Answered step by step

Verified Expert Solution

Question

1 Approved Answer

G Google Canada Revenue A... W wagjag New Tab IELTS TOEFL Vocabu... G does osap Question 13 12 A conventional cash flow is defined as

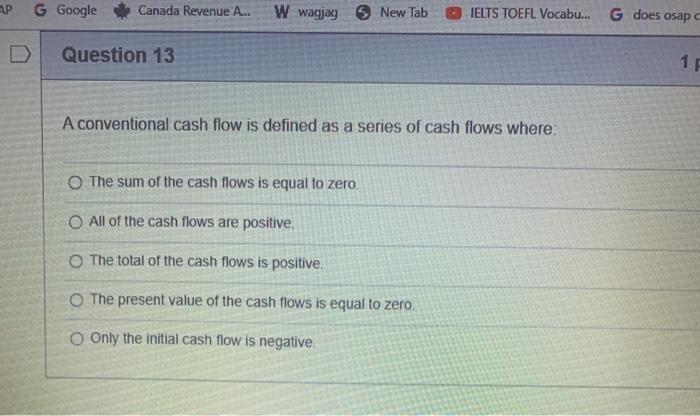

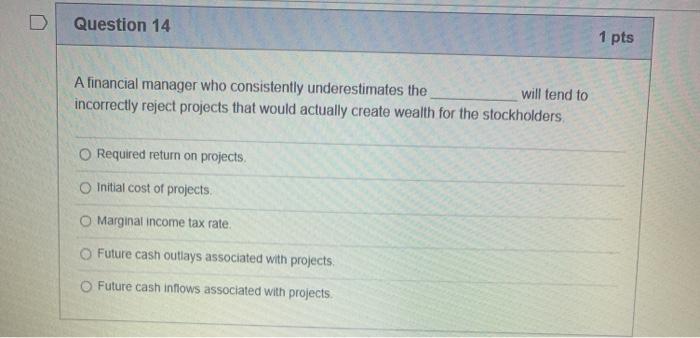

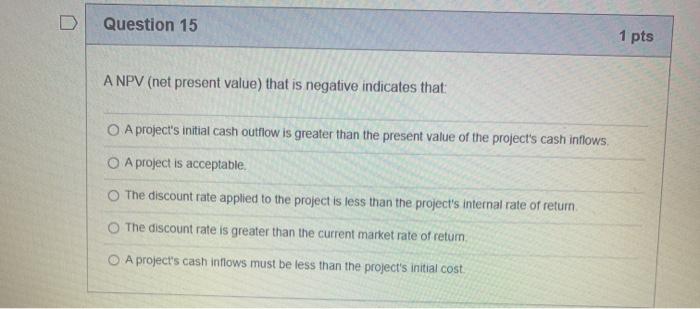

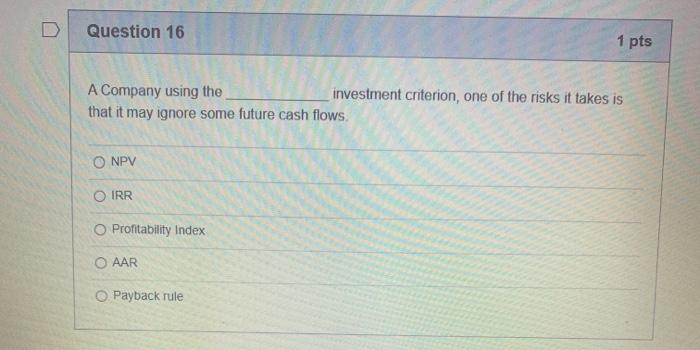

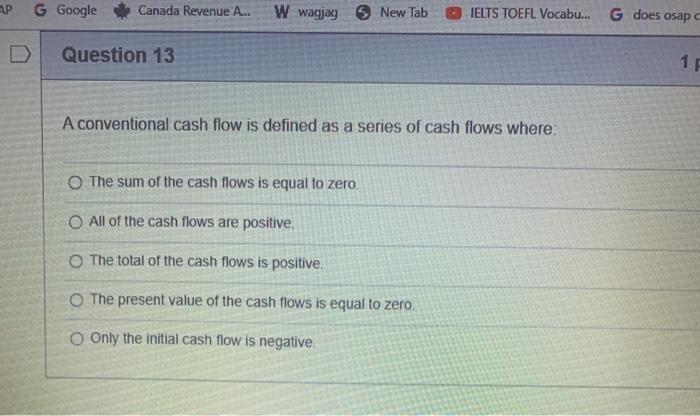

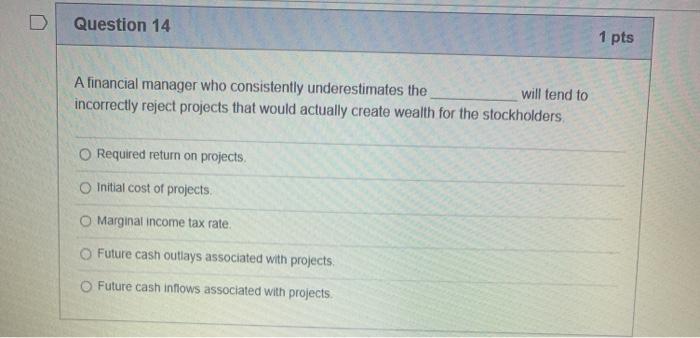

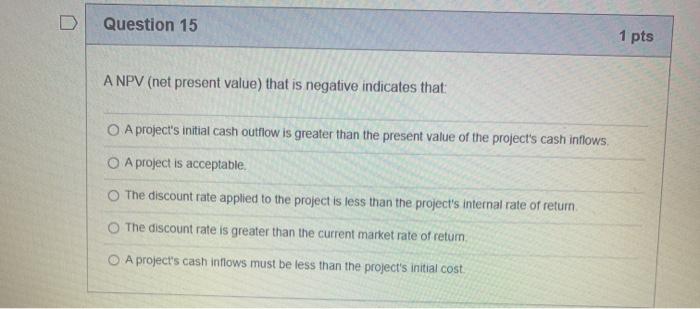

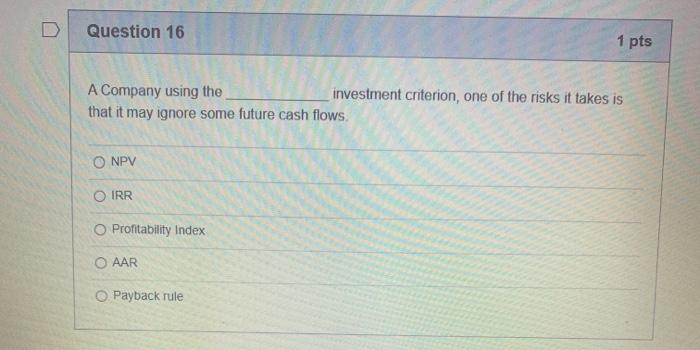

G Google Canada Revenue A... W wagjag New Tab IELTS TOEFL Vocabu... G does osap Question 13 12 A conventional cash flow is defined as a series of cash flows where: The sum of the cash flows is equal to zero. O All of the cash flows are positive, The total of the cash flows is positive. The present value of the cash flows is equal to zero. o Only the initial cash flow is negative Question 14 1 pts A financial manager who consistently underestimates the will tend to incorrectly reject projects that would actually create wealth for the stockholders Required return on projects Initial cost of projects O Marginal income tax rate. Future cash outlays associated with projects, Future cash inflows associated with projects D Question 16 1 pts A Company using the investment criterion, one of the risks it takes is that it may ignore some future cash flows. O NPV IRR O Profitability Index AAR O Payback rule G Google Canada Revenue A... W wagjag New Tab IELTS TOEFL Vocabu... G does osap Question 13 12 A conventional cash flow is defined as a series of cash flows where: The sum of the cash flows is equal to zero. O All of the cash flows are positive, The total of the cash flows is positive. The present value of the cash flows is equal to zero. o Only the initial cash flow is negative Question 14 1 pts A financial manager who consistently underestimates the will tend to incorrectly reject projects that would actually create wealth for the stockholders Required return on projects Initial cost of projects O Marginal income tax rate. Future cash outlays associated with projects, Future cash inflows associated with projects D Question 16 1 pts A Company using the investment criterion, one of the risks it takes is that it may ignore some future cash flows. O NPV IRR O Profitability Index AAR O Payback rule

