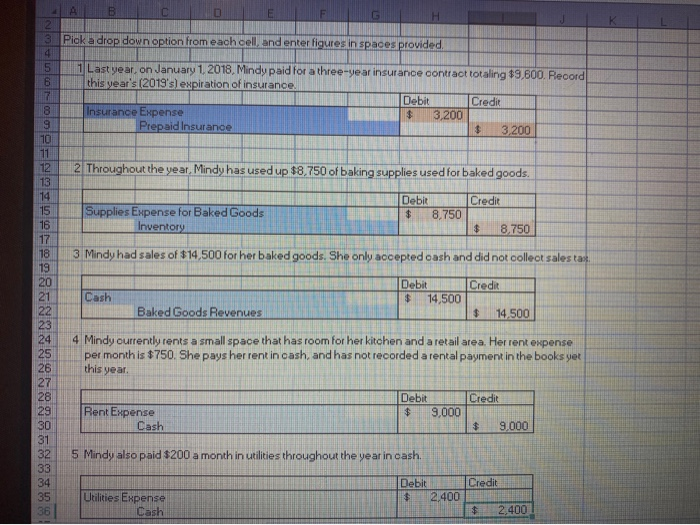

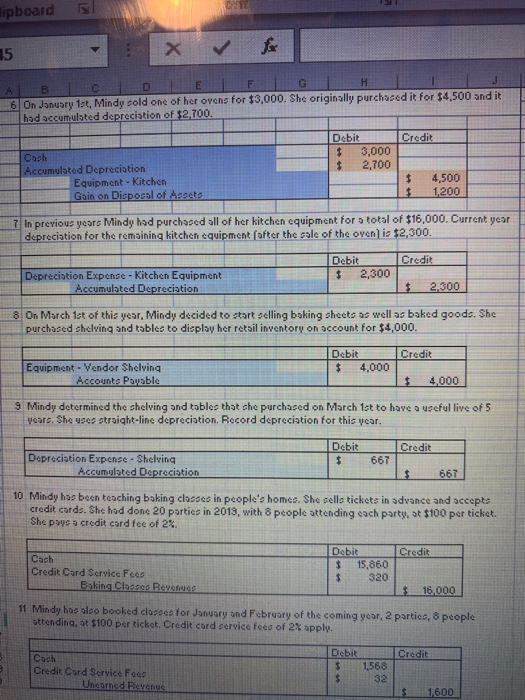

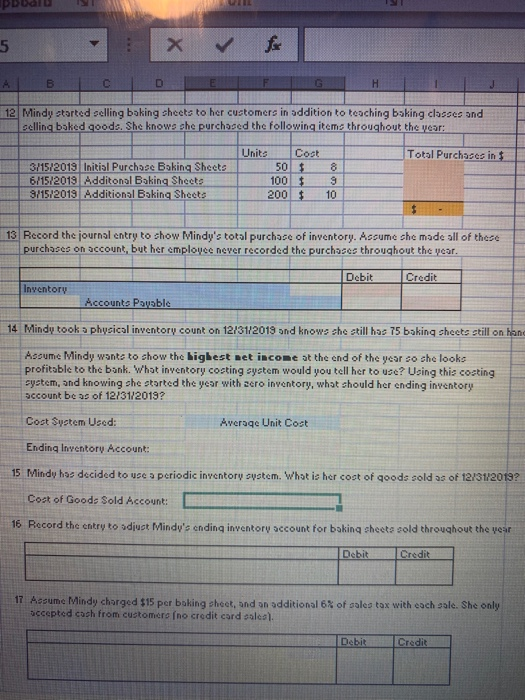

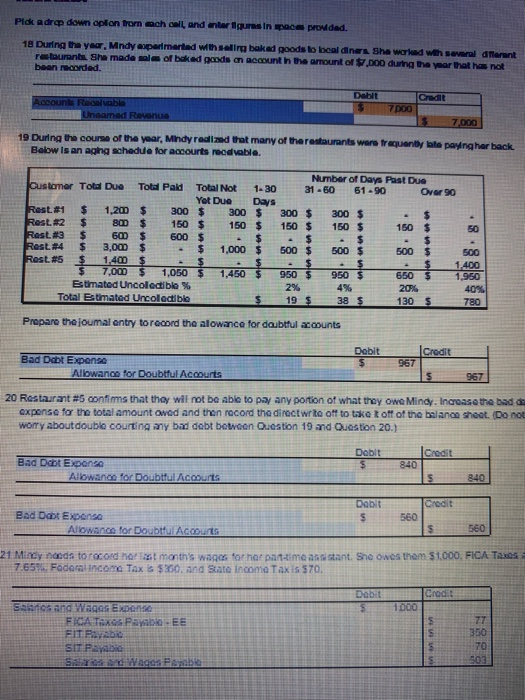

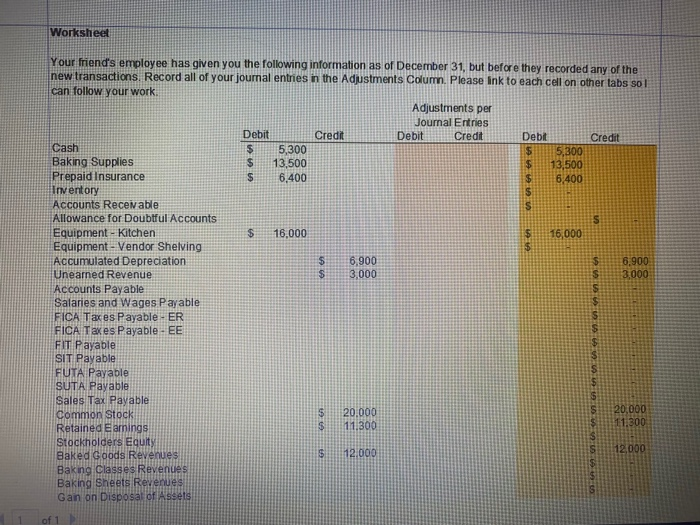

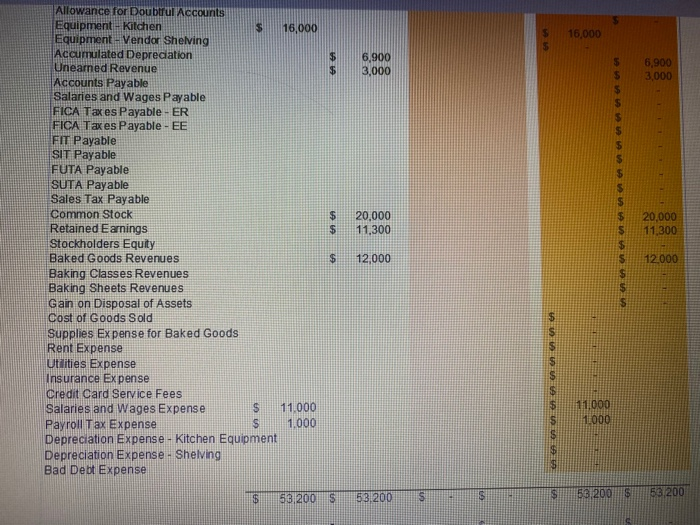

G H 3 Pick a drop down option from each cell and enter figures in spaces provided 1 Last year, on January 1, 2018, Mindy paid for a three-year insurance contract totaling $9,600. Record this year's (2019 slexpiration of insurance. Debit Credit Insurance Expense $ 3,200 Prepaid Insurance $ 3,200 2 Throughout the year, Mindy has used up $8,750 of baking supplies used for baked goods. Credit Supplies Expense for Baked Goods Debit $ 8.750 Inventory $ 8.750 3 Mindy had sales of $14,500 for her baked goods. She only accepted cash and did not colleot sales tas Credit Debit $ 14,500 Baked Goods Revenues $ 14,500 4 Mindy Ourrently rents a small space that has room for her kitchen and a retail area. Her rent expense per month is $750. She pays her rent in cash and has not recorded a rental payment in the books yet this year. Debit Credit Rent Expense $ 9.000 $ 9.000 Cash 5 Mindy also paid $200 a month in utilities throughout the year in cash Debit $ 2,400 Credit... Utilities Expense Cash $ 2,400 lipboard A B C D E F G H I 6 On January 1ot, Mindy sold one of her ovens for $3,000. She originally purchased it for $4,500 and it had accumulated depreciation of $2.700. Credit Debit $ 3,000 $ 2,700 Cash Accumulated Depreciation Equipment - Kitchen Gain on Disposal of Assets $ $ 4,500 1200 7 in previous years Mindy had purchased all of her kitchen equipment for a total of $16,000. Current year depreciation for the remaining kitchen equipment after the sale of the oven is $2,300. Credit Debit $ 2,300 Depreciation Expense - Kitchen Equipment Accumulated Depreciation $ 2,300 8 On March 1st of this year, Mindy decided to start selling baking sheets as well as baked goods. She purchased shelving and tables to display her retail inventory on account for $4,000. Credit Debit $ 4.000 Equipment - Vendor Shelving Account Pausble $ 4,000 9 Mindy determined the shelving and tables that she purchased on March 1st to have a useful live of 5 years. She uses straight-line depreciation. Record depreciation for this year. Debit Credit Depreciation Expense - Shelving Accumulated Depreciation 667 10 Mindy has been teaching boking classes in people's homes. She cells tickets in advance and accepta credit cards. She had done 20 parties in 2013, with 8 people attending each party, at $100 per ticket She pays a credit card fee of 