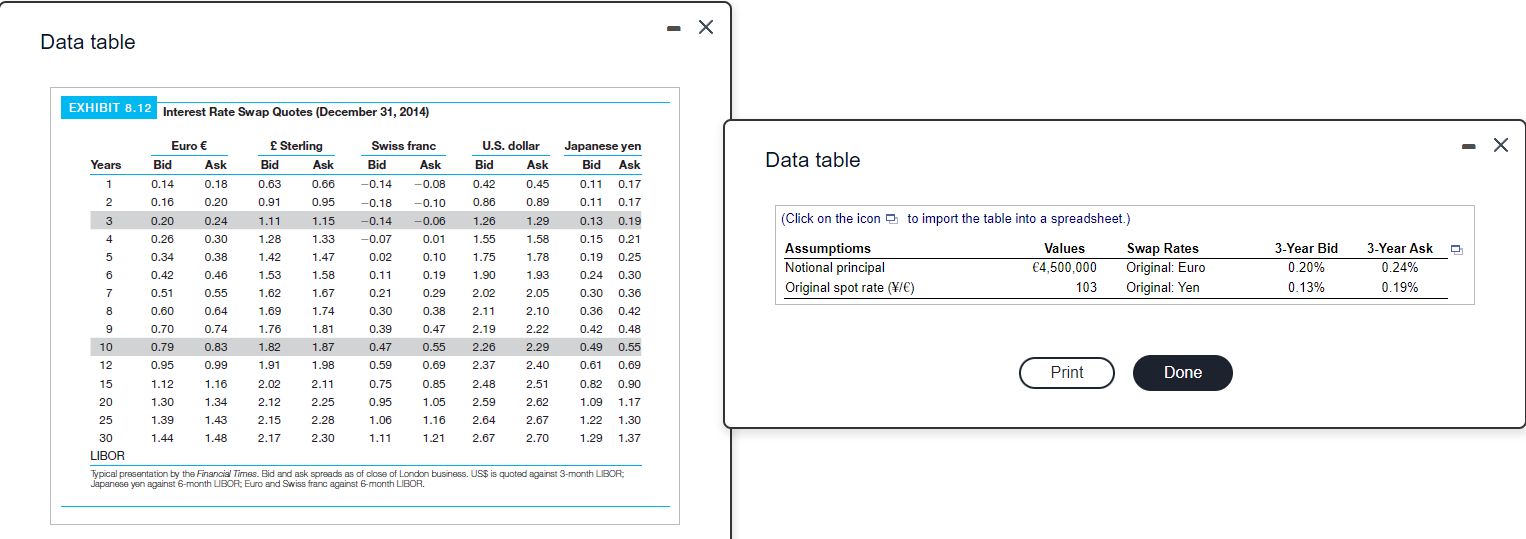

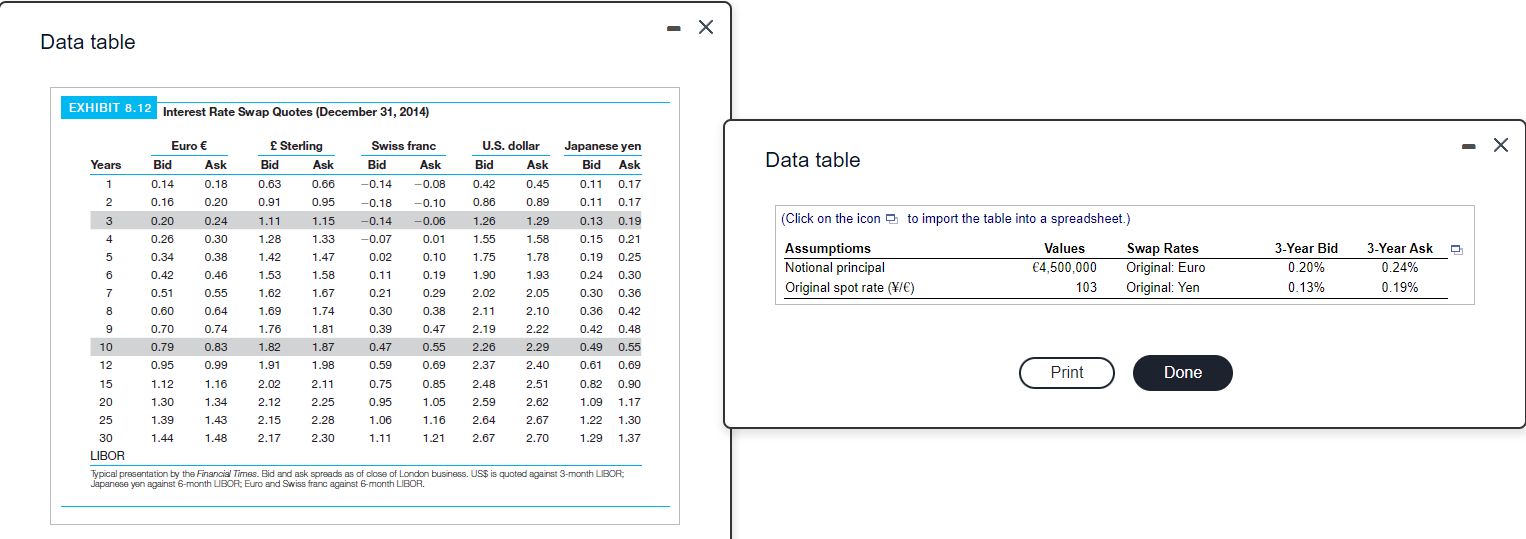

Ganado's Cross-Currency Swap: Yen for Euros. Use Year 3 of the table of swap rates, E, and assume Ganado enters into a swap agreement to receive euros and pay Japanese yen, on a notional principal of 4,500,000. The spot exchange rate at the time of the swap is 1037. a. Calculate all principal and interest payments in both euros and Japanese yen, for the life of the swap agreement. b. Assume that one year into the swap agreement Ganado decides it wants to unwind the swap agreement and settle it in euros. Assuming that a 2-year fixed rate of interest on the Japanese yen is now 0.80%, a 2-year fixed rate of interest on the euro is now 3.60%, and the spot rate of exchange is now 1137, what is the net present value of the swap agreement? Who pays whom what? See the inital values on the table: a. Calculate all principal and interest payments in both euros and Japanese yen, for the life of the swap agreement The notional principal in Japanese yen is . (Round to the nearest yen.) In the first year of the swap, Ganado will receive []. (Round to the nearest euro.) In the second year of the swap, Ganado will receive e (Round to the nearest euro.) In the third year of the swap, Ganado will receive (Round to the nearest euro.) In the first year of the swap, Ganado will pay #O. (Round to the nearest yen.) In the second year of the swap, Ganado will pay y (Round to the nearest yen.) In the third year of the swap, Ganado will pay (Round to the nearest yen.) b. Assume that one year into the swap agreement Ganado decides it wants to unwind the swap agreement and settle it in euros. Assuming that a two-year fixed rate of interest on the Japanese yen is now 0.80%, and a two-year fixed rate of interest on the euro is now 3.60%, and the spot rate of exchange is now 1137, what is the net present value of the swap agreement? Who pays whom what? The present value of the euro cash flow from the second year is (Round to the nearest euro.) The present value of the euro cash flow from the third year is (Round to the nearest euro.) The cumulative present value of the remaining euro cash flows is (Round to the nearest euro.) The present value of the yen cash flow from the second year is . (Round to the nearest yen.) The present value of the yen cash flow from the third year is y (Round to the nearest yen.) The cumulative present value of the remaining yen cash flows is . (Round to the nearest yen.) The cumulative present value of the remaining yen cash flows in terms of euros is (Round to the nearest euro.) The settlement of the unwinding is . This is a cash receipt by from (Round to the nearest euro and select from the drop-down menus.) - Data table