Question

Gamma Company is considering an investment proposal that would require an initial outlay of $800,000, and would yield yearly cash flows of $200,000 for 9

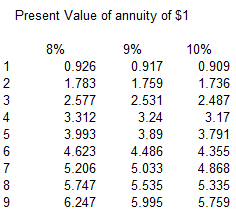

Gamma Company is considering an investment proposal that would require an initial outlay of $800,000, and would yield yearly cash flows of $200,000 for 9 years. The company uses a discount rate of 10%. What is the NPV of the investment?

$350,000

$400,000

$351,000

$250,000

===========================================================================

The NPV method of evaluating capital investments suggests that a project with positive net cash inflows that exceed the cost of the investment should be accepted.

True False

===========================================================================

Zane has received a prize which entitles him to receive annual payments of $10,000 for the next 10 years. Which of the following is to be referred to in order to calculate the total value of the prize today?

Present Value of $1

Present Value of an Annuity of $1

Future Value of $1

Future Value of an Annuity of $1

===========================================================================

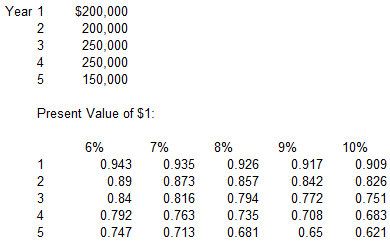

Paramount Company is considering purchasing new equipment costing $700,000. Company's management has estimated that the equipment will generate cash flows as follows.

The company's required rate of return is 9%. Using the factors in the table, calculate the present value of the cash flows.

================================================================================

An annuity refers to a series of equal cash flows received or paid annually.

True False

================================================================================

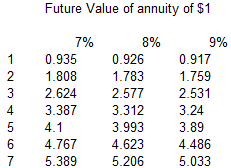

If $15,000 is invested annually in an account with 9% interest compounding yearly, what will the balance of the account be after five years? Refer to the following Future Value table:

==========================================================================

Which of the following two methods are typically used for initial screening of investments, rather than for detailed, in-depth analysis?

Net present value and Payback

Internal rate of return and Net present value

Accounting rate of return and Net present value

Payback and Accounting rate of return

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started