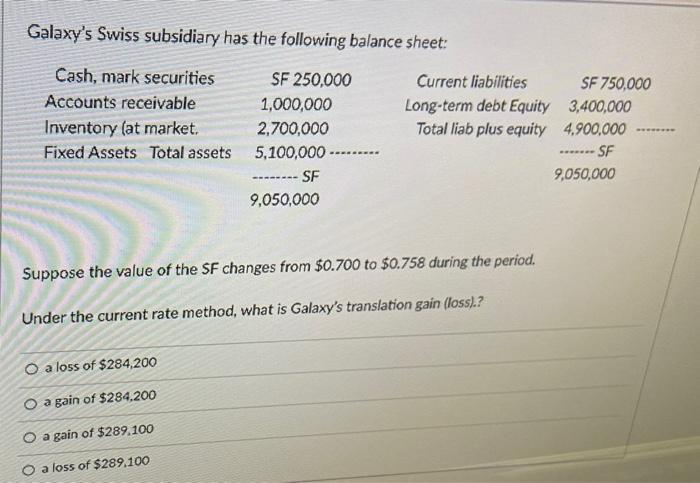

Galaxy's Swiss subsidiary has the following balance sheet: Cash, mark securities SF 250,000 Accounts receivable Inventory (at market. Fixed Assets Total assets 1,000,000 2,700,000

Galaxy's Swiss subsidiary has the following balance sheet: Cash, mark securities SF 250,000 Accounts receivable Inventory (at market. Fixed Assets Total assets 1,000,000 2,700,000 5,100,000- SF O a loss of $284,200 O a gain of $284,200 a gain of $289.100 a loss of $289.100 ------- 9,050,000 Current liabilities Long-term debt Equity Total liab plus equity Suppose the value of the SF changes from $0.700 to $0.758 during the period. Under the current rate method, what is Galaxy's translation gain (loss).? SF 750,000 3,400,000 4,900,000 --SF ******* 9,050,000 ********

Step by Step Solution

3.37 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

The image shows a problem relating to the translation of a foreign subsidiarys financial statements into the parent companys reporting currency Galaxy...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started