Question

Tom and Gail form Owl Corporation with the following consideration: The installment note has a face amount of $350,000 and was acquired last year from

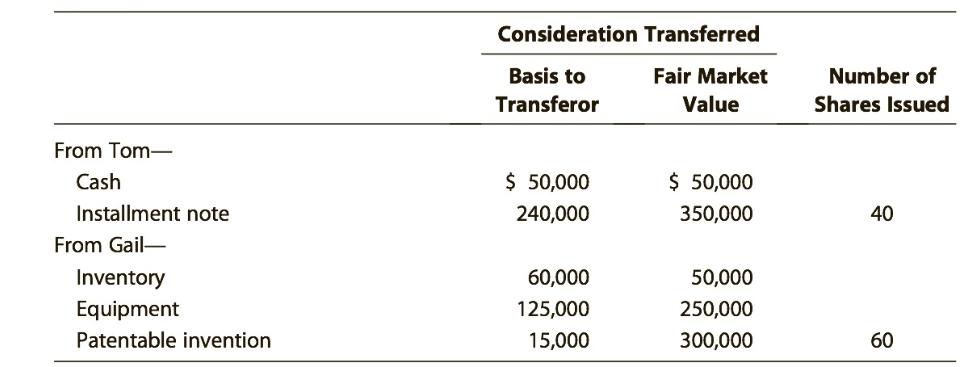

Tom and Gail form Owl Corporation with the following consideration:

The installment note has a face amount of $350,000 and was acquired last year from the sale of land held for investment purposes (adjusted basis of $240,000).

Gail is considering an alternative to the plan as presented above. She is considering selling the inventory to an unrelated third party for $50,000 in the current year instead of contributing it to Owl. After the sale, she will transfer the $50,000 sales proceeds along with the equipment and patentable invention to Owl for 60 shares of Owl stock. Whether or not she pursues the alternative, she plans to sell her Owl stock in six years for an anticipated sales price of $700,000. In present value terms and assuming she later sells her Owl stock, determines the tax cost of

(1) contributing the property as originally planned

(2) pursuing the alternative she has identified. Referring to Appendix F, assume a discount rate of 6%. Further, assume Gail’s marginal income tax rate is 28% and her capital gains rate is 15%.

Consideration Transferred Basis to Fair Market Number of Transferor Value Shares Issued From Tom- Cash $ 50,000 $ 50,000 Installment note 240,000 350,000 40 From Gail- Inventory 60,000 50,000 Equipment 125,000 250,000 Patentable invention 15,000 300,000 60

Step by Step Solution

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

a Toms recognized gain or loss is 0 This transfer meets the requirement of Sec 351 Hence Tom doesnt ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started