Answered step by step

Verified Expert Solution

Question

1 Approved Answer

GameStop Corp. ( GameStop , we , us , our, or the Company ) offers games and entertainment products

GameStop Corp. GameStopweus "our," or the "Company" offers games and entertainment products through its stores and ecommerce platforms. We offer new and preowned gaming software for current and certain prior generation consoles. We also sell a wide variety of ingame digital currency, digital downloadable content and fullgame downloads. We aim to be the leading destination for games and entertainment products through our stores and ecommerce platforms.

GameStop states this about revenue recognition.

Customer Liabilities

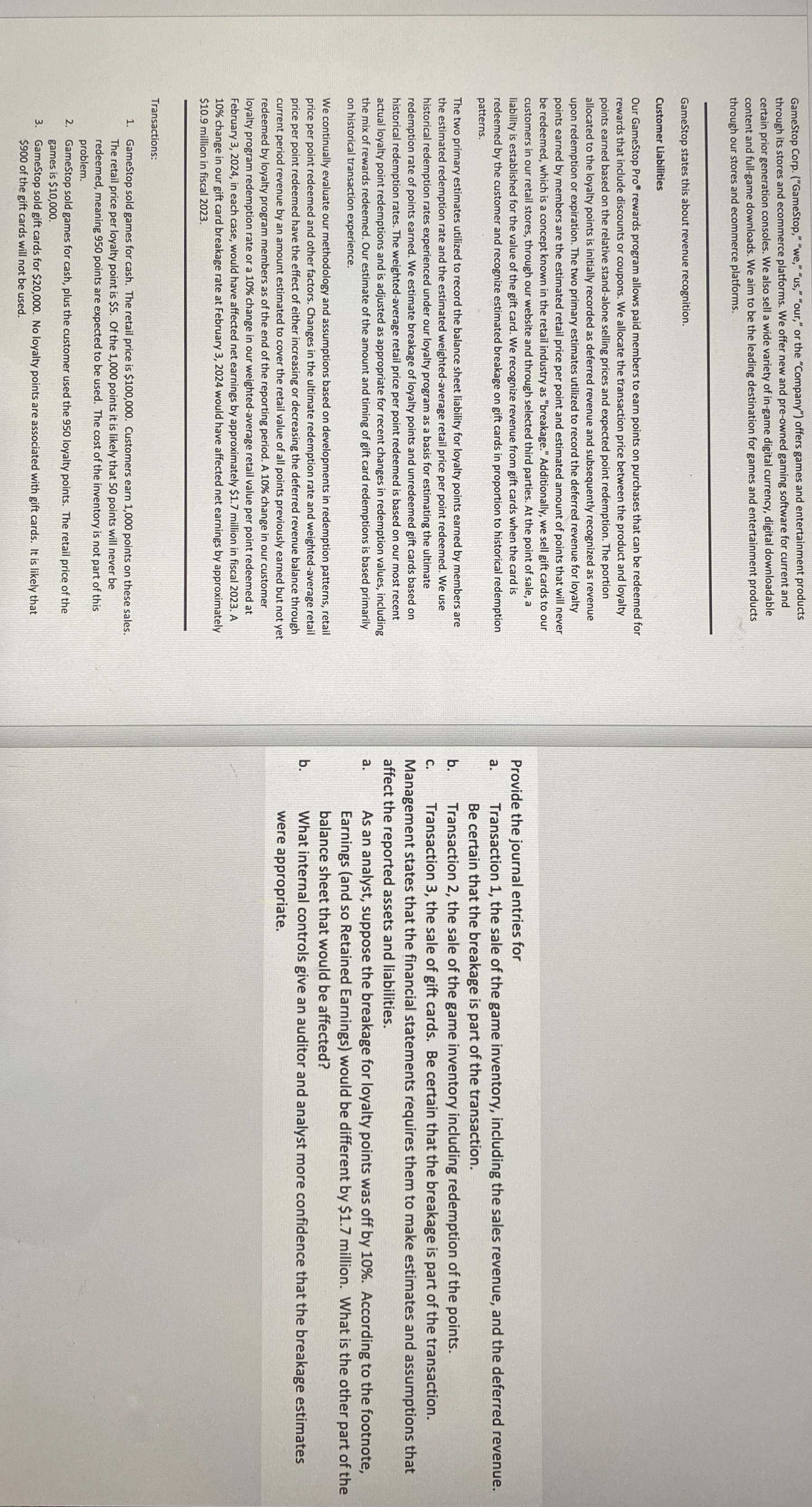

Our GameStop Pro rewards program allows paid members to earn points on purchases that can be redeemed for rewards that include discounts or coupons. We allocate the transaction price between the product and loyalty points earned based on the relative standalone selling prices and expected point redemption. The portion allocated to the loyalty points is initially recorded as deferred revenue and subsequently recognized as revenue upon redemption or expiration. The two primary estimates utilized to record the deferred revenue for loyalty points earned by members are the estimated retail price per point and estimated amount of points that will never be redeemed, which is a concept known in the retail industry as "breakage." Additionally, we sell gift cards to our customers in our retail stores, through our website and through selected third parties. At the point of sale, a liability is established for the value of the gift card. We recognize revenue from gift cards when the card is redeemed by the customer and recognize estimated breakage on gift cards in proportion to historical redemption patterns.

The two primary estimates utilized to record the balance sheet liability for loyalty points earned by members are the estimated redemption rate and the estimated weightedaverage retail price per point redeemed. We use historical redemption rates experienced under our loyalty program as a basis for estimating the ultimate redemption rate of points earned. We estimate breakage of loyalty points and unredeemed gift cards based on historical redemption rates. The weightedaverage retail price per point redeemed is based on our most recent actual loyalty point redemptions and is adjusted as appropriate for recent changes in redemption values, including the mix of rewards redeemed. Our estimate of the amount and timing of gift card redemptions is based primarily on historical transaction experience.

We continually evaluate our methodology and assumptions based on developments in redemption patterns, retail price per point redeemed and other factors. Changes in the ultimate redemption rate and weightedaverage retail price per point redeemed have the effect of either increasing or decreasing the deferred revenue balance through current period revenue by an amount estimated to cover the retail value of all points previously earned but not yet redeemed by loyalty program members as of the end of the reporting period. A change in our customer loyalty program redemption rate or a change in our weightedaverage retail value per point redeemed at February in each case, would have affected net earnings by approximately $ million in fiscal A change in our gift card breakage rate at February would have affected net earnings by approximately $ million in fiscal

Transactions:

GameStop sold games for cash. The retail price is $ Customers earn points on these sales. The retail price per loyalty point is $ Of the points it is likely that points will never be redeemed, meaning points are expected to be used. The cost of the inventory is not part of this problem.

Gamestop sold games for cash, plus the customer used the loyalty points. The retail price of the games is $

GameStop sold gift cards for $ No loyalty points are associated with gift cards. It is likely that $ of the gift cards will not be used.

Provide the journal entries for

a Transaction the sale of the game inventory, including the sales revenue, and the deferred revenue. Be certain that the breakage is part of the transaction.

b Transaction the sale of the game inventory including redemption of the points.

c Transaction the sale of gift cards. Be certain that the breakage is part of the transaction.

Management states that the financial statements requires them to make estimates and assumptions that affect the reported assets and liabilities.

a As an analyst, suppose the breakage for loyalty points was off by According to the footnote, Earnings and so Retained Earnings would be different

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started