Answered step by step

Verified Expert Solution

Question

1 Approved Answer

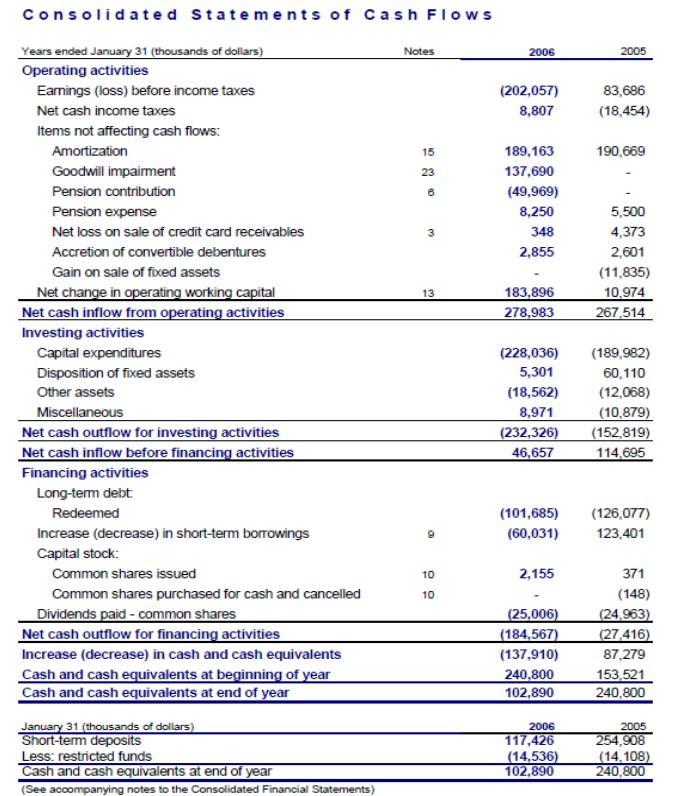

You have been provided with the following extract from the financial statements of The Bay. Compare The Bay's operating cash flow (OCF) of 2006 with

You have been provided with the following extract from the financial statements of The Bay.

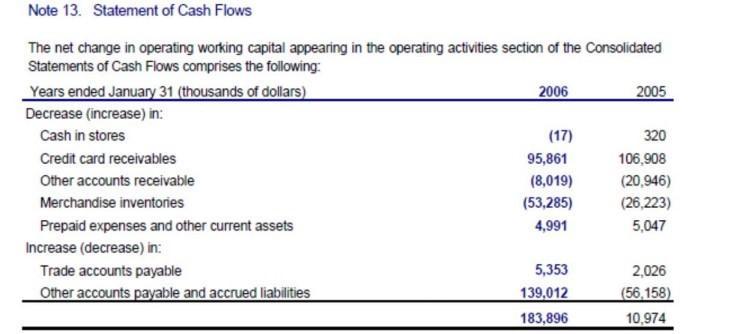

Compare The Bay's operating cash flow (OCF) of 2006 with that of 2005, what do you think is the major contributor to 2006's positive OCF? Briefly comment on The Bay's cash flow status.

Consolidated Statements of Cash Flows Years ended January 31 (thousands of dollars) Operating activities Earnings (loss) before income taxes Net cash income taxes Items not affecting cash flows: Amortization Goodwill impairment Pension contribution Pension expense Net loss on sale of credit card receivables Accretion of convertible debentures Gain on sale of fixed assets Net change in operating working capital Net cash inflow from operating activities Investing activities Capital expenditures Disposition of fixed assets Other assets Miscellaneous Net cash outflow for investing activities Net cash inflow before financing activities Financing activities Long-term debt: Redeemed Increase (decrease) in short-term borrowings Capital stock: Common shares issued Common shares purchased for cash and cancelled Dividends paid - common shares Net cash outflow for financing activities Increase (decrease) in cash and cash equivalents Cash and cash equivalents at beginning of year Cash and cash equivalents at end of year January 31 (thousands of dollars) Short-term deposits Less: restricted funds Cash and cash equivalents at end of year (See accompanying notes to the Consolidated Financial Statements) Notes 15 23 6 3 13 D 10 10 2006 (202,057) 8,807 189,163 137,690 (49,969) 8,250 348 2,855 183,896 278,983 (228,036) 5,301 (18,562) 8,971 (232,326) 46,657 2,155 (25,006) (184,567) (137,910) 240,800 102,890 2005 2006 117,426 (14,536) 102,890 83,686 (18,454) (101,685) (126,077) (60,031) 123,401 190,669 5,500 4,373 2,601 (11,835) 10,974 267,514 (189,982) 60,110 (12,068) (10,879) (152,819) 114,695 371 (148) (24,963) (27,416) 87,279 153,521 240,800 2005 254,908 (14,108) 240,800

Step by Step Solution

★★★★★

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Observation of contributors to 2006s positive Operating Cash Flow i The major contributor to 2006s p...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started