Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Gaby Nobelium is a passionate investor. She wants to invest his considerable wealth of $15 million in a diversified portfolio consisting of stocks, bonds,

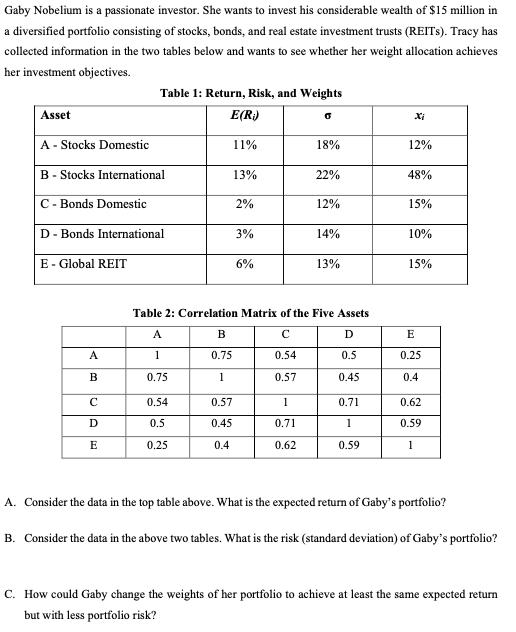

Gaby Nobelium is a passionate investor. She wants to invest his considerable wealth of $15 million in a diversified portfolio consisting of stocks, bonds, and real estate investment trusts (REITs). Tracy has collected information in the two tables below and wants to see whether her weight allocation achieves her investment objectives. Asset A- Stocks Domestic B - Stocks International C - Bonds Domestic D- Bonds International E- Global REIT A B D Table 1: Return, Risk, and Weights E(R;) E A 1 0.75 0.54 0.5 0.25 B 0.75 1 11% 0.57 0.45 0.4 13% 2% 3% 6% 6 1 0.71 0.62 18% Table 2: Correlation Matrix of the Five Assets D 0.54 0.5 0.57 0.45 22% 12% 14% 13% 0.71 1 0.59 12% 48% 15% 10% 15% E 0.25 0.4 0.62 0.59 1 A. Consider the data in the top table above. What is the expected return of Gaby's portfolio? B. Consider the data in the above two tables. What is the risk (standard deviation) of Gaby's portfolio? C. How could Gaby change the weights of her portfolio to achieve at least the same expected return but with less portfolio risk?

Step by Step Solution

★★★★★

3.26 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

A To calculate the expected return of Gabys portfolio we need to use the formula for the weighted average of expected returns Expected Return of Portf...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started