Question

Ganado Europe is a subsidiary of Ganado USA. Assume the exchange rate on January 2, 2006, appreciated from December 31, 2005 from $1.2000/ to $1.500/.

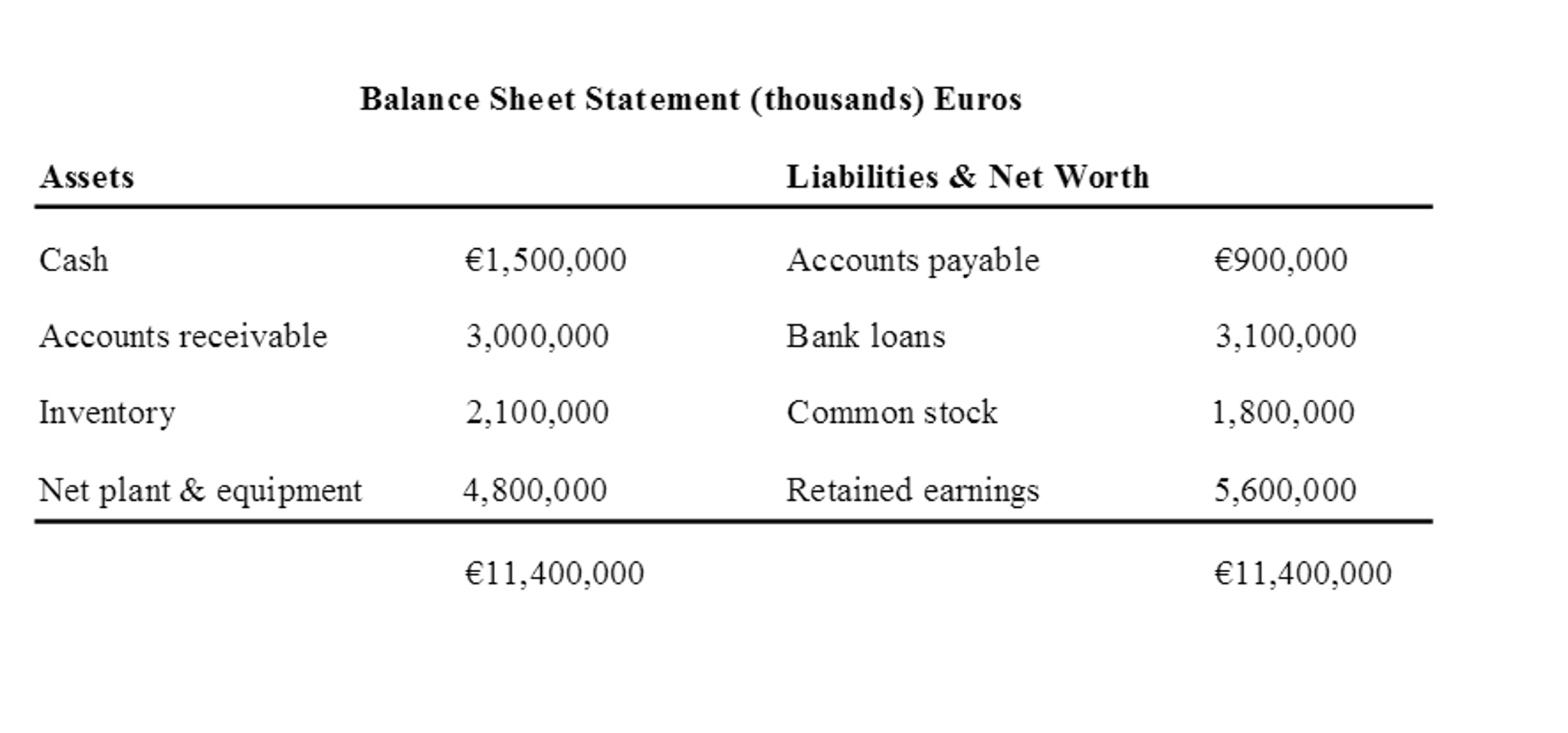

Ganado Europe is a subsidiary of Ganado USA. Assume the exchange rate on January 2, 2006, appreciated from December 31, 2005 from $1.2000/ to $1.500/. Calculate Ganado Europe's translated balance sheet for January 2, 2006 with the new exchange rate using the current ratemethod. Do by using both current rate method and temporal method. Assume historical rate for fixed assets is $1.2760/, inventory historical rate is 95 percent of fixed

assets, common stock is same as fixed assets.For retained earnings, it is cumulative sum of additions to retained earnings of all prior years.Where it should appear on the financial statement?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started