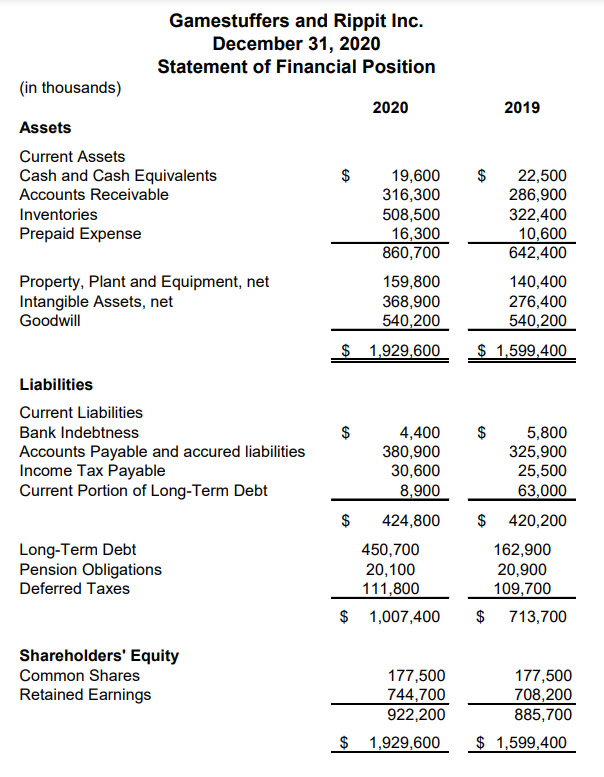

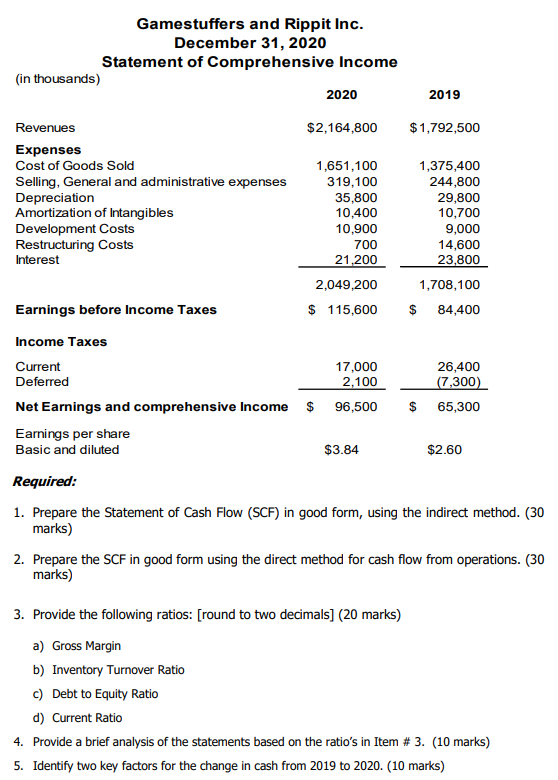

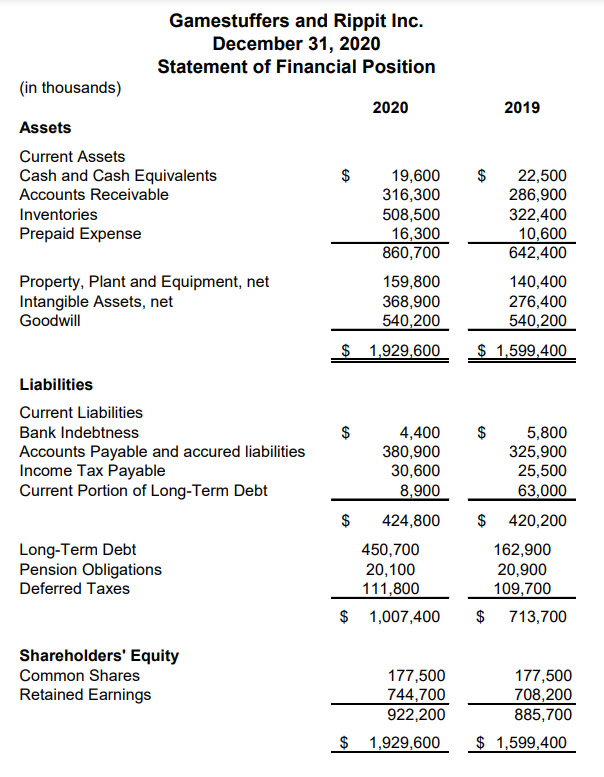

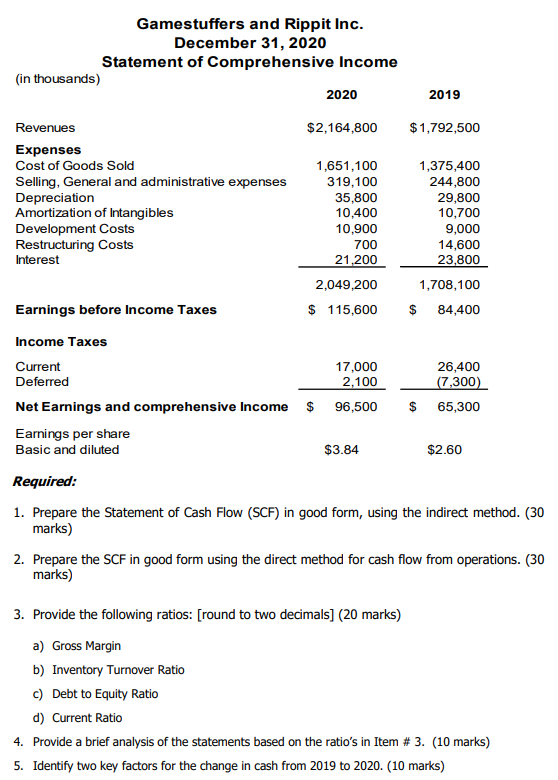

Gamestuffers and Rippit Inc. December 31, 2020 Statement of Financial Position (in thousands) 2020 2019 Assets Current Assets Cash and Cash Equivalents Accounts Receivable Inventories Prepaid Expense $ 19,600 316,300 508,500 16,300 860,700 159,800 368,900 540,200 $ 1,929,600 $ 22,500 286,900 322,400 10,600 642,400 140,400 276,400 540,200 $ 1,599,400 Property, Plant and Equipment, net Intangible Assets, net Goodwill Liabilities Current Liabilities Bank Indebtness Accounts Payable and accured liabilities Income Tax Payable Current Portion of Long-Term Debt $ 4,400 380,900 30,600 8,900 $ 424,800 450,700 20,100 111,800 $ 1,007,400 $ 5,800 325,900 25,500 63,000 $ 420,200 162,900 20,900 109,700 $ 713,700 Long-Term Debt Pension Obligations Deferred Taxes Shareholders' Equity Common Shares Retained Earnings 177,500 744,700 922,200 $ 1,929,600 177,500 708,200 885,700 $ 1,599,400 Gamestuffers and Rippit Inc. December 31, 2020 Statement of Comprehensive Income (in thousands) 2020 2019 $1,792,500 Revenues $2,164,800 Expenses Cost of Goods Sold 1,651,100 Selling, General and administrative expenses 319,100 Depreciation 35,800 Amortization of Intangibles 10,400 Development Costs 10,900 Restructuring Costs 700 Interest 21,200 2,049,200 Earnings before Income Taxes $ 115,600 Income Taxes Current 17,000 Deferred 2.100 Net Earnings and comprehensive Income $ 96,500 Earnings per share Basic and diluted $3.84 1,375,400 244,800 29,800 10,700 9,000 14,600 23,800 1,708,100 $ 84,400 26,400 (7,300) $ 65,300 $2.60 Required: 1. Prepare the Statement of Cash Flow (SCF) in good form, using the indirect method. (30 marks) 2. Prepare the SCF in good form using the direct method for cash flow from operations. (30 marks) 3. Provide the following ratios: [round to two decimals] (20 marks) a) Gross Margin b) Inventory Turnover Ratio c) Debt to Equity Ratio d) Current Ratio 4. Provide a brief analysis of the statements based on the ratio's in Item # 3. (10 