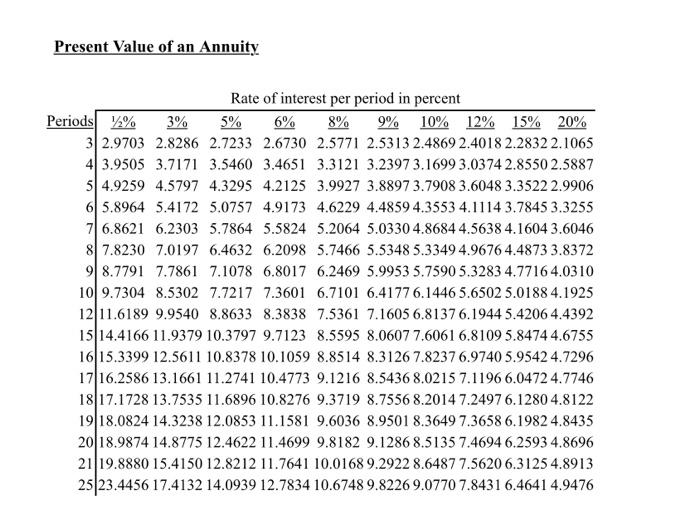

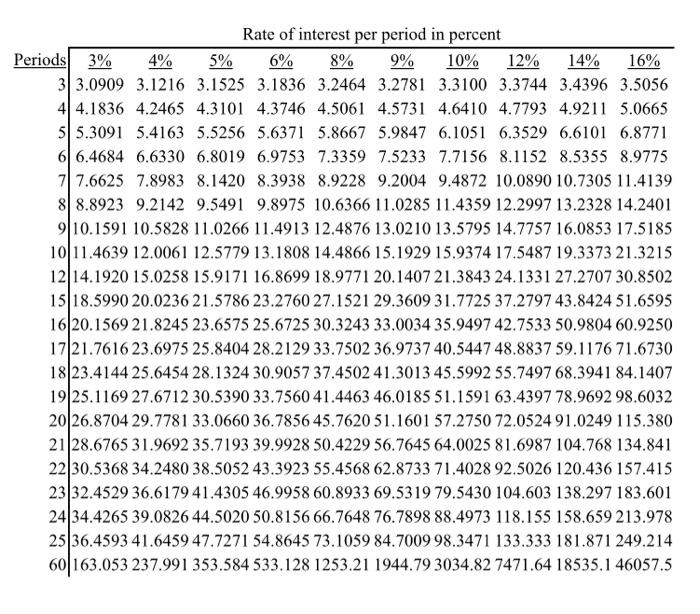

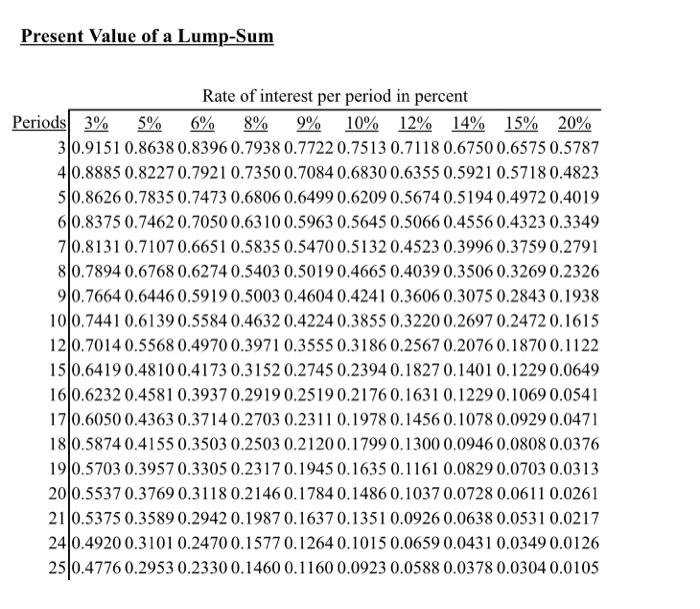

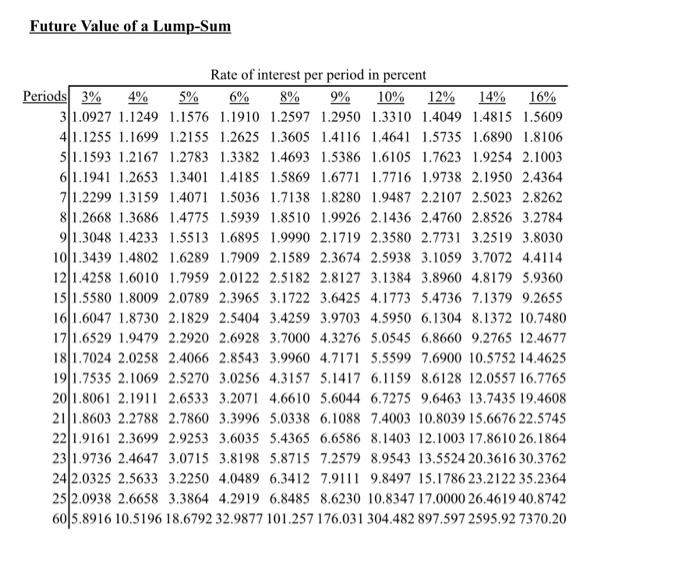

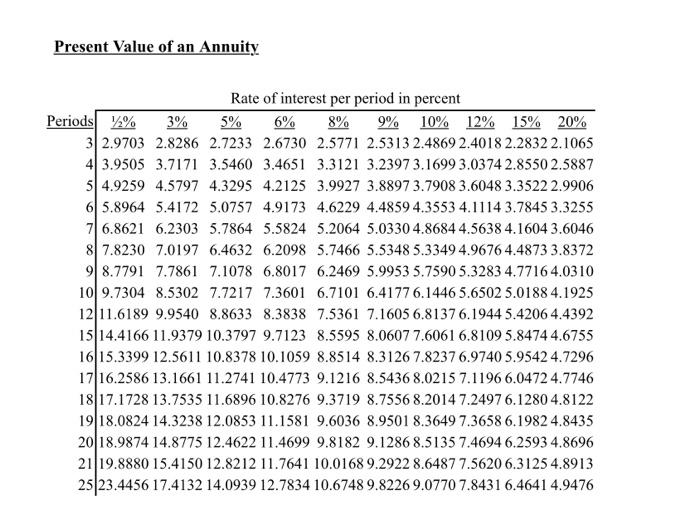

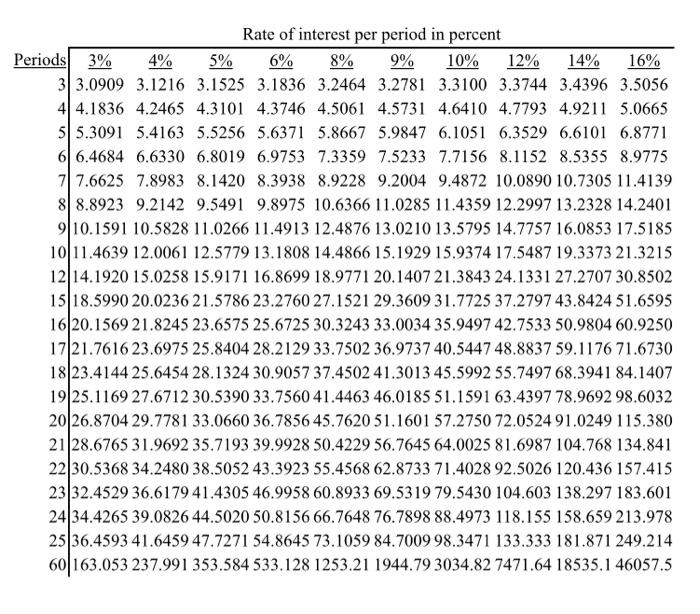

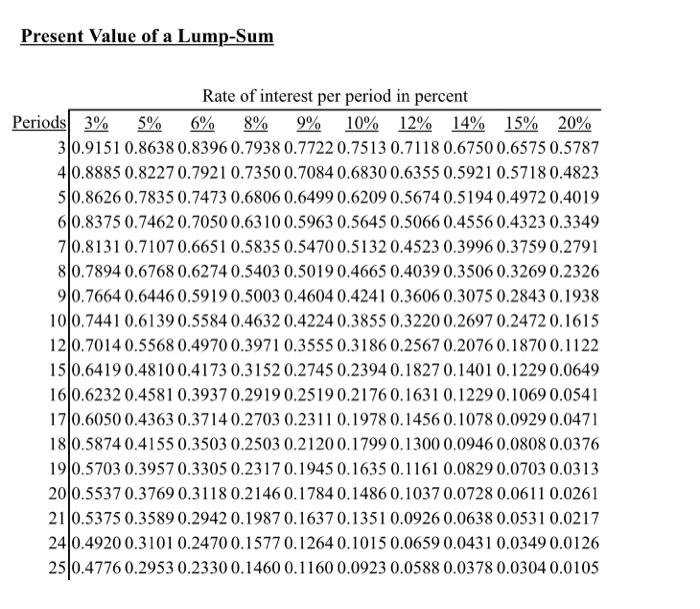

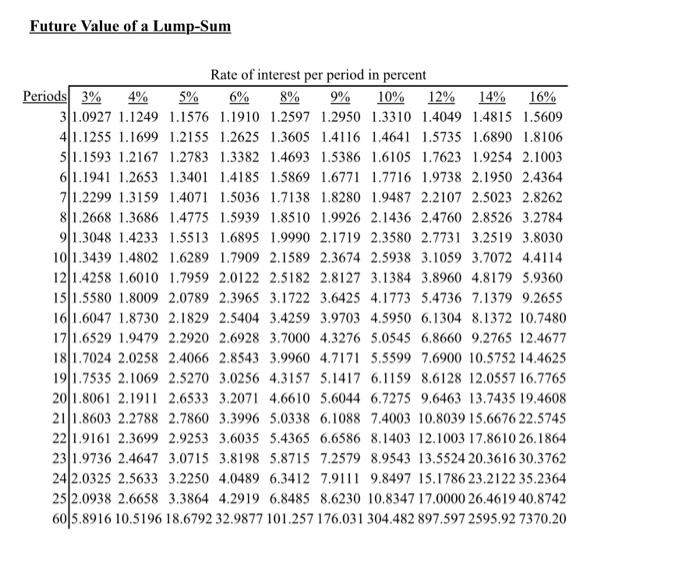

G7yR3 Company is considering buying a new machine to replace an old, outdated machine currently used in its operations. The new machine would cost $210,000 and is expected to last 9 years. The new machine would require a repair of $35,000 in year four and another repair costing $20,000 in year seven. In addition, buying the new machine would require an immediate investment of $40,000 in working capital which would be released for investment elsewhere at the end of the 9 years. The new machine is expected to have a $10,000 salvage value at the end of 9 years. The new machine is expected to result in a cost savings of $50,000 per year. G7yR3 Company employs a 10% cost of capital on all capital budgeting decisions. Calculate the net present value (NPV) of the new machine. Use the time value of money table factors posted in carmen to answer this question. To access these factors, click modules and then scroll to week 14. Click on the link labeled present & future value table factors. No credit will be awarded for this question using a means other than these table factors to answer this question.

