Question

Gamma Medical Company is currently an un-levered firm with a beta of 1.3925. Government of Canada T-bills are yielding 3% and the market risk premium

Gamma Medical Company is currently an un-levered firm with a beta of 1.3925. Government of Canada T-bills are yielding 3% and the market risk premium is 8%. You expect the company will be able to earn the required rate of return forever on an expected before tax earnings of $800,000 per year.

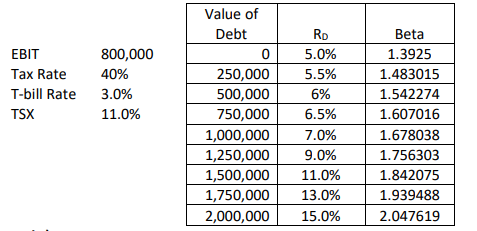

Assuming that the tax rate is 40% and now, there is a cost for the risk of default. Use the following table to answer these questions:

a) Calculate the required rate of return for the un-levered firm and the market value of the un-levered firm using proposition I.

Required Rate of Return (Using CAPM), rU = 3% + 1.3925 x 8% = 14.14% Value of Un-levered Firm = EBIT(1 - Tax Rate)/rU = 800,000 x (1 - 0.4)/(0.1414) = 3,394,625.18

b) Using the information from the table, calculate the value of the firm (proposition I), cost of equity, and the WACC (proposition II) of the firm if the firm issues $500,000 of debt.

rS = rU + (D/S) x (1 - T) x (rU - rD) Assuming Debt is used to retire equity. D/S = 500,000/(3,394,625.18 - 500,000) = 0.1727

rS = 0.1414 + 0.1727 x (1 - 0.4) x (0.1414 - 0.03) = 15.29%

VL = VU + TcD - Distress Costs = 3,394,625.18 + 0.4 x 500,000 - 6% x Default Costs = 3,594,625.18 - 0.06

c) Calculate the WACC for an un-levered firm using proposition II. No calculation required

d) Using the information from the table, calculate the value of the firm (proposition I), cost of equity, and the WACC (proposition II) of the firm if the firm issues $500,000 of debt.

Value of Debt 2 Beta 1.3925 1.483015 1.542274 1.607016 1.678038 1.756303 1.842075 1.939488 2.047619 EBIT Tax Rate T-bill Rate 800,000 40% 3.0% 11.0% 01 5.0% 250,000 500,000 750,000 | 1,000,000 1,250,000 | 1,500,000| 1,750,000| 2,000,000| 5.5% 6% 6.5% 70% 9.0% 11.0% 13.0% 15.0% Value of Debt 2 Beta 1.3925 1.483015 1.542274 1.607016 1.678038 1.756303 1.842075 1.939488 2.047619 EBIT Tax Rate T-bill Rate 800,000 40% 3.0% 11.0% 01 5.0% 250,000 500,000 750,000 | 1,000,000 1,250,000 | 1,500,000| 1,750,000| 2,000,000| 5.5% 6% 6.5% 70% 9.0% 11.0% 13.0% 15.0%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started