Answered step by step

Verified Expert Solution

Question

1 Approved Answer

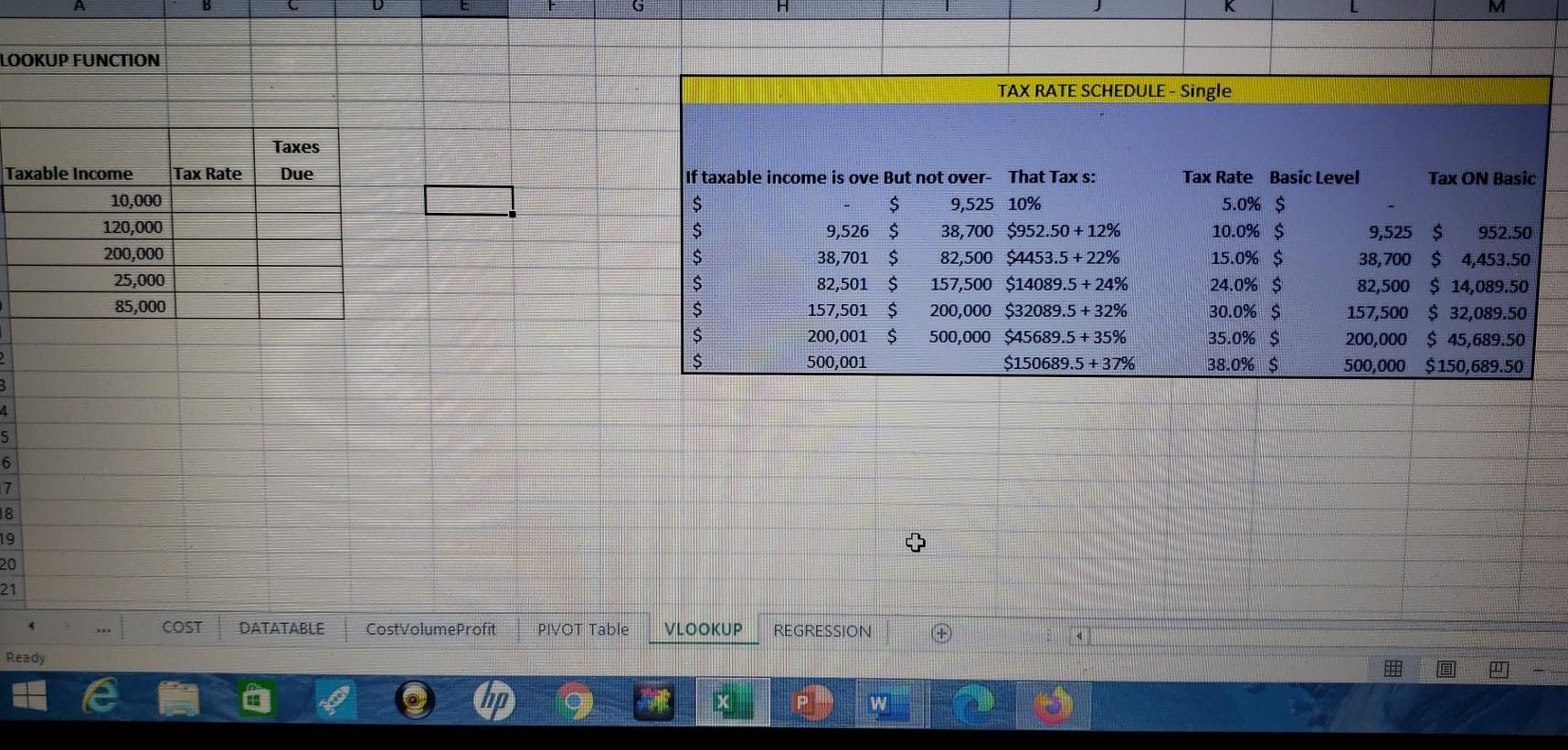

G H LOOKUP FUNCTION TAX RATE SCHEDULE - Single Taxes Taxable income Tax Rate Due 10,000 120,000 200,000 If taxable income is ove But not

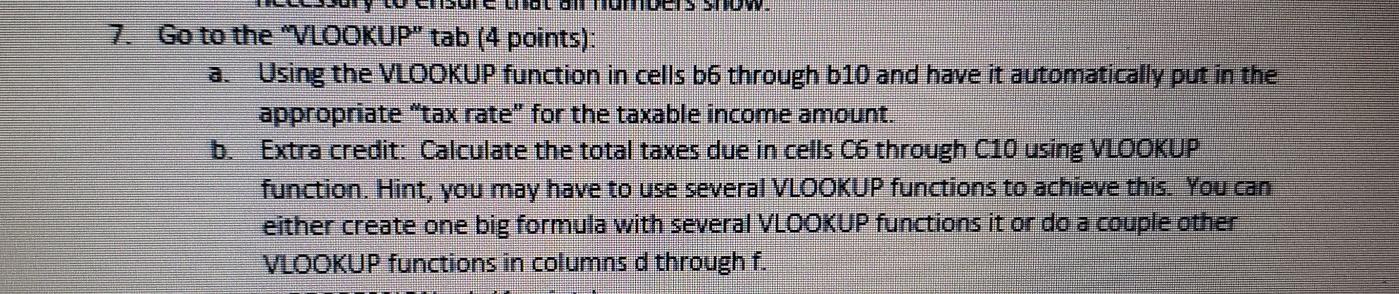

G H LOOKUP FUNCTION TAX RATE SCHEDULE - Single Taxes Taxable income Tax Rate Due 10,000 120,000 200,000 If taxable income is ove But not over- That Taxs: $ $ 9,525 10% $ 9,526 $ 38,700 $952.50 +12% $ 38,701 S 82,500 $4453.5 + 22% $ 82,501 $ 157,500 $14089.5+ 24% $ 157,501 $ 200,000 $32089.5+ 32% $ 200,001 $ 500,000 $45689.5 + 35% $ 500,001 $150689.5 +37% Tax Rate Basic Level Tax ON Basic 5.0% $ 10.0% $ 9,525 $ 952.50 15.0% $ 38,700 $ 4,453.50 24.0% $ 82,500 $ 14,089.50 30.0% $ 157,500 $ 32,089.50 35.0% $ 200,000 $ 45,689.50 38.0% $ 500,000 $150,689,50 25,000 85,000 2 3 4 5 6 17 38 19 + 20 21 COST DATATABLE CostVolume Profit PIVOT Table VL0OKUP REGRESSION Ready hp X P W Lol al 7. Go to the "VLOOKUP" tab (4 points): a. Using the VLOOKUP function in cells b6 through b10 and have it automatically put in the appropriate "tax rate for the taxable income amount. Extra credit: Calculate the total taxes due in cells C6 through Ci0 using VLOOKUP function. Hint, you may have to use several VLOOKUP functions to achieve this. You can either create one big formula with several VLOOKUP functions it or do a couple other VLOOKUP functions in columns d through f

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started