Present Value of an Annuity Rate of interest per period in percent Periods 2% 3% 5% 6% 8% 9% 10% 12% 15% 20% 32.9703 2.8286 2.7233 2.6730 2.5771 2.5313 2.4869 2.4018 2.2832 2.1065 43.9505 3.7171 3.5460 3.4651 3.3121 3.2397 3.1699 3.0374 2.8550 2.5887 54.9259 4.5797 4.3295 4.2125 3.9927 3.8897 3.7908 3.6048 3.3522 2.9906 6 5.8964 5.4172 5.0757 4.9173 4.6229 4.4859 4.3553 4.1114 3.7845 3.3255 7 6.8621 6.2303 5.7864 5.5824 5.2064 5.0330 4.8684 4.5638 4.1604 3.6046 87.8230 7.0197 6.4632 6.2098 5.7466 5.5348 5.3349 4.96764.4873 3.8372 98.7791 7.7861 7.1078 6.8017 6.2469 5.9953 5.7590 5.3283 4.7716 4.0310 109.7304 8.5302 7.7217 7.3601 6.7101 6.4177 6.1446 5.6502 5.0188 4.1925 12 11.6189 9.9540 8.8633 8.3838 7.5361 7.1605 6.81376.1944 5.4206 4.4392 15 14.4166 11.9379 10.3797 9.7123 8.5595 8.0607 7.6061 6.8109 5.8474 4.6755 1615.3399 12.5611 10.8378 10.1059 8.8514 8.3126 7.82376.9740 5.9542 4.7296 17 16.2586 13.1661 11.2741 10.4773 9.1216 8.5436 8.0215 7.1196 6.0472 4.7746 18 17.1728 13.7535 11.6896 10.8276 9.3719 8.7556 8.2014 7.2497 6.1280 4.8122 1918.0824 14.3238 12.0853 11.1581 9.6036 8.9501 8.3649 7.3658 6.1982 4.8435 2018.9874 14.8775 12.4622 11.4699 9.8182 9.1286 8.51357.4694 6.2593 4.8696 2119.8880 15.4150 12.8212 11.7641 10.0168 9.2922 8.6487 7.5620 6.3125 4.8913 25 23.4456 17.4132 14.0939 12.7834 10.6748 9.8226 9.0770 7.8431 6.4641 4.9476 Rate of interest per period in percent Periods 3% 4% 5% 8% 9% 10% 12% 14% 16% 33.0909 3.1216 3.1525 3.1836 3.2464 3.2781 3.3100 3.3744 3.4396 3.5056 4 4.1836 4.2465 4.3101 4.3746 4.5061 4.5731 4.6410 4.7793 4.9211 5.0665 55.3091 5.4163 5.5256 5.6371 5.8667 5.9847 6.1051 6.3529 6.6101 6.8771 6 6.4684 6.6330 6.8019 6.9753 7.3359 7.5233 7.7156 8.1152 8.5355 8.9775 77.6625 7.8983 8.1420 8.3938 8.9228 9.2004 9.4872 10.0890 10.7305 11.4139 8 8.8923 9.2142 9.5491 9.8975 10.6366 11.0285 11.4359 12.2997 13.2328 14.2401 9 10.1591 10.5828 11.0266 11.4913 12.4876 13.0210 13.5795 14.7757 16.0853 17.5185 10 11.4639 12.0061 12.5779 13.1808 14.4866 15.1929 15.9374 17.5487 19.3373 21.3215 12 14.1920 15.0258 15.9171 16.8699 18.9771 20.1407 21.3843 24.1331 27.2707 30.8502 15 18.5990 20.0236 21.5786 23.2760 27.1521 29.3609 31.7725 37.2797 43.8424 51.6595 16 20.1569 21.8245 23.6575 25.6725 30.3243 33.0034 35.9497 42.7533 50.9804 60.9250 1721.7616 23.6975 25.8404 28.2129 33.7502 36.9737 40.5447 48.8837 59.1176 71.6730 18 23.4144 25.6454 28.1324 30.9057 37.4502 41.3013 45.5992 55.7497 68.3941 84.1407 