Answered step by step

Verified Expert Solution

Question

1 Approved Answer

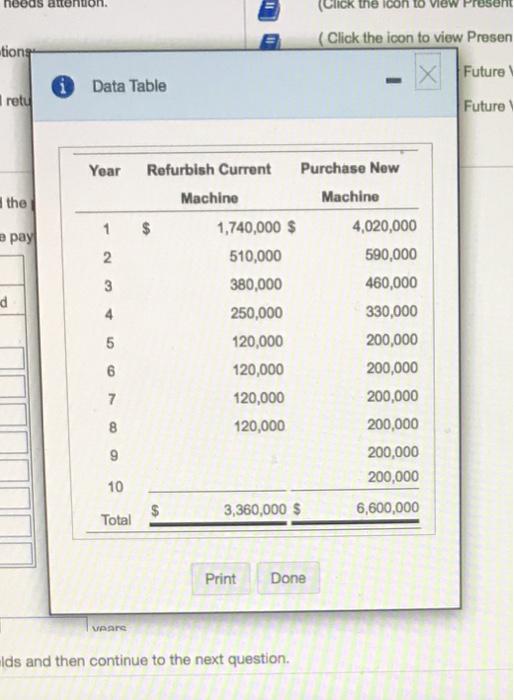

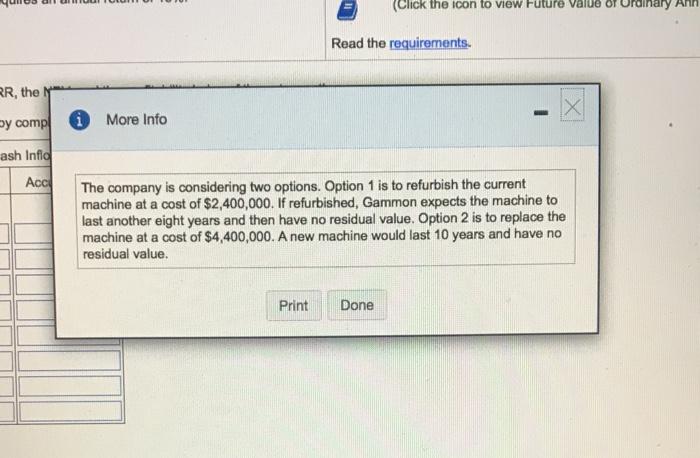

Gammon Manufacturing, Inc. has a manufacturing machine that needs attention. (Click the icon to view additional information.) Gammon expects the following net cash inflows