2%. Credit Cash Credit Card Service Fees Baking Classes Revenues Debit $ 15,860 $ 320 $ 16,000 Mindy has also booked classes for January and February of the coming year, 2 parties, 8 people attending at $100 per ticket Credit card service fees of 2% opply. Debit Credit 1568 Coch Credit Card Service Fees Uneorned Bevenue 32 LS1600 X for 12 Mindy started selling baking sheets to her customers in addition to teaching baking classes and elling baked goods. She knows the purchased the following items throughout the year: Total Purchases in 3/15/2019 Initial Purchase Baking Sheets 6/15/2019 Additonal Baking Sheets 9/15/2019 Additional Baking Sheets Units 50 100 200 Cost $ $ $ 8 9 10 13 Record the journal entry to show Mindy's total purchase of inventory. Assume she made all of these purchases on account, but her employee never recorded the purchases throughout the year. Debit Credit Inventory Accounts Payable 14 Mindy took o physical inventory count on 12/31/2019 and knows she still has 75 baking sheets still on Man Adoume Mindy wants to show the highest net income at the end of the year so she looks profitable to the bank. What inventory costing system would you tell her to use? Using this costing cystem, and knowing she started the year with aero inventory, what should her ending inventory account be as of 12/31/2019? Cost System Used: Average Unit Cost Ending Inventory Account: 15 Mindy has decided to use a periodic inventory system. What is her cost of goods sold as of 12/31/2018? Cost of Goods Sold Account: 16 Record the entry to adjust Mindy's ending inventory account for baking sheets cold throughout the year Debit Credit me Mindy charged 15 per baking sheet, and an additional 6% of sales tax with each oslo. She only sccepted cash from customer no credit card sles. Debit Credit Pick adap down oplon from school and intergures in pc powded. 18 During the year, Mndy experimented with selirg baked goods to local diners She worked with several dierent restaurants She made of baked goods an account in the amount of .000 during the year that has not been recorded. D it Credit Account Reanivable Unaamad Revenue 19 During the course of the year, Mindy redintat many of there aurants were frequenby blaenghebos Below is an aging schedule for a courts reedable. Number of Days Past Due 31-60 61-90 Over 90 1-30 Days $ $ 300 $ 150 $ 300 150 $ 150 $ Customer Tota Due Tote Paid Total Not Yet Due Rest. $1 $ 1.20 $ 300 $ 300 Rest. #2 $ 800 $ 150 $ 150 Rest. #3 $ 60 $ 600 $ Rest. #4 $ 3,000 $ $ 1.000 Rest. #5 $ 1.400 57.00 5 140 Btimated Uncolectible % Total Btimated