Answered step by step

Verified Expert Solution

Question

1 Approved Answer

G H I A B D E F. You issue a 4 year bond with a face value of $50,000 The coupon rate of the

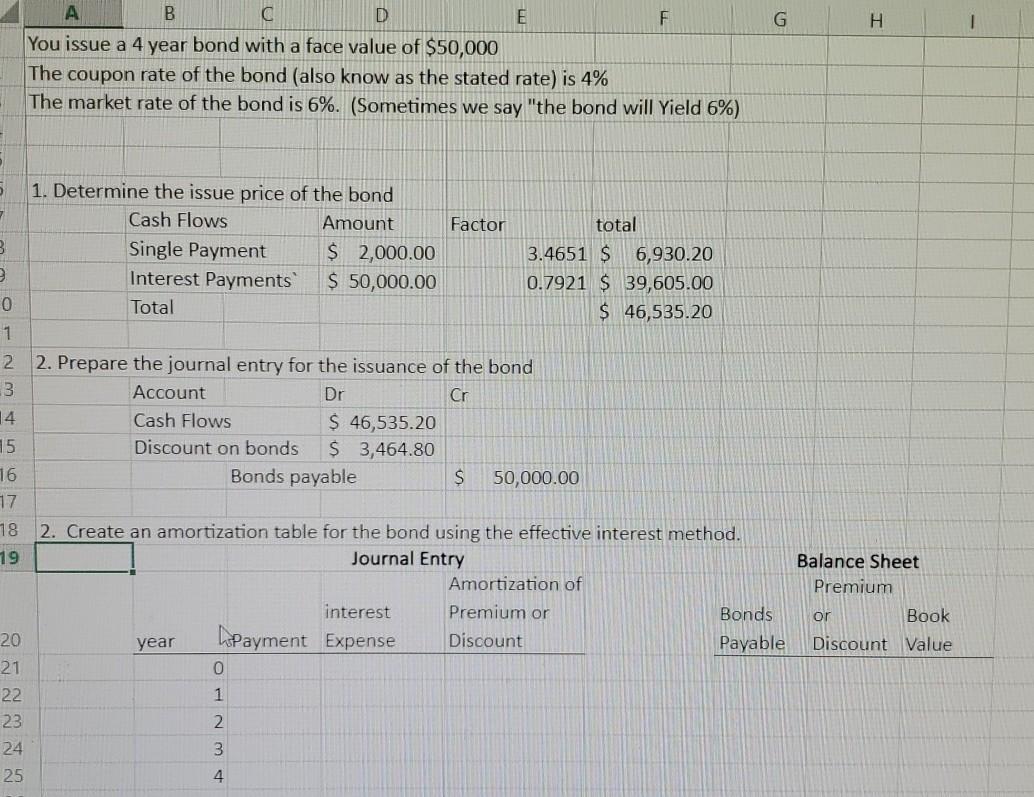

G H I A B D E F. You issue a 4 year bond with a face value of $50,000 The coupon rate of the bond (also know as the stated rate) is 4% The market rate of the bond is 6%. (Sometimes we say "the bond will Yield 6%) 5 1. Determine the issue price of the bond Cash Flows Amount Factor total B Single Payment $ 2,000.00 3.4651 $ 6,930.20 Interest Payments $ 50,000.00 0.7921 $ 39,605.00 0 Total $ 46,535.20 1 2 2. Prepare the journal entry for the issuance of the bond 3 Account Dr Cr 14 Cash Flows $ 46,535.20 15 Discount on bonds $ 3,464.80 16 Bonds payable $ 50,000.00 17 18 2. Create an amortization table for the bond using the effective interest method. 19 Journal Entry Amortization of interest Premium or Bonds 20 year Payment Expense Discount Payable 21 0 22 1 23 2 3 25 4 Balance Sheet Premium or Book Discount Value 24

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started