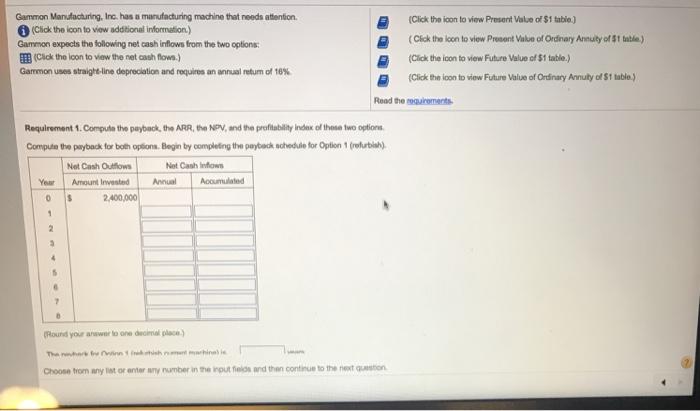

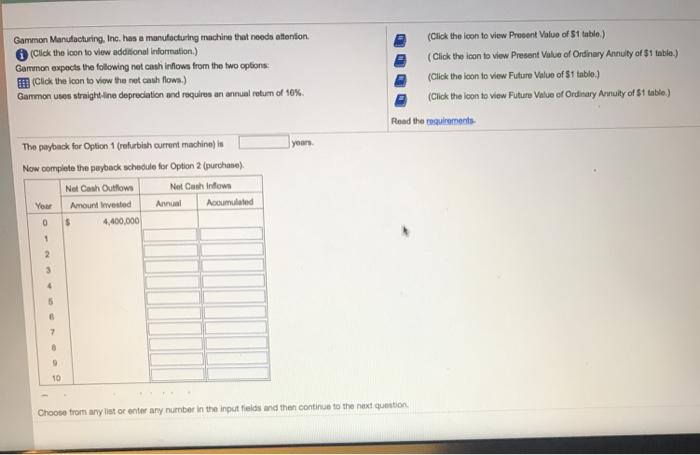

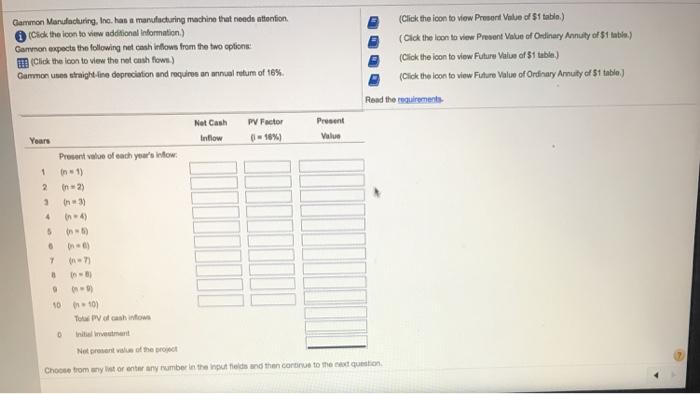

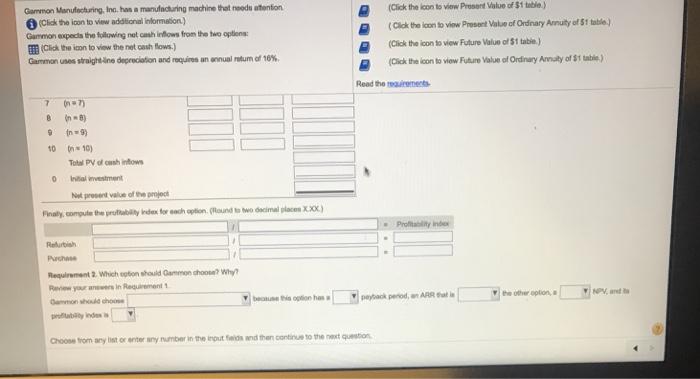

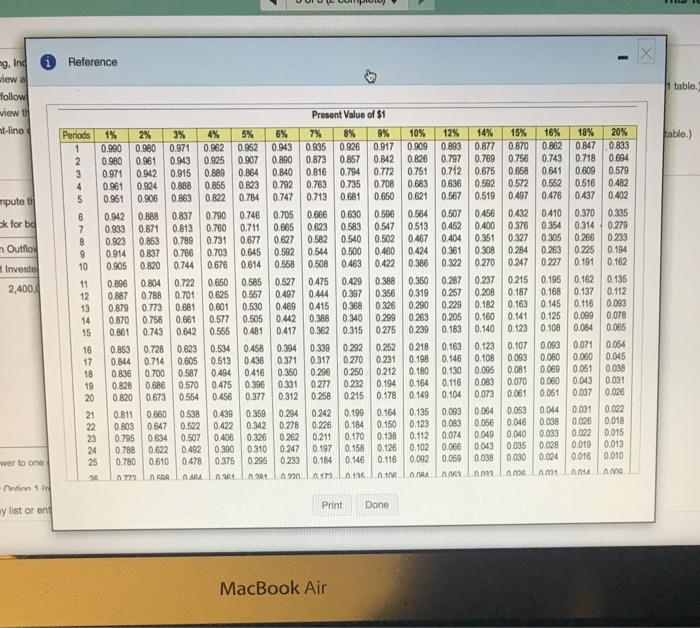

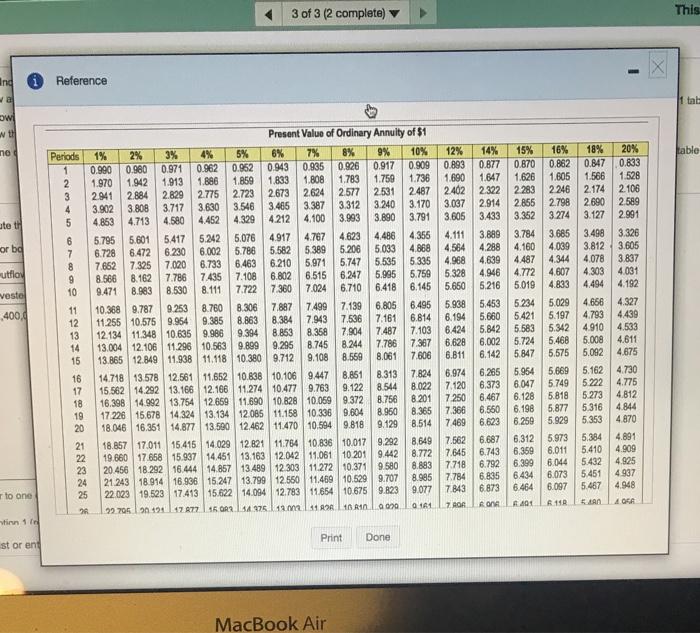

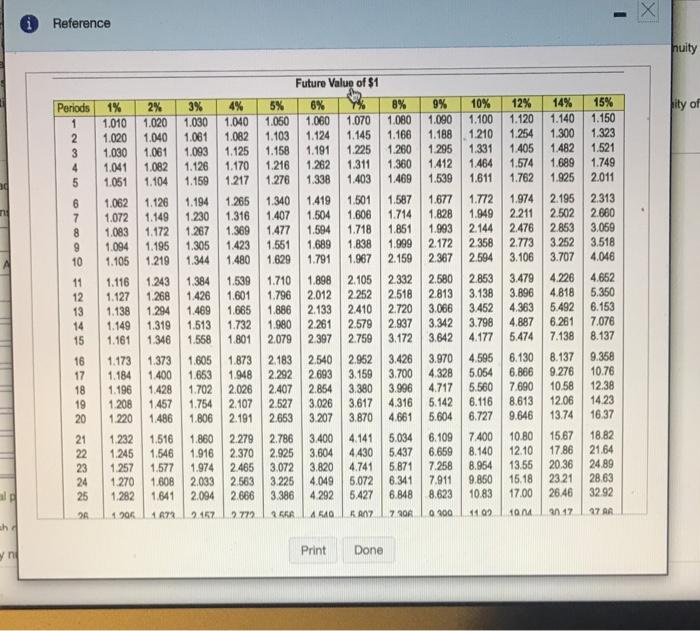

Gammon Manufacturing, Inc. has a manufacturing machine that needs attention. (Click the icon to view additional information.) Gammon expects the following net cash inflows from the two options: (Click the loon to view the net cash flows.) Gammon uses straight-line depreciation and requires an annual return of 16% Requirement 1. Compute the payback, the ARR, the NPV, and the profitability index of these two options. Compute the payback for both options. Begin by completing the payback schedule for Option 1 (refurbish) Net Cash Outflows Net Cash inflows Year Amount Invested 0 $ 2,400,000 1 6 Annual Accumulated Read the requirements (Click the icon to view Present Value of $1 table.) (Click the icon to view Present Value of Ordinary Annuity of $1 table) (Click the icon to view Future Value of $1 table.) (Click the icon to view Future Value of Ordinary Annuity of $1 table.) (Round your answer to one decimal place) The inherk by winn 1 ikisht machina) is Choose from any list or enter any number in the input fields and then continue to the next question Gammon Manufacturing, Inc. has a manufacturing machine that needs attention. (Click the icon to view additional information.) Gammon expects the following net cash inflows from the two options: (Click the icon to view the net cash flows.) Gammon uses straight-line depreciation and requires an annual retum of 10%. The payback for Option 1 (refurbish current machine) is Now complete the payback schedule for Option 2 (purchase). Net Cash Inflows Year 0 1 9 10 Net Cash Outflows Amount Invested $ 4,400,000 Annual Accumulated years. (Click the icon to view Prosent Value of $1 table.) (Click the icon to view Present Value of Ordinary Annuity of $1 table.) (Click the icon to view Future Value of $1 table.) (Click the icon to view Future Value of Ordinary Annuity of $1 table.) Read the requirements Choose from any list or enter any number in the input fields and then continue to the next question. Gammon Manufacturing, Inc. has a manufacturing machine that needs attention (Click the icon to view additional information.) Gammon expects the following net