Question

Galenic Inc. is a wholesaler for a range of pharmaceutical products. Before deducting any losses from bad debts, Galenic operates on a profit margin of

Galenic Inc. is a wholesaler for a range of pharmaceutical products. Before deducting any losses from bad debts, Galenic operates on a profit margin of 5%. For a long time the firm has employed a numerical credit-scoring system based on a small number of key ratios. This has resulted in a bad debt ratio of 1.00%.

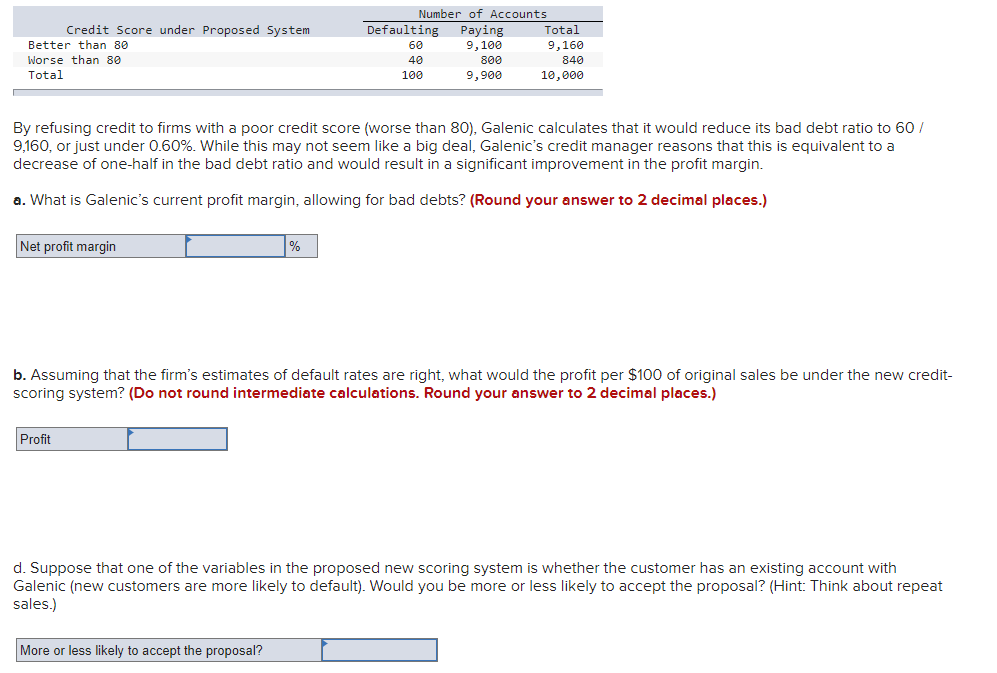

Galenic has recently commissioned a detailed statistical study of the payment record of its customers over the past 7 years and, after considerable experimentation, has identified five variables that could form the basis of a new credit-scoring system. On the evidence of the past 8 years, Galenic calculates that for every 10,000 accounts it would have experienced the following default rates:

Credit Score under Proposed System Better than 80 Worse than 80 Total Number of Accounts Defaulting Paying Total 60 9,100 9,160 40 800 840 109 9,900 10,000 By refusing credit to firms with a poor credit score (worse than 80), Galenic calculates that it would reduce its bad debt ratio to 60 / 9,160, or just under 0.60%. While this may not seem like a big deal, Galenic's credit manager reasons that this is equivalent to a decrease of one-half in the bad debt ratio and would result in a significant improvement in the profit margin. a. What is Galenic's current profit margin, allowing for bad debts? (Round your answer to 2 decimal places.) Net profit margin % b. Assuming that the firm's estimates of default rates are right, what would the profit per $100 of original sales be under the new credit- scoring system? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Profit d. Suppose that one of the variables in the proposed new scoring system is whether the customer has an existing account with Galenic (new customers are more likely to default). Would you be more or less likely to accept the proposal? (Hint: Think about repeat sales.) More or less likely to accept the proposal

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started