Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Gaffney Corporation is a wholesale distributor of auto parts and uses the cash method of accounting. The company's sales have been about $20,000,000 per

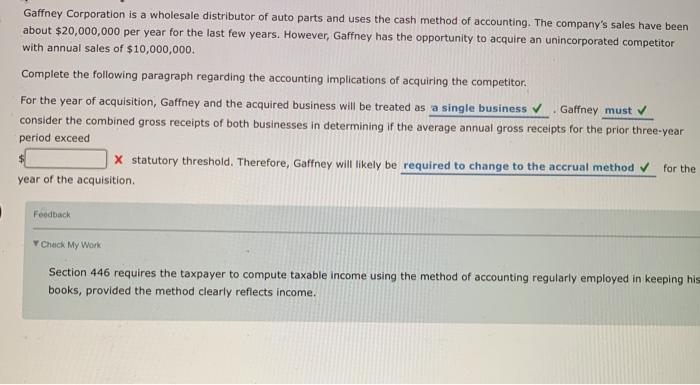

Gaffney Corporation is a wholesale distributor of auto parts and uses the cash method of accounting. The company's sales have been about $20,000,000 per year for the last few years. However, Gaffney has the opportunity to acquire an unincorporated competitor with annual sales of $10,000,000. Complete the following paragraph regarding the accounting implications of acquiring the competitor. For the year of acquisition, Gaffney and the acquired business will be treated as a single business. Gaffney must consider the combined gross receipts of both businesses in determining if the average annual gross receipts for the prior three-year period exceed X statutory threshold. Therefore, Gaffney will likely be required to change to the accrual method for the year of the acquisition. Feedback Check My Work Section 446 requires the taxpayer to compute taxable income using the method of accounting regularly employed in keeping his books, provided the method clearly reflects income.

Step by Step Solution

★★★★★

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Answer For the year of acquisition Gaffney and the acquired ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started