as soon is Possible

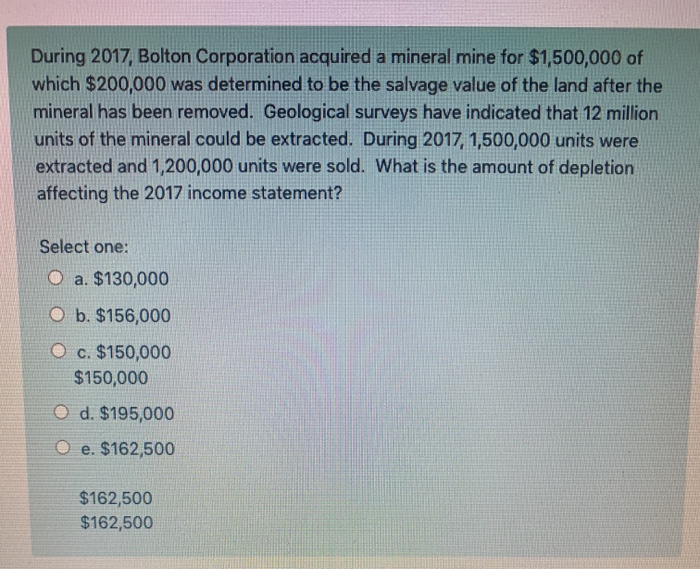

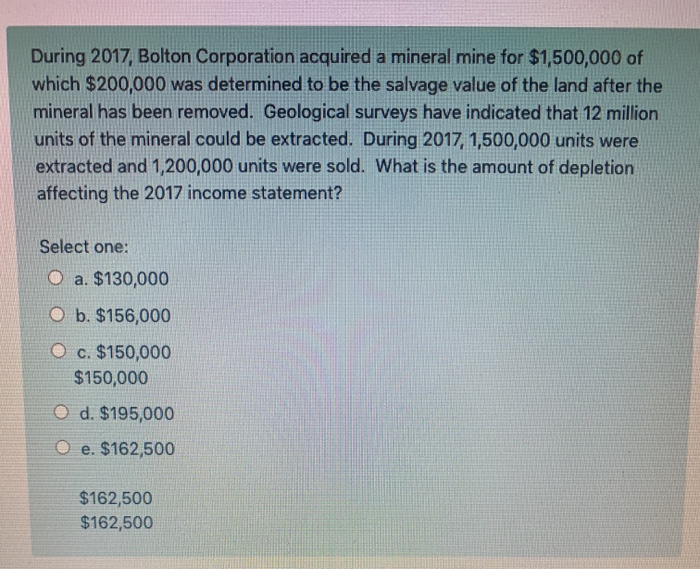

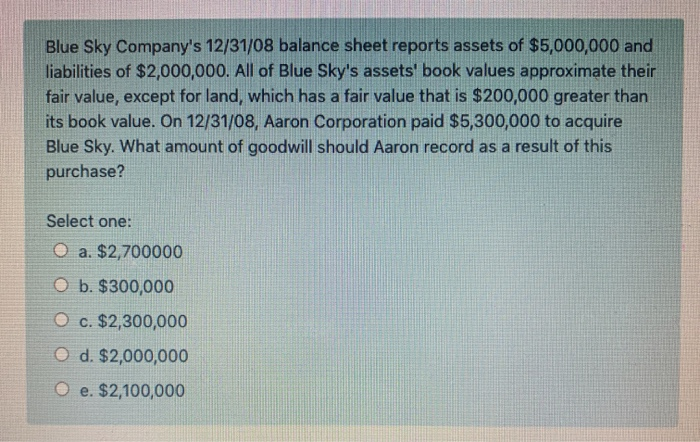

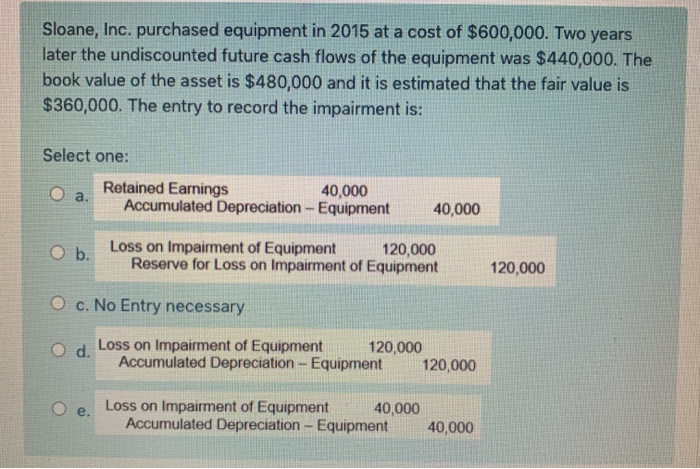

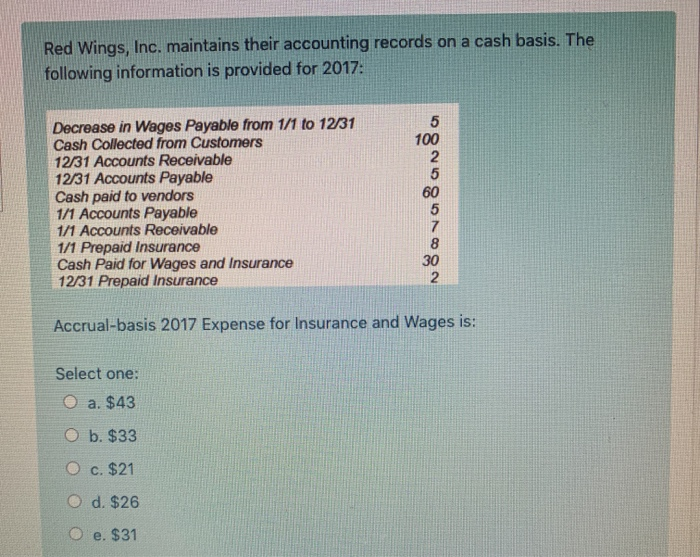

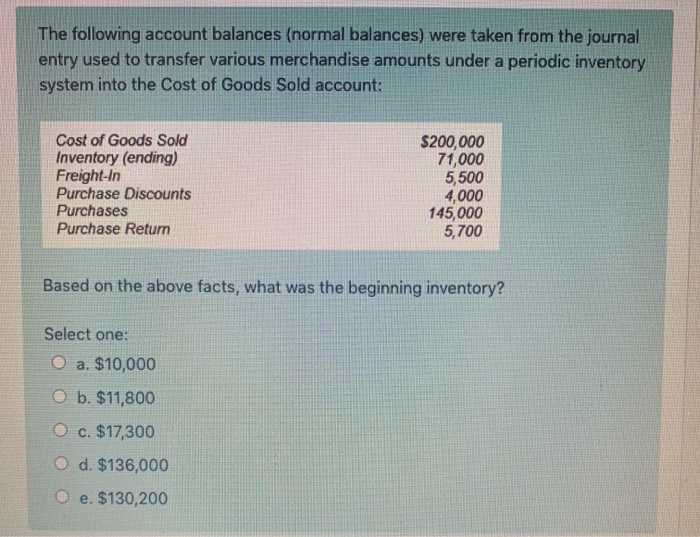

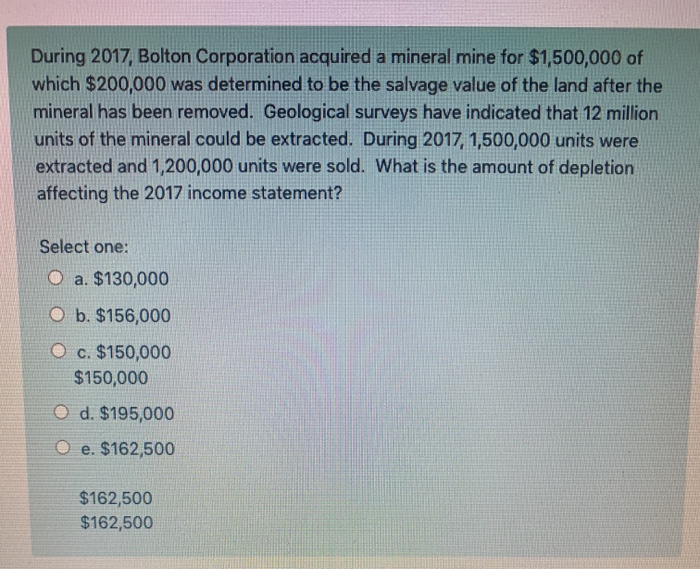

During 2017, Bolton Corporation acquired a mineral mine for $1,500,000 of which $200,000 was determined to be the salvage value of the land after the mineral has been removed. Geological surveys have indicated that 12 million units of the mineral could be extracted. During 2017, 1,500,000 units were extracted and 1,200,000 units were sold. What is the amount of depletion affecting the 2017 income statement? Select one: O a. $130,000 O b. $156,000 O c. $150,000 $150,000 O d. $195,000 e. $162,500 $162,500 $162,500 Blue Sky Company's 12/31/08 balance sheet reports assets of $5,000,000 and liabilities of $2,000,000. All of Blue Sky's assets' book values approximate their fair value, except for land, which has a fair value that is $200,000 greater than its book value. On 12/31/08, Aaron Corporation paid $5,300,000 to acquire Blue Sky. What amount of goodwill should Aaron record as a result of this purchase? Select one: O a. $2,700000 O b. $300,000 O c. $2,300,000 O d. $2,000,000 O e. $2,100,000 Sloane, Inc. purchased equipment in 2015 at a cost of $600,000. Two years later the undiscounted future cash flows of the equipment was $440,000. The book value of