Question

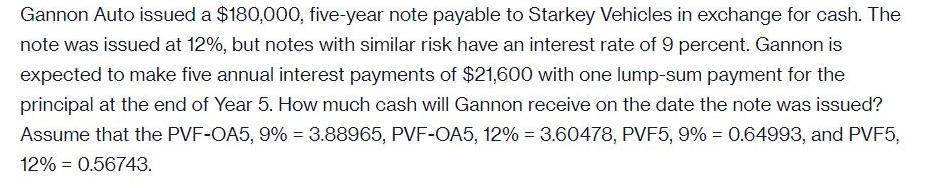

Gannon Auto issued a $180,000, five-year note payable to Starkey Vehicles in exchange for cash. The note was issued at 12%, but notes with

Gannon Auto issued a $180,000, five-year note payable to Starkey Vehicles in exchange for cash. The note was issued at 12%, but notes with similar risk have an interest rate of 9 percent. Gannon is expected to make five annual interest payments of $21,600 with one lump-sum payment for the principal at the end of Year 5. How much cash will Gannon receive on the date the note was issued? Assume that the PVF-OA5, 9% = 3.88965, PVF-OA5, 12% = 3.60478, PVF5, 9% = 0.64993, and PVF5, 12% = 0.56743.

Step by Step Solution

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Step 12 Answer 20100384 First figure out the notes present value at 9 Present value is equal to 1...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting in an Economic Context

Authors: Jamie Pratt

10th edition

978-1-119-3061, 1119306167, 978-1119444367

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App