(g) In part (f), suppose an investor borrows at the risk-free rate to invest in the tangency portfolio. How much leverage would the investor have to choose in order to attain a target return is 20 percent? What is the standard deviation of this two-fund portfolio?

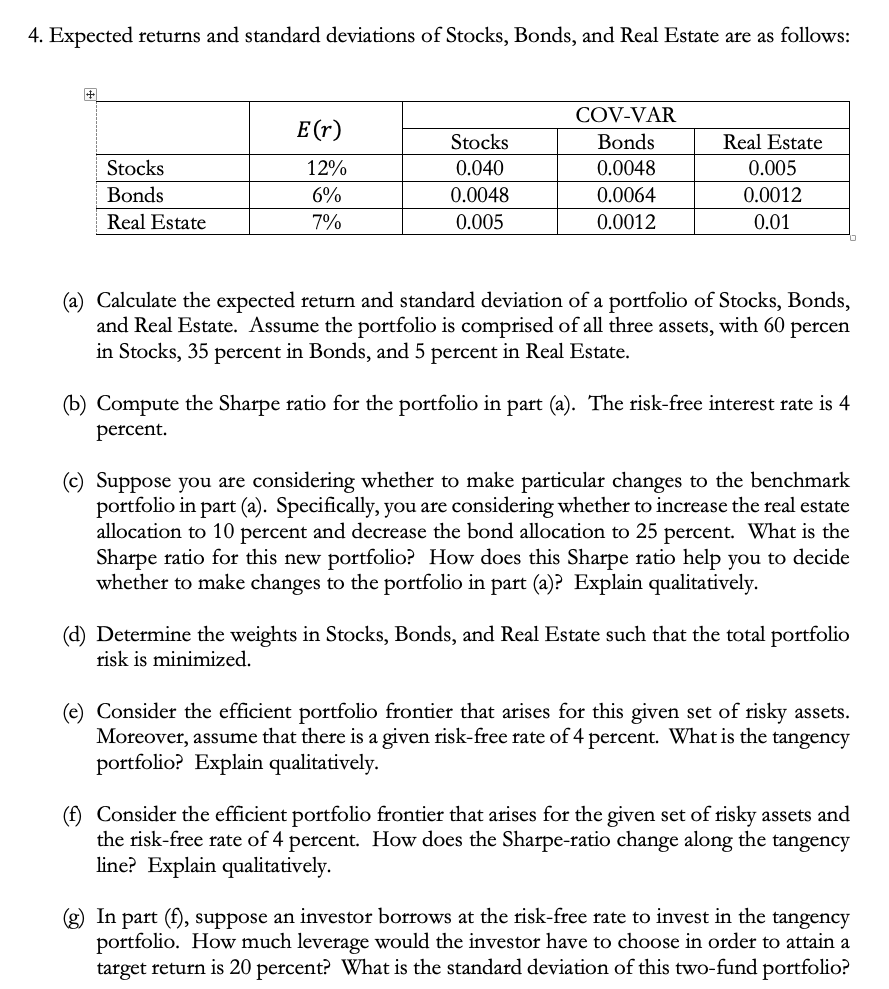

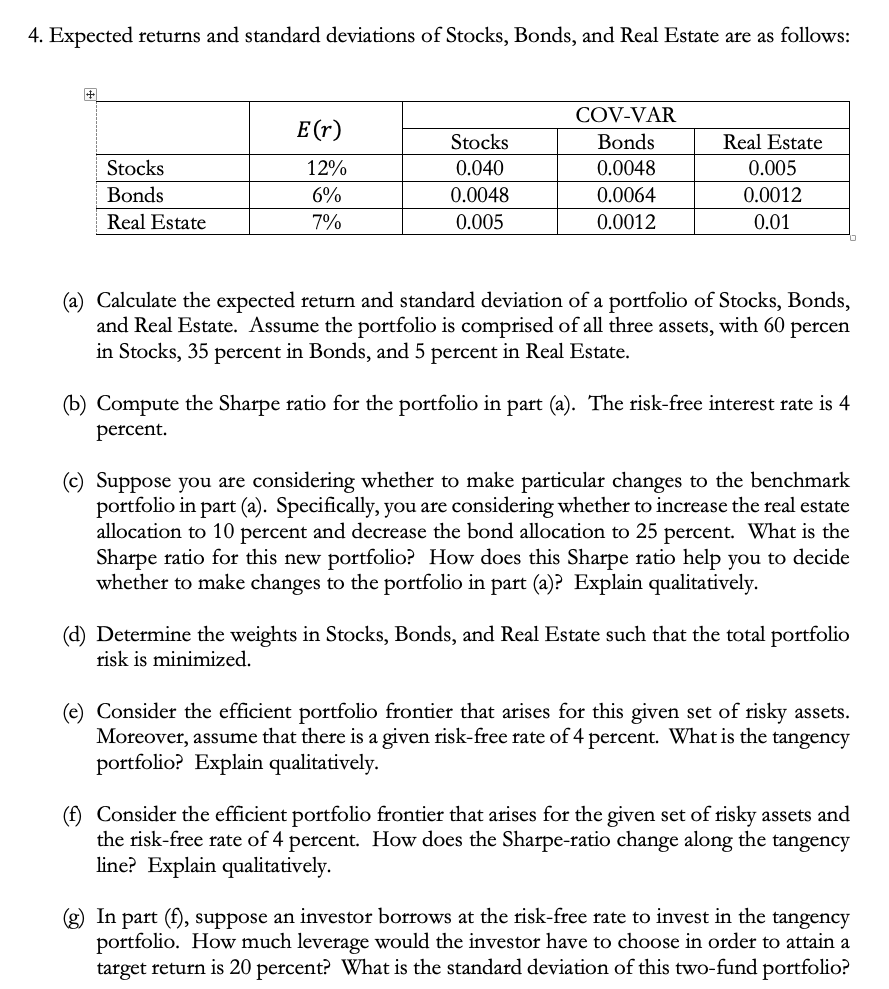

4. Expected returns and standard deviations of Stocks, Bonds, and Real Estate are as follows: (a) Calculate the expected return and standard deviation of a portfolio of Stocks, Bonds, and Real Estate. Assume the portfolio is comprised of all three assets, with 60 percen in Stocks, 35 percent in Bonds, and 5 percent in Real Estate. (b) Compute the Sharpe ratio for the portfolio in part (a). The risk-free interest rate is 4 percent. (c) Suppose you are considering whether to make particular changes to the benchmark portfolio in part (a). Specifically, you are considering whether to increase the real estate allocation to 10 percent and decrease the bond allocation to 25 percent. What is the Sharpe ratio for this new portfolio? How does this Sharpe ratio help you to decide whether to make changes to the portfolio in part (a)? Explain qualitatively. (d) Determine the weights in Stocks, Bonds, and Real Estate such that the total portfolio risk is minimized. (e) Consider the efficient portfolio frontier that arises for this given set of risky assets. Moreover, assume that there is a given risk-free rate of 4 percent. What is the tangency portfolio? Explain qualitatively. (f) Consider the efficient portfolio frontier that arises for the given set of risky assets and the risk-free rate of 4 percent. How does the Sharpe-ratio change along the tangency line? Explain qualitatively. (g) In part (f), suppose an investor borrows at the risk-free rate to invest in the tangency portfolio. How much leverage would the investor have to choose in order to attain a target return is 20 percent? What is the standard deviation of this two-fund portfolio? 