cash inflows from the two options: (Click the icon to view the net cash flows.) Gammon uses straight-line depreciation and requires an annual return of 16%. The payback for Option 2 (purchase new machine) is Compute the ARR (accounting rate of return) for each of the options. Years 1 2 3 4 Refurbish Purchase Compute the NPV for each of the options. Begin with Option 1 (refurbish). (Enter the factors to three decimal places, XXXX. Use parentheses or a minus sign for a negative not present value) Net Cash Inflow PV Factor (i=10%) Present Value 5 6 years. Present value of each year's inflow (n=1) (n=2) (n-3) (n=4) (1= 6) (Click the icon to view Present Value of $1 table.) (Click the icon to view Present Value of Ordinary Annuity of $1 table.) (Click the icon to view Future Value of $1 table.) (Click the icon to view Future Value of Ordinary Annuity of $1 table.) Read the requirements Choose from any list or enter any number in the input fields and then continue to the next question W ARR Gammon Manufacturing, Inc. has a manufacturing machine that needs attention. (Click the icon to view additional information) (Click the icon to view Prosent Value of $1 table.) (Click the icon to view Present Value of Ordinary Annuity of $1 table) (Click the icon to view Future Value of $1 table) (Click the icon to view Future Value of Ordinary Annuity of $1 table) Read the requirements Now compute the NPV for Option 2 (purchase), (Enter the factors to three decimal places. X.XXX. Use parentheses or a minus sign for a negative not present value) PV Factor (-10%) Gammon expects the following net cash inflows from the two options: (Click the loon to view the net cash flows) Gammon uses straight-line depreciation and requires an annual return of 10%. Years 1 2 3 4 5 6 7 B 9 10 Present value of each year's inflow (n=1) (n=2) (n-3) (n=4) (n = 5) (n=6) (n=7) (18) 816 in-101 Total PV of cash inflows Not Cash Inflow Present Value Choose from any list or enter any number in the input fields and then continue to the next question Gammon Manufacturing, Inc. has a manufacturing machine that needs attention. (Click the icon to view additional information.) Gammon expects the following net cash inflows from the two options: (Click the loon to view the net cash flows.) Gammon uses straight-line depreciation and requires an annual retum of 16%. Years 1 2 3 4 5 6 7 B 9 Present value of each year's inflow: 10 (n=2) (n=3) (n=4) (15) (0) (n=7) (n=8) (n=9) Net Cash PV Factor Inflow (16%) 0 Present Value (10) Total PV of cash infows Initial investment Net present value of the project Choose from any list or enter any number in the input fields and then continue to the next question. (Click the icon to view Present Value of $1 table.) (Click the loon to view Present Value of Ordinary Annuity of $1 table.) (Click the icon to view Future Value of $1 table) (Click the loon to view Future Value of Ordinary Annuity of $1 table) Read the requirements Gammon Manufacturing, Inc. has a manufacturing machine that needs attention. (Click the icon to view additional information) (Click the icon to view Present Value of $1 table.) (Click the icon to view Present Value of Ordinary Annuity of $1 table.) (Click the loon to view Future Value of $1 table) (Click the loon to view Future Value of Ordinary Annuity of $1 tab.) Read the requirements Compute the NPV for each of the options. Begin with Option 1 (refurbish). (Enter the factors to three decimal places XXOO. Use parentheses or a minus sign for a negative net present value) Not Cash Present Value Inflow Gammon expects the following net cash inflows from the two options: (Click the icon to view the net cash flows) Gammon uses straight-ine depreciation and requires an annual return of 16%. Years 1 2 (n=2) (n-3) (n=4) (1-5) (n=6) (1-7) 3 4 S 0 7 B Present value of each year's inflow: (n=1) 0 (n=8) Total PV of cash inflows Wital investment Net present value of the projec PV Factor (-10%) Choose from any list or enter any number in the input fields and then continue to the next question Gammon Manufacturing, Inc. has a manufacturing machine that noods attention (Click the icon to view additional information) Gammon expects the following net cash inflows from the two options: (Click the icon to view the net cash flows.) Gammon uses straight-line depreciation and requires an annual retum of 16%. 7 (n=7) 8 (n=8) (n=9) 9 10 (10) Total PV of cash inflows Initial investment Net present value of the project Finally, compute the profitability index for each option. (Round to two decimal places X.XX.) 0 Refurbish Purchase Requirement 2. Which option should Gammon choose? Why? Review your answers in Requirement 1 Gammon should choose profitability indesi because this option has a (Click the icon to view Present Value of $1 table) (Click the icon to view Present Value of