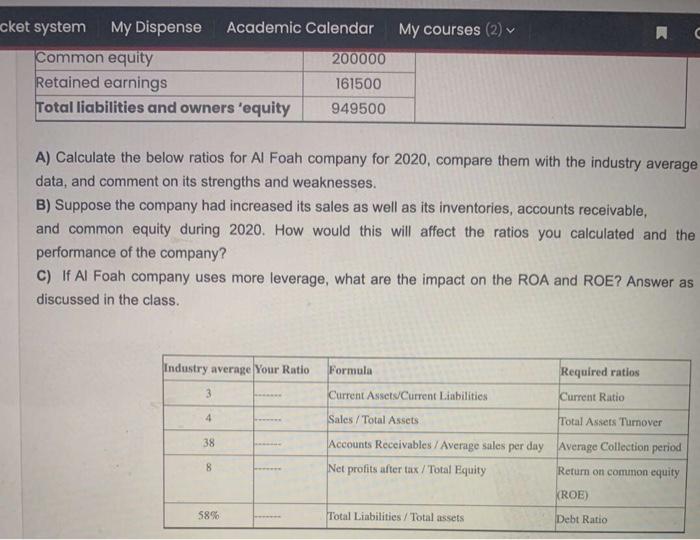

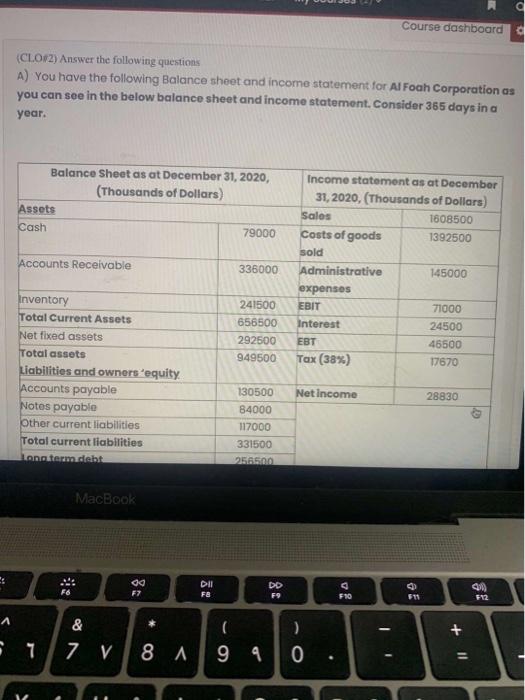

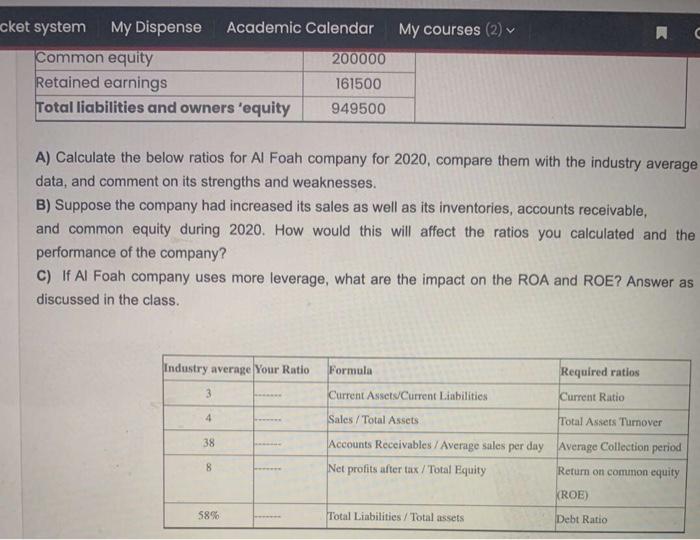

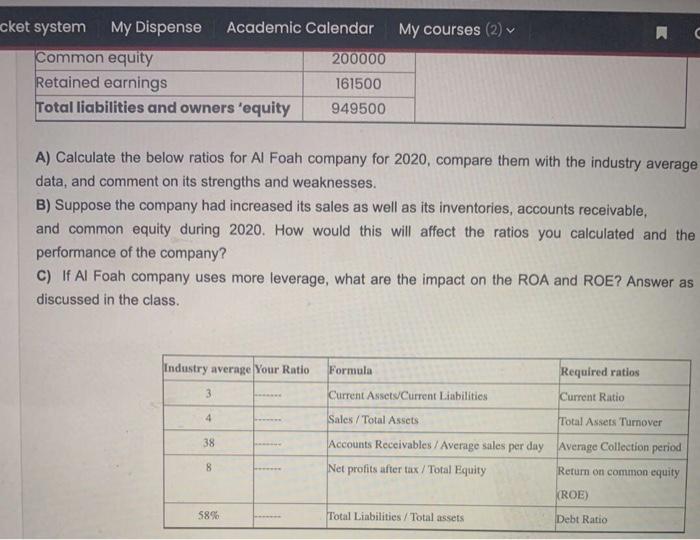

g Course dashboard (CLOF2) Answer the following questions A) You have the following Balance sheet and income statement for Al Foah Corporation as you can see in the below balance sheet and income statement. Consider 365 days in a year. Balance Sheet as at December 31, 2020, (Thousands of Dollars) Assets Cash 79000 Accounts Receivable 336000 Income statement as at December 31, 2020, (Thousands of Dollars) Sales 1608500 Costs of goods 1392500 sold Administrative 145000 expenses EBIT 71000 Interest 24500 EBT 46500 Tax (38%) 17670 241500 656500 292500 949500 Inventory Total Current Assets Net fixed assets Total assets Liabilities and owners 'equity Accounts payable Notes payable Other current liabilities Total current liabilities Lanternet Net Income 28830 130500 84000 117000 331500 2505 MacBook 00 F7 FB DD F9 F10 F12 & 7 V 1 8 A C ) 9 9 0 + 11 . 1 . C cket system My Dispense Academic Calendar My courses (2) Common equity 200000 Retained earnings 161500 Total liabilities and owners 'equity 949500 A) Calculate the below ratios for Al Foah company for 2020, compare them with the industry average data, and comment on its strengths and weaknesses. B) Suppose the company had increased its sales as well as its inventories, accounts receivable, and common equity during 2020. How would this will affect the ratios you calculated and the performance of the company? C) If Al Foah company uses more leverage, what are the impact on the ROA and ROE? Answer as discussed in the class. Industry average Your Ratio Formula Required ratios 3 Current Assets Current Liabilities Current Ratio 4 Sales/Total Assets Total Assets Turnover 38 8 Accounts Receivables / Average sales per day Average Collection period Net profits after tax / Total Equity Return on common equity (ROE) 58% Total Liabilities / Total assets Debt Ratio C cket system My Dispense Academic Calendar My courses (2) Common equity 200000 Retained earnings 161500 Total liabilities and owners 'equity 949500 A) Calculate the below ratios for Al Foah company for 2020, compare them with the industry average data, and comment on its strengths and weaknesses. B) Suppose the company had increased its sales as well as its inventories, accounts receivable, and common equity during 2020. How would this will affect the ratios you calculated and the performance of the company? C) If Al Foah company uses more leverage, what are the impact on the ROA and ROE? Answer as discussed in the class. Industry average Your Ratio Formula Required ratios 3 Current Assets Current Liabilities Current Ratio 4 38 Sales/Total Assets Total Assets Turnover Accounts Receivables / Average sales per day Average Collection period Net profits after tax / Total Equity Return on common equity 8 (ROE) 58% Total Liabilities / Total assets Debt Ratio