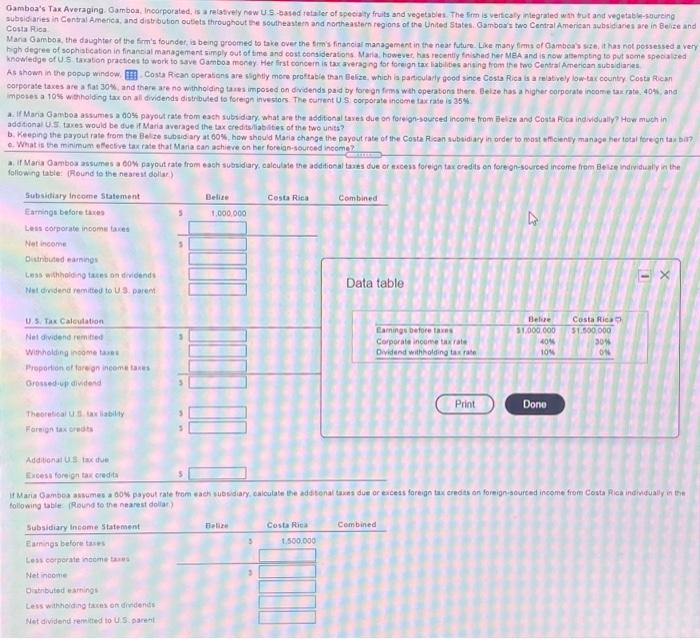

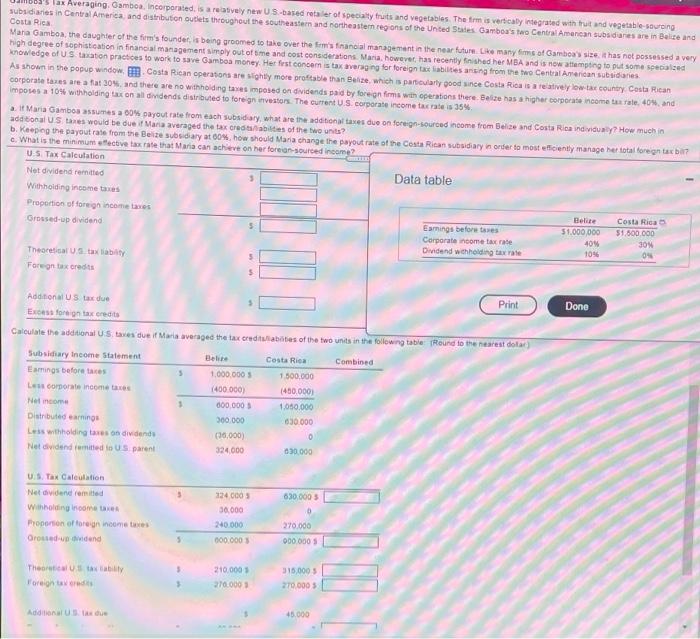

Gamboa's Tax Averaging CamboaIncorporated, is relatively new US-based retailer of specialty fruits and vegetables. The firm is vertically integrated with but and vegetable-sourcing subsidiaries in Central America, and distribution outlets throughout the southeastern and northeastern regions of the United States Gamboa's two Central American subsidiaries are in Beize and Costa Rica Mana Gamboa, the daughter of the firm's founder, is being groomed to take over ther's financial management in the near future. Like many forms of Gamboa sze, it has not possessed a very high degree of sophistication in financial management simply out of time and cost considerations Maria, however has recently finished her MBA and is now attempting to put some specialized knowledge of US taration practices to work to save Gamboa monay. Her first concern is taxaveraging for foreign tax liabilities arising from the two Central American subsidiaries As shown in the popup window Costa Rican operations are slightly more prottable than Belize, which is particularly good since Costa Rica is a relatively low tax country Costa Rica corporate taxes are fat 30% and there are no withholding tas imposed on dividends paid by foregnfums with operations there. Belze has a higher corporate income tax rate 40%, and imposes a 10% wthholding tax on al dividenda distributed to foreign investors. The current U.S. corporate income tax rate is 35% af Mana Gamboa assumes a 005 payout rate from each subsidiary, what are the additional taxes due on foreign-sourced income from Belze and Costa Rica individually? How much in additional US taxes would be due i Maria averaged the tax credits:/labilities of the two units? b. Keeping the payout rate from the Bete subudiary #60% how should Maria change the payout rate of the Costa Rican subsidiary in order to most oficient manage her total frentaba e. What is the minimum effective tax rate that Maria can achieve on her foreign-sourced Income Maria Camboansumes cow sayout rate from each subsidiary, calculate the additional tastes due or excess towion tax credits on tore on-sourced Income from Belize individually in the following table: Round to the nearest dollar Belize Costa Rica Combined 5 1.000.000 Subsidiary Income Statement Earnings before taxes Les corporate income taxes Net income Distributed earnings Less withholding taes on dividends Notdividend remitted to US parent Data table - U.S. Tax Calculation Neladendromitted Withholding income Proportion of foreign income taxes Grossedur dividend Caming before tas Corporate income tax rate Dividend withholding taxa Bebe 51.000.000 404 10 Costa Rica 51.500.000 30 ON Print Dono Theoretical axlabilty Foreign tax credits Additionat take Excess foreign tax credit vt Maria Gamboa wames a 80% payout rate from each sundary calculate the additional luas due or excess foreign tax credits on formign-aourted income from Costa Rica individually in the following table (Round to the nearest dolar) Subsidiary Income Statement Costa Rica Combined Earrings