4. Expected returns and standard deviations of Stocks, Bonds, and Real Estate are as follows: (a) Calculate the expected return and standard deviation of a portfolio of Stocks, Bonds, and Real Estate. Assume the portfolio is comprised of all three assets, with 60 percen in Stocks, 35 percent in Bonds, and 5 percent in Real Estate. (b) Compute the Sharpe ratio for the portfolio in part (a). The risk-free interest rate is 4 percent. (c) Suppose you are considering whether to make particular changes to the benchmark portfolio in part (a). Specifically, you are considering whether to increase the real estate allocation to 10 percent and decrease the bond allocation to 25 percent. What is the Sharpe ratio for this new portfolio? How does this Sharpe ratio help you to decide whether to make changes to the portfolio in part (a)? Explain qualitatively. (d) Determine the weights in Stocks, Bonds, and Real Estate such that the total portfolio risk is minimized. (e) Consider the efficient portfolio frontier that arises for this given set of risky assets. Moreover, assume that there is a given risk-free rate of 4 percent. What is the tangency portfolio? Explain qualitatively. (f) Consider the efficient portfolio frontier that arises for the given set of risky assets and the risk-free rate of 4 percent. How does the Sharpe-ratio change along the tangency line? Explain qualitatively. (g) In part (f), suppose an investor borrows at the risk-free rate to invest in the tangency portfolio. How much leverage would the investor have to choose in order to attain a target return is 20 percent? What is the standard deviation of this two-fund portfolio