Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Galaxy Motors plc is negotiating a joint venture hydrogen vehicle engine manufacturing project. Its partner is Hydro Energy plc, which has developed a prototype

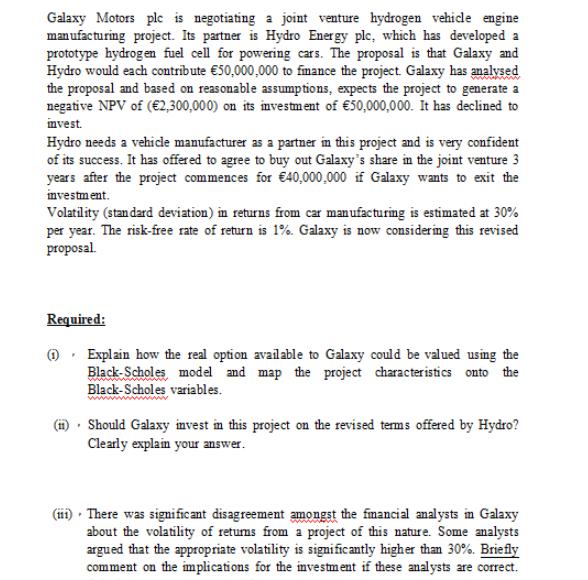

Galaxy Motors plc is negotiating a joint venture hydrogen vehicle engine manufacturing project. Its partner is Hydro Energy plc, which has developed a prototype hydrogen fuel cell for powering cars. The proposal is that Galaxy and Hydro would each contribute 50,000,000 to finance the project. Galaxy has analysed the proposal and based on reasonable assumptions, expects the project to generate a negative NPV of (2,300,000) on its investment of 50,000,000. It has declined to invest. Hydro needs a vehicle manufacturer as a partner in this project and is very confident of its success. It has offered to agree to buy out Galaxy's share in the joint venture 3 years after the project commences for 40,000,000 if Galaxy wants to exit the investment. Volatility (standard deviation) in returns from car manufacturing is estimated at 30% per year. The risk-free rate of return is 1%. Galaxy is now considering this revised proposal Required: Explain how the real option available to Galaxy could be valued using the Black-Scholes, model and map the project characteristics onto the Black-Scholes variables. Should Galaxy invest in this project on the revised terms offered by Hydro? Clearly explain your answer. (iii) There was significant disagreement amongst the financial analysts in Galaxy about the volatility of returns from a project of this nature. Some analysts argued that the appropriate volatility is significantly higher than 30%. Briefly comment on the implications for the investment if these analysts are correct.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started