1925.1169 27.6712 30.5390 33.7560 41.4463 46.0185 51.1591 63.4397 78.9692 98.6032 20|26.8704 29.7781 33.0660 36.7856 45.7620 51.1601 57.2750 72.0524 91.0249 115.380 21|28.6765 31.9692 35.7193 39.9928 50.4229 56.7645 64.0025 81.6987 104.768 134.841 22 30.5368 34.2480 38.5052 43.3923 55.4568 62.8733 71.4028 92.5026 120.436 157.415 23|32.4529 36.6179 41.4305 46.9958 60.8933 69.5319 79.5430 104.603 138.297 183.601 2434.4265 39.0826 44.5020 50.8156 66.7648 76.7898 88.4973 118.155 158.659 213.978 25 36.4593 41.6459 47.7271 54.8645 73.1059 84.700998.3471 133.333 181.871 249.214 60 163.053 237.991 353.584 533.128 1253.21 1944.79 3034.82 7471.64 18535.1 46057.5 Present Value of a Lump-Sum 8% Rate of interest per period in percent Periods 3% 5% 6% 9% 10% 12% 14% 15% 20% 30.9151 0.8638 0.8396 0.7938 0.77220.7513 0.7118 0.6750 0.6575 0.5787 40.8885 0.82270.7921 0.7350 0.7084 0.6830 0.6355 0.5921 0.5718 0.4823 50.8626 0.7835 0.7473 0.6806 0.6499 0.6209 0.56740.5194 0.4972 0.4019 60.8375 0.7462 0.7050 0.6310 0.5963 0.5645 0.5066 0.4556 0.4323 0.3349 70.8131 0.7107 0.6651 0.5835 0.54700.5132 0.4523 0.3996 0.3759 0.2791 810.7894 0.6768 0.62740.5403 0.50190.4665 0.4039 0.3506 0.3269 0.2326 90.7664 0.6446 0.5919 0.5003 0.4604 0.4241 0.3606 0.3075 0.2843 0.1938 100.7441 0.6139 0.55840.4632 0.4224 0.3855 0.3220 0.2697 0.2472 0.1615 120.7014 0.5568 0.4970 0.3971 0.3555 0.3186 0.2567 0.2076 0.1870 0.1122 15 0.64190.48100.4173 0.3152 0.27450.2394 0.18270.1401 0.1229 0.0649 16 0.6232 0.4581 0.3937 0.2919 0.25190.2176 0.1631 0.1229 0.1069 0.0541 170.6050 0.4363 0.37140.2703 0.2311 0.1978 0.1456 0.1078 0.0929 0.0471 180.5874 0.4155 0.3503 0.2503 0.21200.1799 0.13000.0946 0.0808 0.0376 190.5703 0.3957 0.3305 0.23170.1945 0.1635 0.1161 0.0829 0.0703 0.0313 2010.5537 0.3769 0.3118 0.2146 0.1784 0.1486 0.1037 0.0728 0.0611 0.0261 210.5375 0.35890.2942 0.1987 0.1637 0.1351 0.0926 0.0638 0.0531 0.0217 24 0.4920 0.3101 0.2470 0.1577 0.1264 0.1015 0.0659 0.0431 0.0349 0.0126 250.4776 0.29530.2330 0.1460 0.1160 0.0923 0.0588 0.0378 0.0304 0.0105 Future Value of a Lump-Sum 4% 5% 8% Rate of interest per period in percent Periods 3% 9% 10% 12% 14% 16% 31.0927 1.1249 1.1576 1.1910 1.2597 1.2950 1.3310 1.4049 1.4815 1.5609 41.1255 1.1699 1.2155 1.2625 1.3605 1.4116 1.4641 1.5735 1.6890 1.8106 51.1593 1.2167 1.2783 1.3382 1.4693 1.5386 1.6105 1.7623 1.9254 2.1003 611.1941 1.2653 1.3401 1.4185 1.5869 1.6771 1.7716 1.9738 2.1950 2.4364 71.2299 1.3159 1.4071 1.5036 