EXHIBIT 8.12 Interest Rate Swap Quotes (December 31, 2014) - Bid Data table (Click on the icon to import the table into a spreadsheet.) Assumptioms Notional principal Original spot rate (Y/C) Values 4,500,000 103 Swap Rates Original: Euro Original: Yen 3-Year Bid 0.20% 0.13% 3-Year Ask 0.24% 0.19% Euro Sterling Swiss franc U.S. dollar Japanese yen Years Bid Ask Ask Bid Ask Bid Ask Bid Ask 1 0.14 0.18 0.63 0.66 -0.14 -0.08 0.42 0.45 0.11 0.17 2 0.16 0.20 0.91 0.95 -0.18 -0.10 0.86 0.89 0.11 0.17 3 0.20 0.24 1.11 1.15 -0.14 -0.06 1.26 1.29 0.13 0.19 4 0.26 0.30 1.28 1.33 -0.07 0.01 1.55 1.58 0.15 0.21 5 0.34 0.38 1.42 1.47 0.02 0.10 1.75 1.78 0.19 0.25 6 0.42 0.46 1.53 1.58 0.11 0.19 1.90 1.93 0.24 0.30 7 7 0.51 0.55 1.62 1.67 0.21 0.29 2.02 2.05 0.30 0.36 8 0.60 0.64 1.69 1.74 0.30 0.38 2.11 2.10 0.36 0.42 9 0.70 0.74 1.76 1.81 0.39 0.47 2.19 2.22 0.42 0.48 10 0.79 0.83 1.82 1.87 0.47 0.55 2.26 2.29 0.49 0.55 12 0.95 0.99 1.91 1.98 0.59 0.69 2.37 2.40 0.61 0.69 15 1.12 1.16 2.02 2.11 0.75 0.85 2.48 2.51 0.82 0.90 20 1.30 1.34 2.12 2.25 0.95 1.05 2.59 2.62 1.09 1.17 25 1.39 1.43 2.15 2.28 1.06 1.16 2.64 2.67 1.22 1.30 30 1.44 1.48 2.17 2.30 1.11 1.21 2.67 2.70 1.29 1.37 LIBOR Typical presentation by the Financial Times. Bid and ask spreads as of close of London business. US$ is quoted against 3-month LIBOR: Japanese yen against 6-month UBOR: Euro and Swiss franc against 6-month LIBOR. Print Done Ganado's Cross-Currency Swap: Yen for Euros. Use Year 3 of the table of swap rates, E, and assume Ganado enters into a swap agreement to receive euros and pay Japanese yen, on a notional principal of 4,500,000. The spot exchange rate at the time of the swap is 1037. a. Calculate all principal and interest payments in both euros and Japanese yen, for the life of the swap agreement. b. Assume that one year into the swap agreement Ganado decides it wants to unwind the swap agreement and settle it in euros. Assuming that a 2-year fixed rate of interest on the Japanese yen is now 0.80%, a 2-year fixed rate of interest on the euro is now 3.60%, and the spot rate of exchange is now 1137, what is the net present value of the swap agreement? Who pays whom what? See the inital values on the table: a. Calculate all principal and interest payments in both euros and Japanese yen, for the life of the swap agreement The notional principal in Japanese yen is . (Round to the nearest yen.) In the first year of the swap, Ganado will receive []. (Round to the nearest euro.) In the second year of the swap, Ganado will receive e (Round to the nearest euro.) In the third year of the swap, Ganado will receive (Round to the nearest euro.) In the first year of the swap, Ganado will pay #O. (Round to the nearest yen.) In the second year