marks) 5. Identify two key factors for the change in cash from 2019 to 2020. (10 marks) Gamestuffers and Rippit Inc. December 31, 2020 Statement of Financial Position (in thousands) 2020 2019 Assets Current Assets Cash and Cash Equivalents Accounts Receivable Inventories Prepaid Expense $ 19,600 316,300 508,500 16,300 860,700 159,800 368,900 540,200 $ 1,929,600 $ 22,500 286,900 322,400 10,600 642,400 140,400 276,400 540,200 $ 1,599,400 Property, Plant and Equipment, net Intangible Assets, net Goodwill Liabilities Current Liabilities Bank Indebtness Accounts Payable and accured liabilities Income Tax Payable Current Portion of Long-Term Debt $ 4,400 380,900 30,600 8,900 $ 424,800 450,700 20,100 111,800 $ 1,007,400 $ 5,800 325,900 25,500 63,000 $ 420,200 162,900 20,900 109,700 $ 713,700 Long-Term Debt Pension Obligations Deferred Taxes Shareholders' Equity Common Shares Retained Earnings 177,500 744,700 922,200 $ 1,929,600 177,500 708,200 885,700 $ 1,599,400 Gamestuffers and Rippit Inc. December 31, 2020 Statement of Comprehensive Income (in thousands) 2020 2019 $1,792,500 Revenues $2,164,800 Expenses Cost of Goods Sold 1,651,100 Selling, General and administrative expenses 319,100 Depreciation 35,800 Amortization of Intangibles 10,400 Development Costs 10,900 Restructuring Costs 700 Interest 21,200 2,049,200 Earnings before Income Taxes $ 115,600 Income Taxes Current 17,000 Deferred 2.100 Net Earnings and comprehensive Income $ 96,500 Earnings per share Basic and diluted $3.84 1,375,400 244,800 29,800 10,700 9,000 14,600 23,800 1,708,100 $ 84,400 26,400 (7,300) $ 65,300 $2.60 Required: 1. Prepare the Statement of Cash Flow (SCF) in good form, using the indirect method. (30 marks) 2. Prepare the SCF in good form using the direct method for cash flow from operations. (30 marks) 3. Provide the following ratios: [round to two decimals] (20 marks) a) Gross Margin b) Inventory Turnover Ratio c) Debt to Equity Ratio d) Current Ratio 4. Provide a brief analysis of the statements based on the ratio's in Item # 3. (10 marks) 5. Identify two key factors for the change in cash from 2019 to 2020. (10 marks)