Answered step by step

Verified Expert Solution

Question

1 Approved Answer

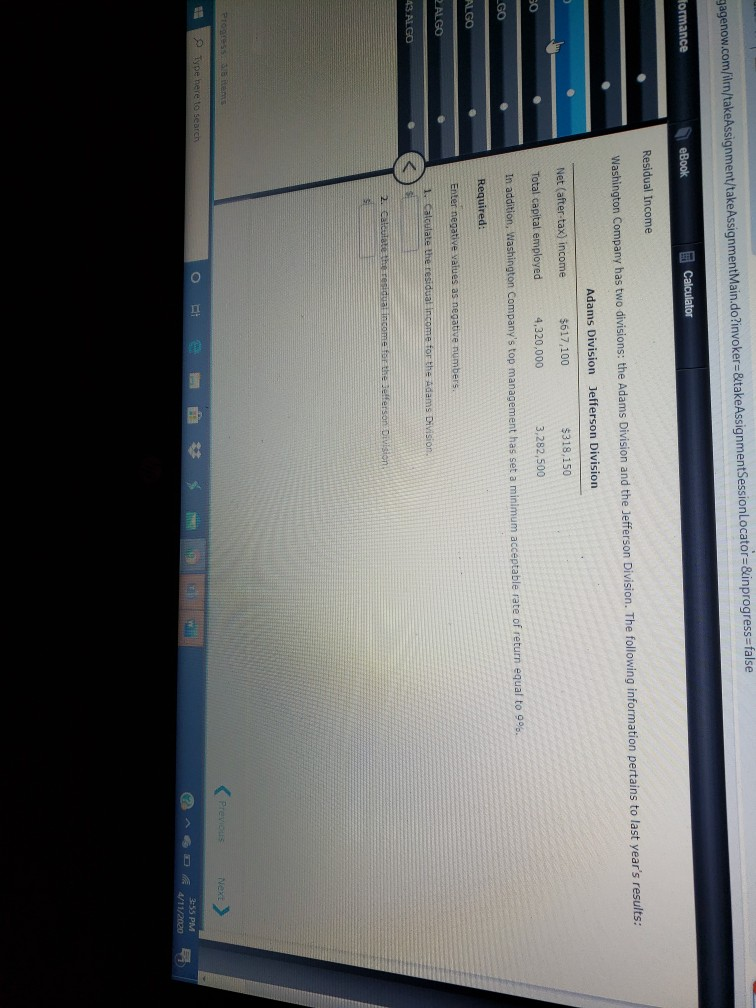

gagenow.com/ilm/takeAssignment/take AssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false Kormance eBook Calculator Residual Income Washington Company has two divisions: the Adams Division and the Jefferson Division. The following information pertains to last

gagenow.com/ilm/takeAssignment/take AssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false Kormance eBook Calculator Residual Income Washington Company has two divisions: the Adams Division and the Jefferson Division. The following information pertains to last year's results: Adams Division Jefferson Division Net (after-tax) income $617,100 $318,150 Total capital employed 4,320,000 3,282,500 . In addition, Washington Company's top management has set a minimum acceptable rate of return equal to 9 LGO Required: ALGO Enter negative values as negative numbers ALGO 1. Calculate the residual income for the Adams Division 43 ALGO 2. Calculate the residual income for the sellerson Division Progress items Previous Next > Type here to search A6D4/11/2020 3:55 PM ) gagenow.com/ilm/takeAssignment/take AssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false Kormance eBook Calculator Residual Income Washington Company has two divisions: the Adams Division and the Jefferson Division. The following information pertains to last year's results: Adams Division Jefferson Division Net (after-tax) income $617,100 $318,150 Total capital employed 4,320,000 3,282,500 . In addition, Washington Company's top management has set a minimum acceptable rate of return equal to 9 LGO Required: ALGO Enter negative values as negative numbers ALGO 1. Calculate the residual income for the Adams Division 43 ALGO 2. Calculate the residual income for the sellerson Division Progress items Previous Next > Type here to search A6D4/11/2020 3:55 PM )

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started