Question

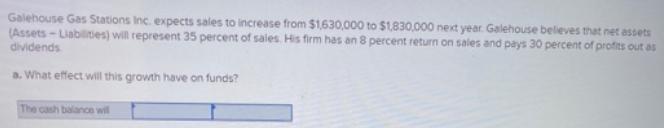

Galehouse Gas Stations Inc. expects sales to increase from $1,630,000 to $1,830,000 next year. Galehouse believes that net assets (Assets - Liabilites) will represent

Galehouse Gas Stations Inc. expects sales to increase from $1,630,000 to $1,830,000 next year. Galehouse believes that net assets (Assets - Liabilites) will represent 35 percent of sales His firm has an 8 percent return on sales and pays 30 percent of profits out as dividends a. What effect will this growth have on funds? The cash balance will rork 2 i Saved b. If the dividend payout is only 10 percent, what effect will this growth have on funds? pok The cash balance will wint rint < Prev 2 of 19 Next > e here to search O BI pfm-lt-4akh + F1 F2 F3 F4 F5 F6 F8 F9 F10 23 % & 2 3 4 7- 8 W. R ( CO A LO

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Sale increased amount expected sale current sale sales increase amou...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Foundations of Financial Management

Authors: Stanley Block, Geoffrey Hirt, Bartley Danielsen

15th edition

77861612, 1259194078, 978-0077861612, 978-1259194078

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App