Answered step by step

Verified Expert Solution

Question

1 Approved Answer

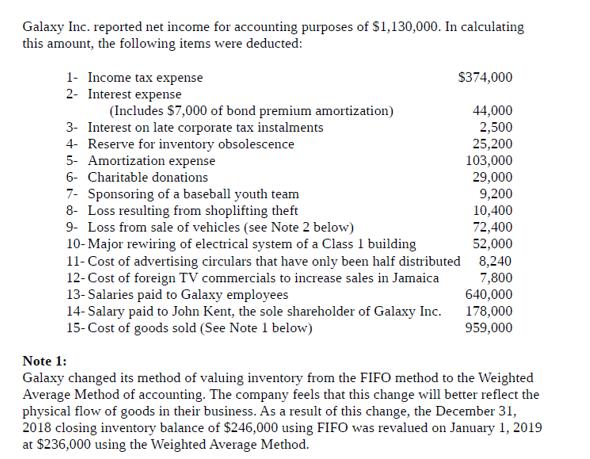

Galaxy Inc. reported net income for accounting purposes of $1,130,000. In calculating this amount, the following items were deducted: 1- Income tax expense 2-

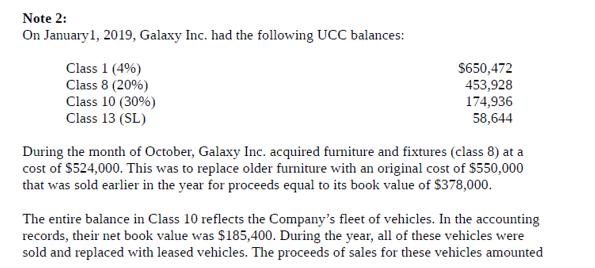

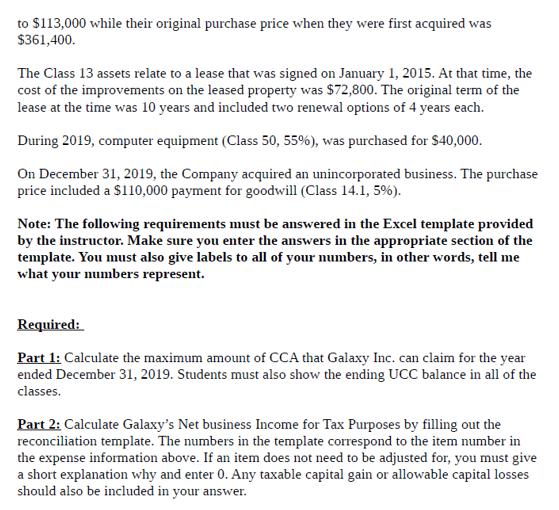

Galaxy Inc. reported net income for accounting purposes of $1,130,000. In calculating this amount, the following items were deducted: 1- Income tax expense 2- Interest expense (Includes $7,000 of bond premium amortization) 3- Interest on late corporate tax instalments 4- Reserve for inventory obsolescence 5- Amortization expense 6- Charitable donations $374,000 44,000 2,500 25,200 103,000 7- Sponsoring of a baseball youth team 8- Loss resulting from shoplifting theft 9- Loss from sale of vehicles (see Note 2 below) 10-Major rewiring of electrical system of a Class 1 building 11- Cost of advertising circulars that have only been half distributed 12-Cost of foreign TV commercials to increase sales in Jamaica 13-Salaries paid to Galaxy employees 14- Salary paid to John Kent, the sole shareholder of Galaxy Inc. 15-Cost of goods sold (See Note 1 below) 29,000 9,200 10,400 72,400 52,000 8,240 7,800 640,000 178,000 959,000 Note 1: Galaxy changed its method of valuing inventory from the FIFO method to the Weighted Average Method of accounting. The company feels that this change will better reflect the physical flow of goods in their business. As a result of this change, the December 31, 2018 closing inventory balance of $246,000 using FIFO was revalued on January 1, 2019 at $236,000 using the Weighted Average Method. Note 2: On January 1, 2019, Galaxy Inc. had the following UCC balances: Class 1 (4%) Class 8 (20%) Class 10 (30%) Class 13 (SL) $650,472 453,928 174,936 58,644 During the month of October, Galaxy Inc. acquired furniture and fixtures (class 8) at a cost of $524,000. This was to replace older furniture with an original cost of $550,000 that was sold earlier in the year for proceeds equal to its book value of $378,000. The entire balance in Class 10 reflects the Company's fleet of vehicles. In the accounting records, their net book value was $185,400. During the year, all of these vehicles were sold and replaced with leased vehicles. The proceeds of sales for these vehicles amounted to $113,000 while their original purchase price when they were first acquired was $361,400. The Class 13 assets relate to a lease that was signed on January 1, 2015. At that time, the cost of the improvements on the leased property was $72,800. The original term of the lease at the time was 10 years and included two renewal options of 4 years each. During 2019, computer equipment (Class 50, 55%), was purchased for $40,000. On December 31, 2019, the Company acquired an unincorporated business. The purchase price included a $110,000 payment for goodwill (Class 14.1, 5%). Note: The following requirements must be answered in the Excel template provided by the instructor. Make sure you enter the answers in the appropriate section of the template. You must also give labels to all of your numbers, in other words, tell me what your numbers represent. Required: Part 1: Calculate the maximum amount of CCA that Galaxy Inc. can claim for the year ended December 31, 2019. Students must also show the ending UCC balance in all of the classes. Part 2: Calculate Galaxy's Net business Income for Tax Purposes by filling out the reconciliation template. The numbers in the template correspond to the item number in the expense information above. If an item does not need to be adjusted for, you must give a short explanation why and enter 0. Any taxable capital gain or allowable capital losses should also be included in your answer.

Step by Step Solution

★★★★★

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

a Statement of Income for Colonial Restaurant for the Year Ending December 31 20XX Revenue Food sales 375000 Beverage sales 125000 Total Revenue 50000...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started