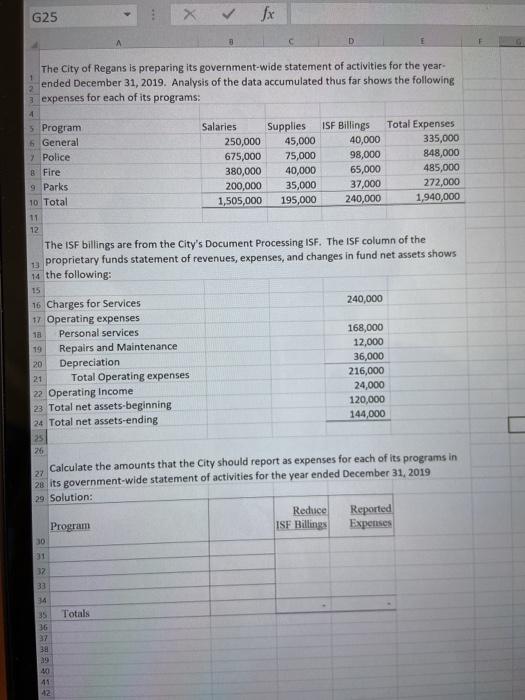

G25 fx D The City of Regans is preparing its government-wide statement of activities for the year- ended December 31, 2019. Analysis of the data accumulated thus far shows the following 3 expenses for each of its programs: 2 5 Program 6 General 7 Police 8 Fire 9 Parks 10 Total Salaries Supplies ISF Billings 250,000 45,000 40,000 675,000 75,000 98,000 380,000 40,000 65,000 200,000 35,000 37,000 1,505,000 195,000 240,000 Total Expenses 335,000 848,000 485,000 272,000 1,940,000 11 12 The ISF billings are from the City's Document Processing ISF. The ISF column of the proprietary funds statement of revenues, expenses, and changes in fund net assets shows 14 the following: 15 16 Charges for Services 240,000 17 Operating expenses 18 Personal services 168,000 Repairs and Maintenance 12,000 20 Depreciation 36,000 21 Total Operating expenses 216,000 22 Operating Income 24,000 23 Total net assets-beginning 120,000 24 Total net assets-ending 144,000 19 25 26 Calculate the amounts that the City should report as expenses for each of its programs in 27 28 its government-wide statement of activities for the year ended December 31, 2019 29 Solution: Reduce Reported Program ISF Billings Expenses 30 31 32 33 Totals 34 35 36 37 38 40 41 G25 fx D The City of Regans is preparing its government-wide statement of activities for the year- ended December 31, 2019. Analysis of the data accumulated thus far shows the following 3 expenses for each of its programs: 2 5 Program 6 General 7 Police 8 Fire 9 Parks 10 Total Salaries Supplies ISF Billings 250,000 45,000 40,000 675,000 75,000 98,000 380,000 40,000 65,000 200,000 35,000 37,000 1,505,000 195,000 240,000 Total Expenses 335,000 848,000 485,000 272,000 1,940,000 11 12 The ISF billings are from the City's Document Processing ISF. The ISF column of the proprietary funds statement of revenues, expenses, and changes in fund net assets shows 14 the following: 15 16 Charges for Services 240,000 17 Operating expenses 18 Personal services 168,000 Repairs and Maintenance 12,000 20 Depreciation 36,000 21 Total Operating expenses 216,000 22 Operating Income 24,000 23 Total net assets-beginning 120,000 24 Total net assets-ending 144,000 19 25 26 Calculate the amounts that the City should report as expenses for each of its programs in 27 28 its government-wide statement of activities for the year ended December 31, 2019 29 Solution: Reduce Reported Program ISF Billings Expenses 30 31 32 33 Totals 34 35 36 37 38 40 41