of the swap, Ganado will pay y (Round to the nearest yen.) In the third year of the swap, Ganado will pay (Round to the nearest yen.) b. Assume that one year into the swap agreement Ganado decides it wants to unwind the swap agreement and settle it in euros. Assuming that a two-year fixed rate of interest on the Japanese yen is now 0.80%, and a two-year fixed rate of interest on the euro is now 3.60%, and the spot rate of exchange is now 1137, what is the net present value of the swap agreement? Who pays whom what? The present value of the euro cash flow from the second year is (Round to the nearest euro.) The present value of the euro cash flow from the third year is (Round to the nearest euro.) The cumulative present value of the remaining euro cash flows is (Round to the nearest euro.) The present value of the yen cash flow from the second year is . (Round to the nearest yen.) The present value of the yen cash flow from the third year is y (Round to the nearest yen.) The cumulative present value of the remaining yen cash flows is . (Round to the nearest yen.) The cumulative present value of the remaining yen cash flows in terms of euros is (Round to the nearest euro.) The settlement of the unwinding is . This is a cash receipt by from (Round to the nearest euro and select from the drop-down menus.) - Data table EXHIBIT 8.12 Interest Rate Swap Quotes (December 31, 2014) - Bid Data table (Click on the icon to import the table into a spreadsheet.) Assumptioms Notional principal Original spot rate (Y/C) Values 4,500,000 103 Swap Rates Original: Euro Original: Yen 3-Year Bid 0.20% 0.13% 3-Year Ask 0.24% 0.19% Euro Sterling Swiss franc U.S. dollar Japanese yen Years Bid Ask Ask Bid Ask Bid Ask Bid Ask 1 0.14 0.18 0.63 0.66 -0.14 -0.08 0.42 0.45 0.11 0.17 2 0.16 0.20 0.91 0.95 -0.18 -0.10 0.86 0.89 0.11 0.17 3 0.20 0.24 1.11 1.15 -0.14 -0.06 1.26 1.29 0.13 0.19 4 0.26 0.30 1.28 1.33 -0.07 0.01 1.55 1.58 0.15 0.21 5 0.34 0.38 1.42 1.47 0.02 0.10 1.75 1.78 0.19 0.25 6 0.42 0.46 1.53 1.58 0.11 0.19 1.90 1.93 0.24 0.30 7 7 0.51 0.55 1.62 1.67 0.21 0.29 2.02 2.05 0.30 0.36 8 0.60 0.64 1.69 1.74 0.30 0.38 2.11 2.10 0.36 0.42 9 0.70 0.74 1.76 1.81 0.39 0.47 2.19 2.22 0.42 0.48 10 0.79 0.83 1.82 1.87 0.47 0.55 2.26 2.29 0.49 0.55 12 0.95 0.99 1.91 1.98 0.59 0.69 2.37 2.40 0.61 0.69 15 1.12 1.16 2.02 2.11 0.75 0.85 2.48 2.51 0.82 0.90 20 1.30 1.34 2.12 2.25 0.95 1.05 2.59 2.62 1.09 1.17 25 1.39 1.43 2.15 2.28 1.06 1.16 2.64 2.67 1.22 1.30 30 1.44 1.48 2.17 2.30 1.11 1.21 2.67 2.70 1.29 1.37 LIBOR Typical presentation by the Financial Times. Bid and ask spreads as of close of London business. US$ is quoted against 3-month LIBOR: Japanese yen against 6-month UBOR: Euro and Swiss franc against 6-month LIBOR. Print Done