1.7138 1.8280 1.9487 2.2107 2.5023 2.8262 8|1.2668 1.3686 1.4775 1.5939 1.8510 1.9926 2.1436 2.4760 2.8526 3.2784 91.3048 1.4233 1.5513 1.6895 1.9990 2.1719 2.3580 2.7731 3.2519 3.8030 101.3439 1.4802 1.6289 1.7909 2.1589 2.3674 2.5938 3.1059 3.7072 4.4114 121.4258 1.6010 1.7959 2.0122 2.5182 2.8127 3.1384 3.8960 4.8179 5.9360 151.5580 1.8009 2.0789 2.3965 3.1722 3.6425 4.1773 5.4736 7.1379 9.2655 161.6047 1.8730 2.1829 2.5404 3.4259 3.9703 4.5950 6.1304 8.1372 10.7480 17 1.6529 1.9479 2.2920 2.6928 3.7000 4.3276 5.0545 6.8660 9.2765 12.4677 181.7024 2.0258 2.4066 2.8543 3.9960 4.7171 5.5599 7.6900 10.5752 14.4625 191.7535 2.1069 2.5270 3.0256 4.3157 5.1417 6.1159 8.6128 12.0557 16.7765 201.8061 2.1911 2.6533 3.2071 4.6610 5.6044 6.7275 9.6463 13.7435 19.4608 211.8603 2.2788 2.7860 3.3996 5.0338 6.1088 7.4003 10.8039 15.6676 22.5745 22 1.9161 2.3699 2.9253 3.6035 5.4365 6.6586 8.1403 12.1003 17.8610 26.1864 231.9736 2.4647 3.0715 3.8198 5.8715 7.2579 8.9543 13.5524 20.3616 30.3762 242.0325 2.5633 3.2250 4.0489 6.3412 7.9111 9.8497 15.1786 23.2122 35.2364 25 2.0938 2.6658 3.3864 4.2919 6.8485 8.6230 10.8347 17.0000 26.4619 40.8742 605.8916 10.5196 18.6792 32.9877 101.257 176,031 304.482 897.597 2595.92 7370.20 Present Value of an Annuity Rate of interest per period in percent Periods 2% 3% 5% 6% 8% 9% 10% 12% 15% 20% 32.9703 2.8286 2.7233 2.6730 2.5771 2.5313 2.4869 2.4018 2.2832 2.1065 43.9505 3.7171 3.5460 3.4651 3.3121 3.2397 3.1699 3.0374 2.8550 2.5887 54.9259 4.5797 4.3295 4.2125 3.9927 3.8897 3.7908 3.6048 3.3522 2.9906 6 5.8964 5.4172 5.0757 4.9173 4.6229 4.4859 4.3553 4.1114 3.7845 3.3255 7 6.8621 6.2303 5.7864 5.5824 5.2064 5.0330 4.8684 4.5638 4.1604 3.6046 87.8230 7.0197 6.4632 6.2098 5.7466 5.5348 5.3349 4.96764.4873 3.8372 98.7791 7.7861 7.1078 6.8017 6.2469 5.9953 5.7590 5.3283 4.7716 4.0310 109.7304 8.5302 7.7217 7.3601 6.7101 6.4177 6.1446 5.6502 5.0188 4.1925 12 11.6189 9.9540 8.8633 8.3838 7.5361 7.1605 6.81376.1944 5.4206 4.4392 15 14.4166 11.9379 10.3797 9.7123 8.5595 8.0607 7.6061 6.8109 5.8474 4.6755 1615.3399 12.5611 10.8378 10.1059 8.8514 8.3126 7.82376.9740 5.9542 4.7296 17 16.2586 13.1661 11.2741 10.4773 9.1216 8.5436 8.0215 7.1196 6.0472 4.7746 18 17.1728 13.7535 11.6896 10.8276 9.3719 8.7556 8.2014 7.2497 6.1280 4.8122 1918.0824 14.3238 12.0853 11.1581 9.6036 8.9501 8.3649 7.3658 6.1982 4.8435 2018.9874 14.8775 12.4622 11.4699 9.8182 9.1286 8.51357.4694 6.2593 4.8696 2119.8880 15.4150 