Ordinary Annuity of $1 table.) (Click the icon to view Future Value of $1 table) (Click the icon to view Future Value of Ordinary Annuity of $1 table) Read the mairements Choose from any list or enter any number in the input fields and then continue to the next question Profitability index peyback period, an ARR that is the other option, a NPV, and needs attention. tions retu the a pay d i Data Table Year Refurbish Current 2 3 5 6 7 8 9 10 Total Vaare $ Machine 1,740,000 $ 510,000 380,000 250,000 120,000 120,000 120,000 120,000 3,360,000 $ Print Done lds and then continue to the next question. Click the icon to view Presen (Click the icon to view Presen X Future Future Purchase New Machine 4,020,000 590,000 460,000 330,000 200,000 200,000 200,000 200,000 200,000 200,000 6,600,000 RR, the N by comp ash Infic Acc More Info Print (Click the icon to view Future Value of Or Read the requirements. Done - The company is considering two options. Option 1 is to refurbish the current machine at a cost of $2,400,000. If refurbished, Gammon expects the machine to last another eight years and then have no residual value. Option 2 is to replace the machine at a cost of $4,400,000. A new machine would last 10 years and have no residual value. X ng, Ind view a follow view th nt-line mpute th ck for bo m Outflow t Investe 2,400,0 wer to one Ontion 1 in ay list or ent Reference Periods 1% 1 2 3 4 5 6 7 8 OR INSHS SAP22 222 2 9 10 11 12 13 15 17 14 0.870 0.861 0.990 0.980 0.971 0.980 0.961 0.943 0.971 0.942 0.961 0.924 0.951 0.906 0.942 0.933 16 0.853 0.844 18 0.836 23 0.923 24 0.914 0.905 19 0.828 25 0.896 0.887 0.879 20 0.820 26 21 0.811 2% 3% 4% 5% 0.962 0.952 0.925 0.907 0.915 0.889 0.864 0.855 0.823 0.822 0.784 0.746 0.760 0.711 0.731 0.677 0.627 0.645 0.614 0.568 0.508 0.888 0.871 0.804 0.788 0.853 0.837 0.820 0.744 0.773 0.758 0.743 0.888 0.863 0.837 0.790 0.813 0.660 0.647 0.634 0.622 0.610 FOR 0.789 0.766 0.703 0.676 0.722 0.650 0.701 0.681 0.661 0.642 0.728 0.623 0.714 0.605 0.700 0.587 0.686 0.570 0.673 0.554 0.585 0.557 0.625 0.601 0.530 0.577 0.505 0.555 0.481 Present Value of $1 0.735 0.708 0.683 6% 7% 8% 9% 10% 0.943 0.935 0.926 0.917 0.909 0.890 0.873 0.857 0.842 0.826 0.840 0.816 0.794 0.772 0.751 0.792 0.763 0.747 0.713 0.681 0.705 0.666 0.630 0.665 0.623 0.583 0.582 0.592 0.544 0.650 0.621 0.500 0.564 0.547 0.513 0.540 0.502 0.500 0.460 0.463 0.422 0.534 0.458 0.513 0.394 0.339 