Question

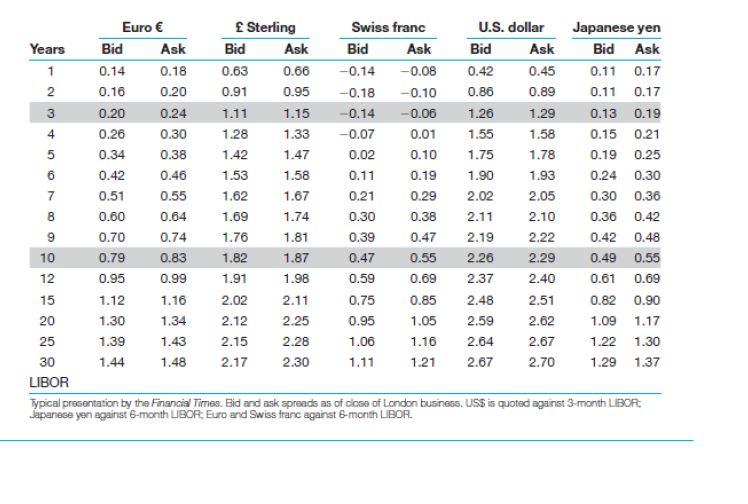

Ganado's Cross-Currency Swap: Yen for Euros.Use Year 3 of the table of swap rates and assume Ganado enters into a swap agreement to receive euros

Ganado's Cross-Currency Swap: Yen for Euros.Use Year 3 of the table of swap rates and assume Ganado enters into a swap agreement to receive euros and pay Japanese yen, on a notional principal of 5,000,000. The spot exchange rate at the time of the swap is 106/.

a. Calculate all principal and interest payments, in both euros and Japanese yen, for the life of the swap agreement.

b. Assume that one year into the swap agreement Ganado decides it wants to unwind the swap agreement and settle it in euros. Assuming that a 2-year fixed rate of interest on the Japanese yen is now 0.80%, a 2-year fixed rate of interest on the euro is now 3.60%, and the spot rate of exchange is now 116/, what is the net present value of the swap agreement? Who pays whom what? See the inital values on the table:

| Assumptioms | Values | Swap Rates | 3-Year Bid | 3-Year Ask |

| |

| Notional principal | 5,000,000 | Original: Euro | 0.20% | 0.24% | ||

| Original spot rate (/) | 106 | Original: Yen | 0.13% | 0.19% |

Typical presentation by the Financial Times. Eid and ask spreads as of close of London business. USS is quoted against 3-month LBCF: Japanese yen against 6-month LBOFt: Euro and Swiss franc against 6-morith LBOR

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started