Question

Gallio Inc. manufactures socket wrenches. For next month, the vice president of production plans on producing 4,450 wrenches per day. The company can produce as

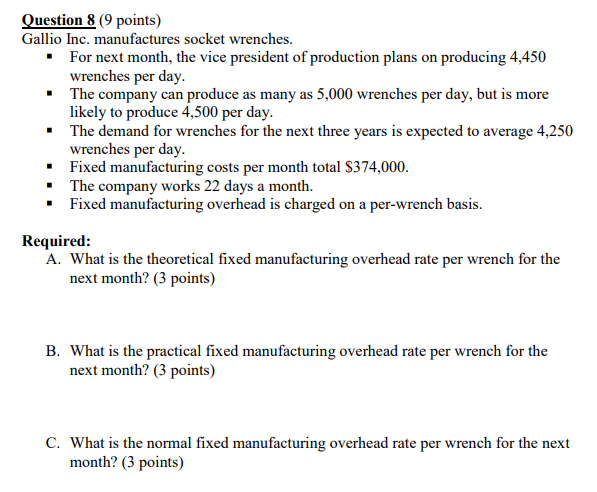

Gallio Inc. manufactures socket wrenches. For next month, the vice president of production plans on producing 4,450 wrenches per day. The company can produce as many as 5,000 wrenches per day, but is more likely to produce 4,500 per day. The demand for wrenches for the next three years is expected to average 4,250 wrenches per day. Fixed manufacturing costs per month total $374,000. The company works 22 days a month. Fixed manufacturing overhead is charged on a per-wrench basis. Required:

A. What is the theoretical fixed manufacturing overhead rate per wrench for the next month? (3 points)

B. What is the practical fixed manufacturing overhead rate per wrench for the next month? (3 points)

C. What is the normal fixed manufacturing overhead rate per wrench for the next month? (3 points

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started