Answered step by step

Verified Expert Solution

Question

1 Approved Answer

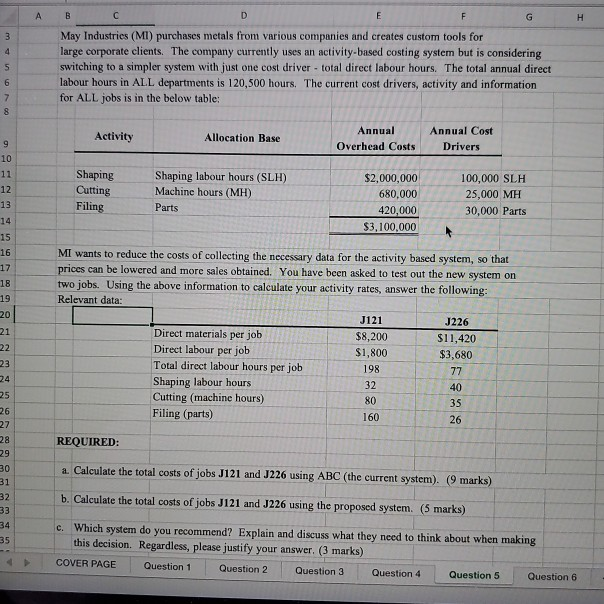

G H May Industries (MI) purchases metals from various companies and creates custom tools for large corporate clients. The company currently uses an activity-based costing

G H May Industries (MI) purchases metals from various companies and creates custom tools for large corporate clients. The company currently uses an activity-based costing system but is considering switching to a simpler system with just one cost driver - total direct labour hours. The total annual direct labour hours in ALL departments is 120,500 hours. The current cost drivers, activity and information for ALL jobs is in the below table: Activity Allocation Base Annual Overhead Costs Annual Cost Drivers Shaping Cutting Shaping labour hours (SLH) Machine hours (MH) Parts $2,000,000 680,000 420,000 $3,100,000 100,000 SLH 25,000 MH 30,000 Parts Filing MI wants to reduce the costs of collecting the necessary data for the activity based system, so that prices can be lowered and more sales obtained. You have been asked to test out the new system on two jobs. Using the above information to calculate your activity rates, answer the following: Relevant data: J121 J226 Direct materials per job $8,200 $11,420 Direct labour per job $1,800 $3,680 2600 Total direct labour hours per job 198 Shaping labour hours Cutting machine hours) Filing (parts) 160 REQUIRED: a Calculate the total costs of jobs J121 and J226 using ABC (the current system). (9 marks) b. Calculate the total costs of jobs J121 and J226 using the proposed system. (5 marks) c. Which system do you recommend? Explain and discuss what they need to think about when making this decision. Regardless, please justify your answer. (3 marks) COVER PAGE Question 1 Question 2 Question 3 Question 4 Question 5 Question 6

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started