0.292 0.436 0.371 0.317 0.494 0.416 0.350 0.296 0.475 0.396 0.456 0.331 0.277 0.377 0.312 0.258 0.538 0.439 0.522 0.422 0.406 0.390 0.310 0.467 0.404 0.424 0.386 0.527 0.475 0.429 0.388 0.350 0.287 0.237 0.497 0.444 0.356 0.397 0.257 0.319 0.208 0.469 0.290 0.415 0.368 0.326 0.229 0.182 0.299 0.442 0.388 0.340 0.362 0.315 0.275 0.252 0.270 0.231 0.198 0.250 0212 0.194 0.205 0.160 0.417 0.183 0.140 0.218 0.163 0.232 0.215 0.178 0.359 0.294 0.342 0.32 0.803 0.795 0.507 0.492 0,788 0.375 0.780 0.478 0772 DARA 0.361 0.278 0.262 0.247 0.295 0.233 0.201 0.220 0,242 0.226 0.199 0.184 0.211 0,170 0.197 0.158 0.126 0.184 0.146 0.116 0172 0.136 0.106 Print MacBook Air 12% 14% 15% 16% 18% 20% 0.893 0.877 0.870 0.862 0.847 0.833 0.797 0.789 0.756 0.743 0.718 0.694 0.579 0.712 0.675 0.658 0.641 0.609 0.636 0.592 0.572 0.562 0.516 0.482 0.567 0.519 0.497 0.476 0.437 0.402 0,410 0.507 0.432 0.376 0.354 0.452 0.456 0.400 0.327 0.305 0.351 0.308 0.284 0.263 0.361 0.322 0.270 0.247 0.227 0.263 0.239 Done 0.164 0.150 0.112 0.074 0.138 0.123 0.107 0.146 0.108 0.093 0.180 0.130 0.095 0.081 0.164 0.116 0.083 0.070 0.061 0.149 0.104 0.073 0.135 0.093 0.123 0.064 0.083 0.056 0.092 0.049 0.066 0.102 0.043 0.069 0.038 nm 0.061 Anan 0.215 0.195 0.162 0.137 0.187 0.168 0.163 0.145 0.141 0.125 0.099 0.116 0.123 0.108 0.084 0.370 0.335 0.314 0.279 0.266 0.233 0.225 0.194 0.191 0.162 0.093 0.071 0.080 0.060 0.054 0.045 0.069 0.061 0.038 0.031 0.043 0.060 0.051 0.037 0.026 0.053 0.046 0.040 0.035 0.028 0.030 0.024 Ame 0.001 0.044 0.038 0.135 0.112 0.093 0.078 0.065 0.031 0.022 0.026 0.033 0.022 0.015 0.018 0.013 0.019 0.016 0.010 0.014 Ama X 1 table. table.) Ind va owl w th no te th or ba utflow veste 400,0 ar to one tinn 1 (n st or ent Reference Periods 1 2345 5 67890 =235 K7D90 12345 13 14 16 5.417 5.242 5.076 4.917 4.767 6.728 6.472 6.230 6.002 5.786 5.582 5.389 7.108 6.802 7.722 7.360 9.394 12.134 11.348 12.106 9.899 13.004 15 13.865 12.849 11.118 10.380 11.652 10.838 10.106 9447 6.733 6.463 6.210 7.652 7.325 7.020 7.435 8.566 8.162 7.786 10 9.471 8.530 8.983 8.111 11 10.368 9.787 9.253 8.760 12 11.255 10.575 9.954 9.385 10.635 9.986 11.296 10.563 11.938 14.718 13.578 12.561 17 15.562 14.292 13.166 12.166 11.274 10.477 9.763 16.398 14.992 13.754 12.659 11.690 17.226 15.678 14.324 13.134 12.085 20 18.046 16.351 14.877 13.590 12.462 15.415 14.029 12.821 15.937 14.451 13.163 16.444 14.857 13.489 16.936 15.247 