Uncolectible - $ $ 600 $ $ 500 $ 950 500 650 20% 2% 19 $ 38 $ 130 $ Prepare the joumal entry to record the alowance for doubtful accounts Debit Credit 967 Bad Dobt Expense Allowance for Doubtful Acoourts 20 Restaurant #5 confirms that they wil not be able to pay any portion of what they owe Mingy. Increase the bado exponse for the total amount owed and then record the direct to off to take toff of the balance sheet. Do nor worry about double courting many bad debt bewoon Question 19 and Question 20.) Debit Credit Bad Dobt Expanse Allowance for Doubtful Account Bad Dot Expono Allowance for Boubtful Acourts 21 Mindy noods to record hot month's wages for her patime assistant. She owe them 51.000. FICA TAX 7.65 Fodor Income Tax is $360, and State Income Taxis 570. Dobit Credit 1000 Saries and Wages Expo FICATOXOS Pambo Worksheet Your friend's employee has given you the following information as of December 31, but before they recorded any of the new transactions. Record all of your journal entries in the Adjustments Column. Please ink to each cell on other labs sol can follow your work Adjustments per Journal Entries Debit Credit Debit Credit Debe Credit Cash 5,300 Baking Supplies $ 13,500 13,500 Prepaid Insurance 6,400 6400 Inventory Accounts Recenable Allowance for Doubtful Accounts Equipment - Kitchen $ 16,000 16,000 Equipment - Vendor Shelving Accumulated Depreciation 6.900 6,900 Unearned Revenue 3,000 3.000 Accounts Payable Salaries and Wages Payable FICA Taxes Payable - ER FICA Taxes Payable - EE FIT Payable SIT Payable FUTA Payable SUTA Payable Sales Tax Payable Common Stock 20.000 Retained Earnings H 11.300 Stockholders Equity Baked Goods Revenue $ 2.000 Baking Classes Revenues Baking Sheets Revenue Gan on Disposal of 20.000 $ 16,000 6.900 3,000 6,900 3,000 20,000 11,300 20,000 11,300 Allowance for Doubtful Accounts Equipment - Kitchen Equipment - Vendor Shelving Accumulated Depreciation Unearned Revenue Accounts Payable Salaries and Wages Payable FICA Taxes Payable - ER FICA Taxes Payable - EE FIT Payable SIT Payable FUTA Payable SUTA Payable Sales Tax Payable Common Stock $ Retained Earnings $ Stockholders Equity Baked Goods Revenues Baking Classes Revenues Baking Sheets Revenues Gain on Disposal of Assets Cost of Goods Sold Supplies Expense for Baked Goods Rent Expense Utilities Expense Insurance Expense Credit Card Service Fees Salaries and Wages Expense $ 11,000 Payroll Tax Expense Depreciation Expense - Kitchen Equipment Depreciation Expense - Shelving Bad Debt Expense 58 200 $ 12,000 12000 GARAG UA 1.000 53.2005 56,200 $ 53.200