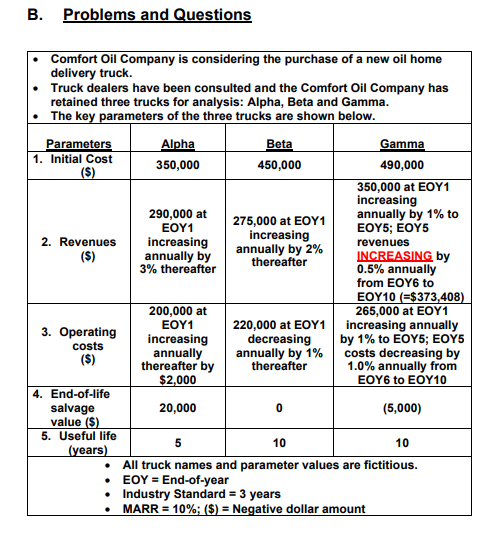

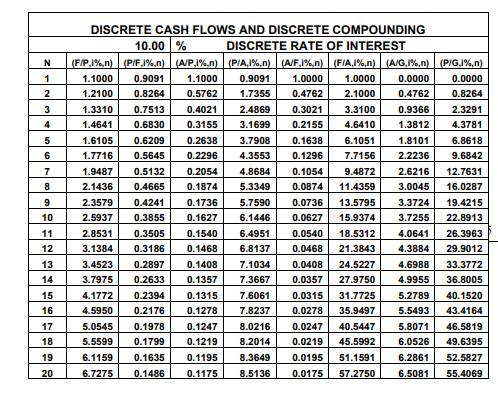

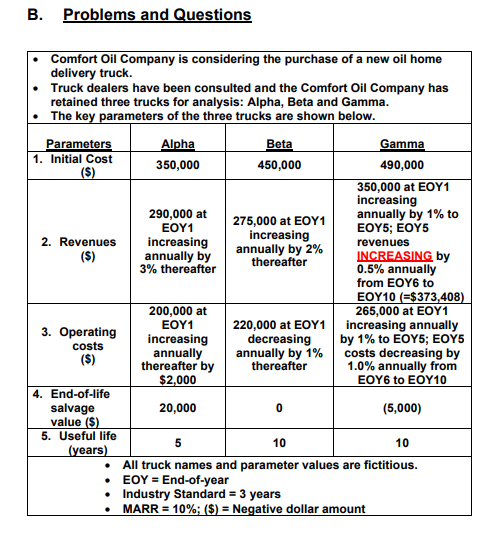

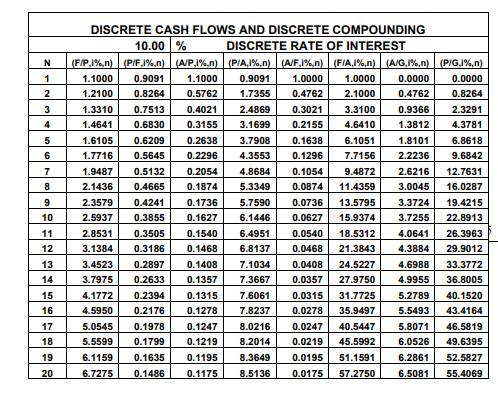

Gamma Project: $350,000 at EOY1 increasing annually by 1% to EOY5; EOY5 revenues INCREASING by 0.5% annually from EOY6 to EOY10 (=$373,408). The revenues given for EOY10 were correct. B. Problems and Questions Comfort Oil Company is considering the purchase of a new oil home delivery truck. Truck dealers have been consulted and the Comfort Oil Company has retained three trucks for analysis: Alpha, Beta and Gamma. The key parameters of the three trucks are shown below. Parameters Alpha Beta Gamma 1. Initial Cost 350,000 450,000 490,000 ($) 350,000 at EOY1 increasing 290,000 at 275,000 at EOY1 annually by 1% to EOY1 2. Revenues EOY5; EOY5 increasing increasing revenues ($) annually by annually by 2% thereafter INCREASING by 3% thereafter 0.5% annually from EOY6 to EOY10 (=$373,408) 200,000 at 265,000 at EOY1 EOY1 220,000 at EOY1 increasing annually 3. Operating increasing decreasing by 1% to EOY5; EOY5 costs ($) annually annually by 1% costs decreasing by thereafter by thereafter 1.0% annually from $2,000 EOY6 to EOY10 4. End-of-life salvage 20,000 0 (5,000) value (5) 5. Useful life 5 10 10 (years) All truck names and parameter values are fictitious. EOY = End-of-year Industry Standard = 3 years MARR = 10%; ($) = Negative dollar amount 1. 2. 3. Beta's Net Future Worth (NFW) at EOY10. Alpha's Net Present Worth (NPW) at EOYO. Gamma's NFW at EOY10. Alpha's Annual Equivalent Worth (AEW). Gamma's AEW over 20 years (as it was repeated without changes to its initial parameter values). 4. . 5. N 1 2 3 4 5 6 7 8 9 DISCRETE CASH FLOWS AND DISCRETE COMPOUNDING 10.00% DISCRETE RATE OF INTEREST (FIP,1%.n) (P/F,1%.n) (AP,1%.n) (PIA,1%,n) (A/F.1%,n) (FIA,1%.n) (AIG,1%.n) (P/G,1%,n) 1.1000 0.9091 1.1000 0.9091 1.0000 1.0000 0.0000 0.0000 1.2100 0.8264 0.5762 1.7355 0.4762 2.1000 0.4762 0.8264 1.3310 0.7513 0.4021 2.4869 0.3021 3.3100 0.9366 2.3291 1.4641 0.6830 0.3155 3.1699 0.2155 4.6410 1.3812 4.3781 1.6105 0.6209 0.2638 3.7908 0.1638 6.1051 1.8101 6.8618 1.7716 0.5645 0.2296 4.3553 0.1296 7.7156 2.2236 9.6842 1.9487 0.5132 0.2054 4.8684 0.1054 9.4872 2.6216 12.7631 2.1436 0.4665 0.1874 5.3349 0.0874 11.4359 3.0045 16.0287 2.3579 0.4241 0.1736 5.7590 0.0736 13.5795 3.3724 19.4215 2.5937 0.3855 0.1627 6.1446 0.0627 15.9374 3.7255 22.8913 2.8531 0.3505 0.1540 6.4951 0.0540 18.5312 4.0641 26.3963 3.1384 0.3186 0.1468 6.8137 0.0468 21.3843 4.3884 29.9012 3.4523 0.2897 0.1408 7.1034 0.0408 24.5227 4.6988 33.3772 3.7975 0.2633 0.1357 7.3667 0.0357 27.9750 4.9955 36.8005 4.1772 0.2394 0.1315 7.6061 0.0315 31.7725 5.2789 40.1520 4.5950 0.2176 0.1278 7.8237 0.0278 35.9497 5.5493 43.4164 5.0545 0.1978 0.1247 8.0216 0.0247 40.5447 5.8071 46.5819 5.5599 0.1799 0.1219 8.2014 0.0219 45.5992 6.0526 49.6395 6.1159 0.1635 0.1195 8.3649 0.0195 51.1591 6.2861 52.5827 6.7275 0.1486 0.1175 8.5136 0.0175 57.2750 6.5081 55.4069 10 11 12 13 14 15 16 17 18 19 20 | |||||||||||||