13.799 17.413 15.622 14.094 14 375 15 GR3 18 1% 2% 0.990 0.980 1.970 2.941 3.902 19 3% 0.962 0.971 1.886 1.942 1.913 2.884 2.829 3.808 3.717 4.853 4.713 4.580 5.795 5.601 18.857 17.011 22 19.660 17.658 Present Value of Ordinary Annuity of $1 5% 6% 7% 8% 9% 10% 0.952 0.943 0.935 0.926 0.917 0.909 1.859 1.833 1.808 1.783 1.759 1.736 2.775 2.723 2.673 2.624 2.577 2.531 2.487 3.630 3.465 3.387 3.312 3.240 3.170 3.037 4.100 3.993 3.890 3.791 3.605 4.452 4212 20.456 18.292 21.243 18.914 22.023 19.523 3.546 4.329 26 22.795 20 121 17 877 3 of 3 (2 complete) 8.306 8.863 7.887 8.384 5.971 5.747 6.515 6.247 7.024 6.710 8.853 9.295 9.712 9.108 4.623 4.486 5.206 5.033 4.355 4.111 4.868 4.564 5.535 5.335 4.968 5.995 5.759 5.328 5.650 6.418 6.145 6.805 6.495 5.938 7.536 7.161 6.814 6.194 7.103 6.424 7.904 7.487 8.244 7.786 7.367 6.628 8.061 7.606 6.811 8.559 8.851 8.313 9.122 8.544 10.828 10.059 9.372 11.158 10.336 9.604 11.470 10.594 9.818 MacBook Air Print 12% 14% 15% 16% 18% 0.893 0.870 0.862 0.847 0.877 1.647 1.626 1.605 2.402 2.322 2.283 2.246 2.174 1.690 1.566 2.914 2.855 2.798 3.433 7.824 6.974 8.022 7.120 8.201 7.250 8.365 7.366 7.469 8.514 8,649 7.562 11.764 10.836 10.017 9.292 8.772 7.645 12.042 11.061 10.201 9.442 8.883 7.718 6.792 12.303 11.272 10.371 9.580 6.835 8.985 7.7841 12.550 11.469 10.529 9.707 7.843 6.873 12.783 11.654 10.675 9.823 9.077 RONA 0020 0161 7.AGR 13.003 11.826 10 810 8.756 8.950 9.129 3.889 4.288 4.639 4.946 5.216 7.499 7.139 5.234 5.029 7.943 5.197 5.453 5.660 5.421 5.842 5.583 8.358 5.724 5.468 5.008 6.002 8.745 5.342 4.910 6.142 Done 2.690 3.352 3.274 3.127 3.784 3.685 3.498 4.160 4.039 3.812 4.487 4.344 4.772 4.607 4.303 5.019 4.833 4.494 20% 0.833 6.198 6.259 5.929 1.528 2.106 4.078 3.837 4.031 4.192 2.589 2.991 3.326 3.605 4.656 4.327 4.793 4.439 4.533 5.384 6.687 6.312 5.973 6.743 6.359 6.011 5.410 6.399 6.044 5.432 6.434 6.073 5.451 6.464 6.097 5.467 5.490 6.118 401 4.611 5.847 5.575 5.092 4.675 5.162 4.730 6.265 5.954 5.669 6.373 6.047 5.749 5.222 4.775 6.467 6.128 5.818 5.273 4.812 5.877 5.316 4.844 6.550 6.623 5.353 4.870 4.891 4.909 4.925 4.937 4.948 A GRA This I tal table 30 En ah d n Reference Periods 1% 1 2345 CTBOD INS* S** ** * 10 11 1.116 1.127 13 1.138 14 1.149 15 1.161 12 16 Future Value of $1 1.020 2% 3% 4% 5% 6% Y% 1.010 1.020 1.030 1.040 1.050 1.060 1.070 1.040 1.061 1.082 1.103 1.124 1.145 1.030 1.093 1.061 1.125 1.158 1.191 1.225 