the asset is $480,000 and it is estimated that the fair value is $360,000. The entry to record the impairment is: Select one: Retained Earnings 40,000 a. Accumulated Depreciation - Equipment 40,000 b. Loss on Impairment of Equipment 120,000 Reserve for Loss on Impairment of Equipment 120,000 O c. No Entry necessary O d. Loss on Impairment of Equipment 120,000 Accumulated Depreciation - Equipment 120,000 Oe. Loss on Impairment of Equipment 40,000 Accumulated Depreciation - Equipment 40,000 Red Wings, Inc. maintains their accounting records on a cash basis. The following information is provided for 2017: 5 100 2 60 Decrease in Wages Payable from 1/1 to 12/31 Cash Collected from Customers 12/31 Accounts Receivable 12/31 Accounts Payable Cash paid to vendors 1/1 Accounts Payable 1/1 Accounts Receivable 1/1 Prepaid Insurance Cash Paid for Wages and Insurance 12/31 Prepaid Insurance 7 8 30 2 Accrual-basis 2017 Expense for Insurance and Wages is: Select one: O a. $43 O b. $33 O c. $21 O d. $26 O e. $31 The following account balances (normal balances) were taken from the journal entry used to transfer various merchandise amounts under a periodic inventory system into the Cost of Goods Sold account: Cost of Goods Sold Inventory (ending) Freight-in Purchase Discounts Purchases Purchase Return $200,000 71,000 5,500 4,000 145,000 5,700 Based on the above facts, what was the beginning inventory? Select one: O a. $10,000 O b. $11,800 O c. $17,300 O d. $136,000 O e. $130,200