G Google Canada Revenue A... W wagjag New Tab IELTS TOEFL Vocabu... G does osap Question 13 12 A conventional cash flow is defined as a series of cash flows where: The sum of the cash flows is equal to zero. O All of the cash flows are positive, The total of the cash flows is positive. The present value of the cash flows is equal to zero. o Only the initial cash flow is negative Question 14 1 pts A financial manager who consistently underestimates the will tend to incorrectly reject projects that would actually create wealth for the stockholders Required return on projects Initial cost of projects O Marginal income tax rate. Future cash outlays associated with projects, Future cash inflows associated with projects D Question 16 1 pts A Company using the investment criterion, one of the risks it takes is that it may ignore some future cash flows. O NPV IRR O Profitability Index AAR O Payback rule G Google Canada Revenue A... W wagjag New Tab IELTS TOEFL Vocabu... G does osap Question 13 12 A conventional cash flow is defined as a series of cash flows where: The sum of the cash flows is equal to zero. O All of the cash flows are positive, The total of the cash flows is positive. The present value of the cash flows is equal to zero. o Only the initial cash flow is negative Question 14 1 pts A financial manager who consistently underestimates the will tend to incorrectly reject projects that would actually create wealth for the stockholders Required return on projects Initial cost of projects O Marginal income tax rate. Future cash outlays associated with projects, Future cash inflows associated with projects D Question 16 1 pts A Company using the investment criterion, one of the risks it takes is that it may ignore some future cash flows. O NPV IRR O Profitability Index AAR O Payback rule

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started