12.8212 11.7641 10.0168 9.2922 8.6487 7.5620 6.3125 4.8913 25 23.4456 17.4132 14.0939 12.7834 10.6748 9.8226 9.0770 7.8431 6.4641 4.9476 Rate of interest per period in percent Periods 3% 4% 5% 8% 9% 10% 12% 14% 16% 33.0909 3.1216 3.1525 3.1836 3.2464 3.2781 3.3100 3.3744 3.4396 3.5056 4 4.1836 4.2465 4.3101 4.3746 4.5061 4.5731 4.6410 4.7793 4.9211 5.0665 55.3091 5.4163 5.5256 5.6371 5.8667 5.9847 6.1051 6.3529 6.6101 6.8771 6 6.4684 6.6330 6.8019 6.9753 7.3359 7.5233 7.7156 8.1152 8.5355 8.9775 77.6625 7.8983 8.1420 8.3938 8.9228 9.2004 9.4872 10.0890 10.7305 11.4139 8 8.8923 9.2142 9.5491 9.8975 10.6366 11.0285 11.4359 12.2997 13.2328 14.2401 9 10.1591 10.5828 11.0266 11.4913 12.4876 13.0210 13.5795 14.7757 16.0853 17.5185 10 11.4639 12.0061 12.5779 13.1808 14.4866 15.1929 15.9374 17.5487 19.3373 21.3215 12 14.1920 15.0258 15.9171 16.8699 18.9771 20.1407 21.3843 24.1331 27.2707 30.8502 15 18.5990 20.0236 21.5786 23.2760 27.1521 29.3609 31.7725 37.2797 43.8424 51.6595 16 20.1569 21.8245 23.6575 25.6725 30.3243 33.0034 35.9497 42.7533 50.9804 60.9250 1721.7616 23.6975 25.8404 28.2129 33.7502 36.9737 40.5447 48.8837 59.1176 71.6730 18 23.4144 25.6454 28.1324 30.9057 37.4502 41.3013 45.5992 55.7497 68.3941 84.1407 1925.1169 27.6712 30.5390 33.7560 41.4463 46.0185 51.1591 63.4397 78.9692 98.6032 20|26.8704 29.7781 33.0660 36.7856 45.7620 51.1601 57.2750 72.0524 91.0249 115.380 21|28.6765 31.9692 35.7193 39.9928 50.4229 56.7645 64.0025 81.6987 104.768 134.841 22 30.5368 34.2480 38.5052 43.3923 55.4568 62.8733 71.4028 92.5026 120.436 157.415 23|32.4529 36.6179 41.4305 46.9958 60.8933 69.5319 79.5430 104.603 138.297 183.601 2434.4265 39.0826 44.5020 50.8156 66.7648 76.7898 88.4973 118.155 158.659 213.978 25 36.4593 41.6459 47.7271 54.8645 73.1059 84.700998.3471 133.333 181.871 249.214 60 163.053 237.991 353.584 533.128 1253.21 1944.79 3034.82 7471.64 18535.1 46057.5 Present Value of a Lump-Sum 8% Rate of interest per period in percent Periods 3% 5% 6% 9% 10% 12% 14% 15% 20% 30.9151 0.8638 0.8396 0.7938 0.77220.7513 0.7118 0.6750 0.6575 0.5787 40.8885 0.82270.7921 0.7350 0.7084 0.6830 0.6355 0.5921 0.5718 0.4823 50.8626 0.7835 0.7473 0.6806 0.6499 0.6209 0.56740.5194 0.4972 0.4019 60.8375 0.7462 0.7050 0.6310 0.5963 0.5645 0.5066 0.4556 0.4323 0.3349 70.8131 0.7107 0.6651 0.5835 0.54700.5132 0.4523 0.3996 0.3759 0.2791 810.7894 0.6768 0.62740.5403 0.50190.4665 0.4039 0.3506 0.3269 0.2326 90.7664 0.6446 0.5919 0.5003 0.4604 0.4241 