before tas 1.500.000 Lens corporate comes Net income Ostbuted emings Less withholding taces on dividends Net dividend remitted to US parent BOSS lax Averaging. Gamboa. Incorporated is arvely new US-based retailer of specialty traits and vegetables. The vertically integrated with trut and vegetable soping subsidiaries in Central America and distribution outlets throughout the southeastern and northeastern regions of the United States Gamboa's two Central American subsidiaries are in Belice and Costa Rica Mara Gamboa, the daughter of the firm's founder, is being groomed to take over the firm's financial management in the near future. Like many firms of Gamboa size. It has not possessed a very high degree of sophistication in financial management simply out of time and cost considerations Mana, however, has recently finished her MBA and is now attempting to put some specialized knowledge of US taxation practices to work to save Gamboa money. Her first concem s tax varging for foreign tatiabilities ansing from the two Central American subsidiaries. As shown in the popup window Costa Rican operations are the more profitable than Belize, which is particularly good sunce Costa Rica is a reativey low tax country Costa Rican corporate taxes are a fat 30%, and there are no wthholding taxes imposed on dividends paid by foreign firms with operations there. Belize has a higher corporate income tax rate 40 and Imposes a 10% withholding tax on all dividends distributed to foreign investors. The current U.S.corporate income tax rates 35% It Maria Gamboa assumes a 60% payout rate from each subsidiary, what are the one taxes due on foreign-sourced income from Belize and Costa Rica individualy? How much in additional US we would be du Mara averaged the tax creates of the town? b. Keeping the payout rate from the Betze subsidiary at 60how should Man change the payout rate of the Costa Rican subsidiary in order to most iciently manage her totalforentabi e. What is the minimum efective tax rate that aria can achieve on her foren-sourced income? U S Tax Calculation Net dividend remitted Data table Withholding income taxes Proportion of foreign income taxes Belize Costa Rica Grossed-up dividend Earnings before tres 51.000.000 51.800.000 Corporate income tax rate 40% 30% Dividend withholding tax rate 10% 04 Theoretical US taxaby Foreign tax credits Additional US tax due Excess foron tax credits Print Done Calculate the additional Staves due if Maria averaged the tax credituliabates of the two units in the following table Round to the nearest dolar) Costa Rica Combined 5 Subsidiary Income Statement Earnings before taxes Le corporate income taxes Not income Distributed earning Less withholding taxes on dividende Net dividend omitted to US parent Belize 1.000.000 (400.000 000.000 300.000 (30,000) 324.000 1 500,000 (480.000 1.050.000 630.000 0 30.000 5 630.000 5 U.S. Tax Calculation Net dividentromitted Withholding income Proportion of foreign income taxes Ground udend 0 124 000 30.000 240.000 000.000 270.000 000 000 TIN 5 The stability Foreight 210.000 270.000 315.000 5 270.000 Add Use 45.000