1.260 1.041 1.082 1.126 1.170 1.216 1.262 1.311 1.360 1.276 1.051 1.338 1.403 1.469 1.340 1.419 1.501 1.587 1.104 1.159 1.217 1.265 1.316 1.407 1.504 1.677 1.772 2.195 1.974 1.949 2.211 2.502 1.606 1.714 1.828 1.369 1.477 1.594 1.718 1.851 1.993 2.144 1.423 1.551 1.689 2.172 2.358 1.999 1.344 1.480 1.629 1.791 1.173 17 1.184 1.196 19 1.208 20 1.220 18 21 22 23 1.062 1.072 1.083 1.094 1.105 26 1.232 1.245 24 1.270 25 1.282 1:205 1.194 1.126 1.149 1.230 172 1.267 1.305 1.195 1.219 1.243 1.268 1.294 1.319 1.513 1.346 1.558 1.539 1.601 1.469 1.665 1.373 1.400 1.428 1.457 1.486 1.384 1.426 1.516 1.546 1.577 1.257 1.608 1.641 1.672 1.605 1.873 2.183 1.653 1.948 1.702 2.026 1.754 2.107 1.806 2.191 1.710 1.796 1.886 1.732 1.980 2.261 2.579 1.801 2.079 2.397 2.759 1.898 2.105 2.012 2.252 2.133 2.410 1.838 1.967 2.159 2.693 2.292 2.540 2.952 3.159 2.407 2.854 3.380 2.527 3.026 3.617 2.653 3.207 3.870 Print 8% 9% 1.080 1.090 1.166 1.188 10% 12% 14% 1.120 1.140 1.100 1.210 1.254 1.300 1.405 1.482 1.574 1.689 1.539 1.611 1.762 1.925 Done 1.295 1.331 1.412 1.464 2.367 2.594 3.106 2.332 2.518 2.720 3.066 2.580 2.853 2.813 3.138 2.937 3.342 3.172 3.642 1.860 2.279 2.786 3.400 4.141 1.916 2.370 2.925 3.604 4.430 2.465 3,072 1.974 3.820 4.741 2.033 2.563 3.225 4.049 5.072 6.341 7.911 2.094 2.666 3.386 4.292 5.427 6.848 8.623 4 540 2.157 2 GRA 2.772 5A07 7.306 0 200 3.426 3.970 3.700 4.328 3.996 4.717 4.316 5.142 6.116 4.661 5.604 6.727 5.034 6.109 7.400 5.437 6.659 5.871 7.258 2.853 2.476 2.773 3.252 3.707 3.479 3.896 3.452 4.363 3.798 4.887 4.177 6.130 8.137 4.595 5.054 6.866 9.276 5.560 7.690 10.58 8.613 12.06 9.646 13.74 4.226 4.818 5.492 6.261 10.80 8.140 12.10 8.954 9.850 15.18 10.83 17.00 11.02 10.04 4.652 5.350 6.153 7.076 5.474 7.138 8.137 15% 1.150 1.323 1.521 1.749 2.011 2.313 2.660 3.059 3.518 4.046 20.36 13.55 23.21 26.46 30.17 9.358 10.76 12.38 14.23 16.37 15.67 18.82 17.86 21.64 24.89 28.63 32.92 27 AR X huity ity of NPV, and the profitability index of these two options. pl fic OC 1. 2. Requirements Compute the payback, the ARR, the NPV, and the profitability index of these two options. Which option should Gammon choose? Why? Print Done X

Step by Step Solution

★★★★★

3.48 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Based on the information available in the question we can answer as follows Requirement 1 Refurbish ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started