0.3606 0.3075 0.2843 0.1938 100.7441 0.6139 0.55840.4632 0.4224 0.3855 0.3220 0.2697 0.2472 0.1615 120.7014 0.5568 0.4970 0.3971 0.3555 0.3186 0.2567 0.2076 0.1870 0.1122 15 0.64190.48100.4173 0.3152 0.27450.2394 0.18270.1401 0.1229 0.0649 16 0.6232 0.4581 0.3937 0.2919 0.25190.2176 0.1631 0.1229 0.1069 0.0541 170.6050 0.4363 0.37140.2703 0.2311 0.1978 0.1456 0.1078 0.0929 0.0471 180.5874 0.4155 0.3503 0.2503 0.21200.1799 0.13000.0946 0.0808 0.0376 190.5703 0.3957 0.3305 0.23170.1945 0.1635 0.1161 0.0829 0.0703 0.0313 2010.5537 0.3769 0.3118 0.2146 0.1784 0.1486 0.1037 0.0728 0.0611 0.0261 210.5375 0.35890.2942 0.1987 0.1637 0.1351 0.0926 0.0638 0.0531 0.0217 24 0.4920 0.3101 0.2470 0.1577 0.1264 0.1015 0.0659 0.0431 0.0349 0.0126 250.4776 0.29530.2330 0.1460 0.1160 0.0923 0.0588 0.0378 0.0304 0.0105 Future Value of a Lump-Sum 4% 5% 8% Rate of interest per period in percent Periods 3% 9% 10% 12% 14% 16% 31.0927 1.1249 1.1576 1.1910 1.2597 1.2950 1.3310 1.4049 1.4815 1.5609 41.1255 1.1699 1.2155 1.2625 1.3605 1.4116 1.4641 1.5735 1.6890 1.8106 51.1593 1.2167 1.2783 1.3382 1.4693 1.5386 1.6105 1.7623 1.9254 2.1003 611.1941 1.2653 1.3401 1.4185 1.5869 1.6771 1.7716 1.9738 2.1950 2.4364 71.2299 1.3159 1.4071 1.5036 1.7138 1.8280 1.9487 2.2107 2.5023 2.8262 8|1.2668 1.3686 1.4775 1.5939 1.8510 1.9926 2.1436 2.4760 2.8526 3.2784 91.3048 1.4233 1.5513 1.6895 1.9990 2.1719 2.3580 2.7731 3.2519 3.8030 101.3439 1.4802 1.6289 1.7909 2.1589 2.3674 2.5938 3.1059 3.7072 4.4114 121.4258 1.6010 1.7959 2.0122 2.5182 2.8127 3.1384 3.8960 4.8179 5.9360 151.5580 1.8009 2.0789 2.3965 3.1722 3.6425 4.1773 5.4736 7.1379 9.2655 161.6047 1.8730 2.1829 2.5404 3.4259 3.9703 4.5950 6.1304 8.1372 10.7480 17 1.6529 1.9479 2.2920 2.6928 3.7000 4.3276 5.0545 6.8660 9.2765 12.4677 181.7024 2.0258 2.4066 2.8543 3.9960 4.7171 5.5599 7.6900 10.5752 14.4625 191.7535 2.1069 2.5270 3.0256 4.3157 5.1417 6.1159 8.6128 12.0557 16.7765 201.8061 2.1911 2.6533 3.2071 4.6610 5.6044 6.7275 9.6463 13.7435 19.4608 211.8603 2.2788 2.7860 3.3996 5.0338 6.1088 7.4003 10.8039 15.6676 22.5745 22 1.9161 2.3699 2.9253 3.6035 5.4365 6.6586 8.1403 12.1003 17.8610 26.1864 231.9736 2.4647 3.0715 3.8198 5.8715 7.2579 8.9543 13.5524 20.3616 30.3762 242.0325 2.5633 3.2250 4.0489 6.3412 7.9111 9.8497 15.1786 23.2122 35.2364 25 2.0938 2.6658 3.3864 4.2919 6.8485 8.6230 10.8347 17.0000 26.4619 40.8742 605.8916 10.5196 18.6792 32.9877 101.257 176,031 304.482 897.597 2595.92 7370.20