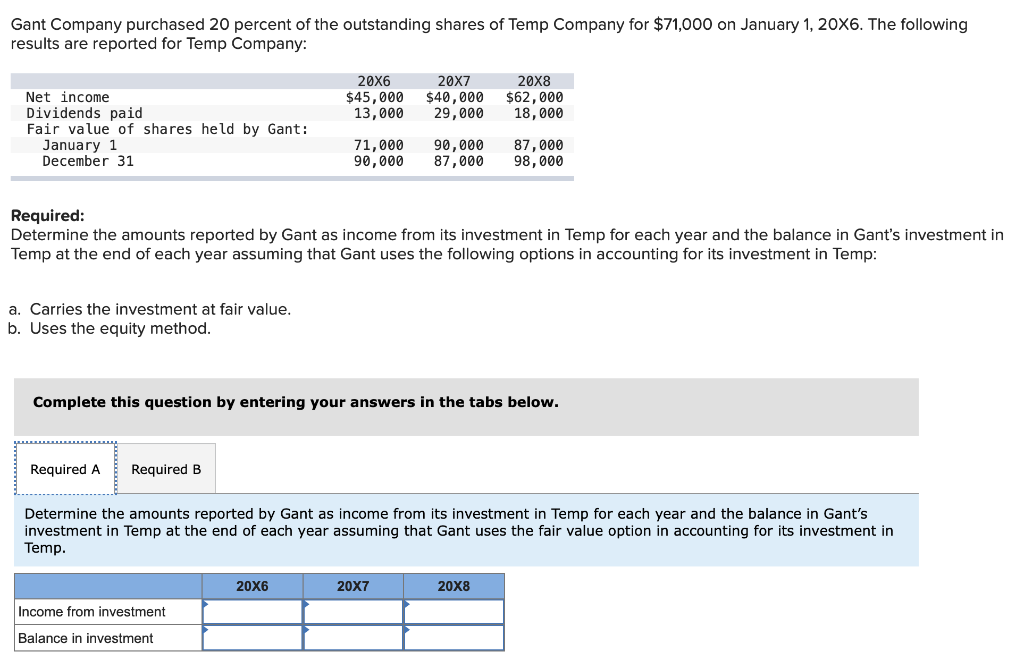

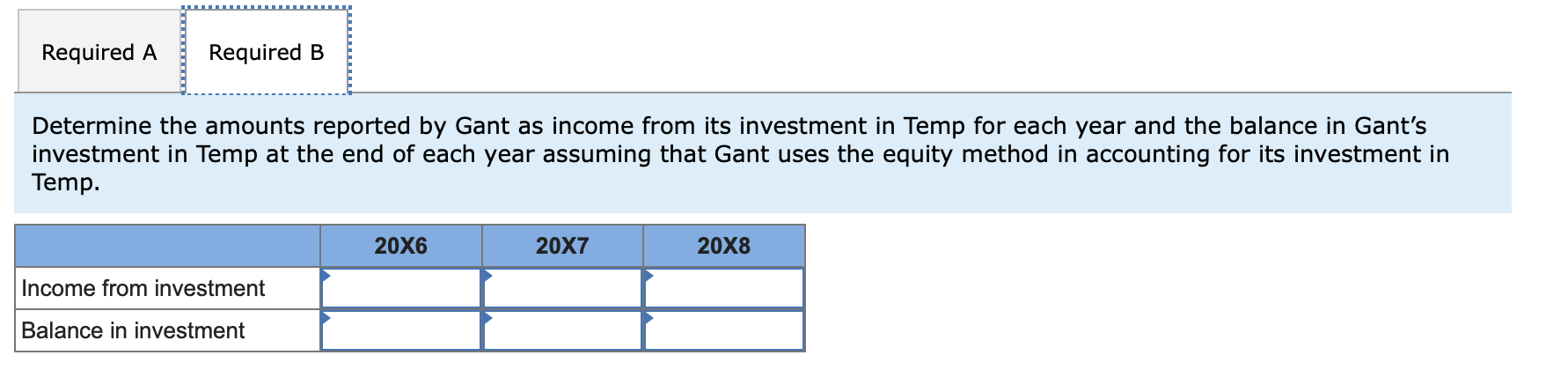

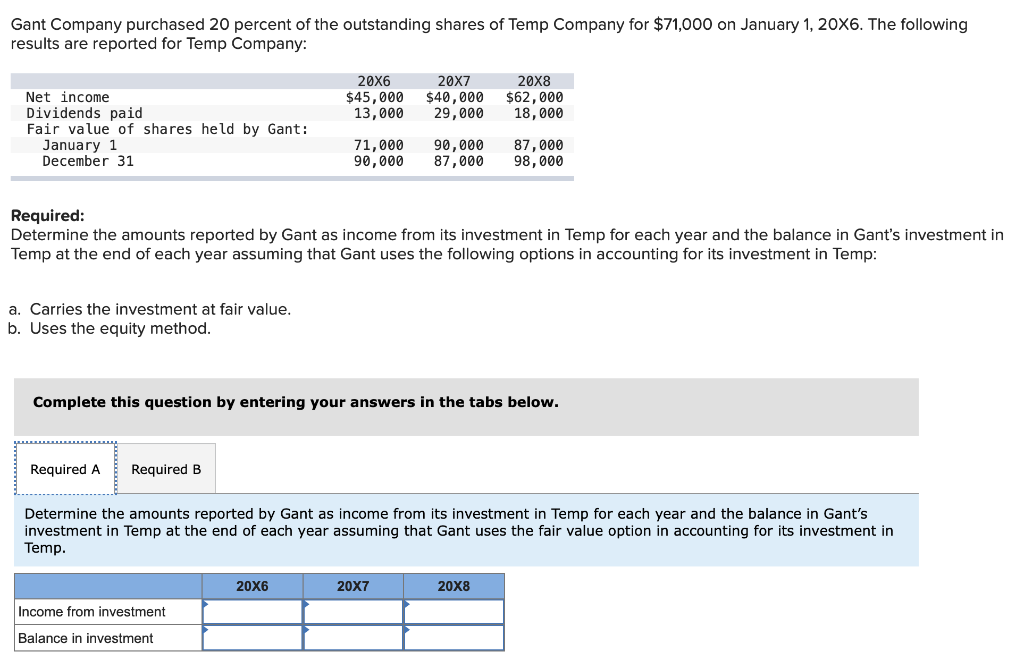

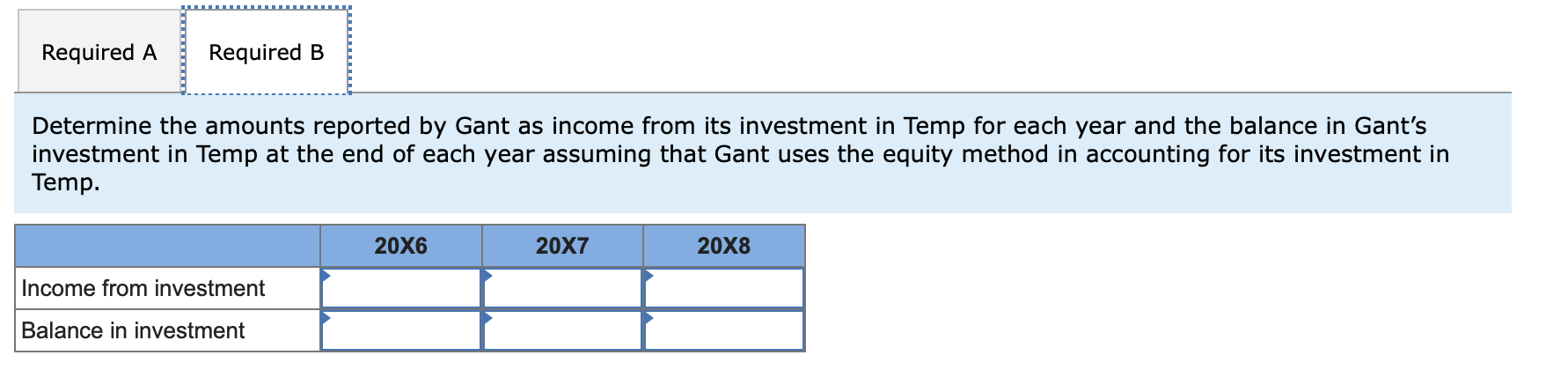

Gant Company purchased 20 percent of the outstanding shares of Temp Company for $71,000 on January 1, 20X6. The following results are reported for Temp Company: 20x620x720X8 $45,000 $40,000 $62,000 13,000 29,000 18,000 Net income Dividends paid Fair value of shares held by Gant: January 1 December 31 71,000 90,000 90,000 87,000 87,000 98,000 Required: Determine the amounts reported by Gant as income from its investment in Temp for each year and the balance in Gant's investment in Temp at the end of each year assuming that Gant uses the following options in accounting for its investment in Temp: a. Carries the investment at fair value. b. Uses the equity method. Complete this question by entering your answers in the tabs below. Required A Required B Determine the amounts reported by Gant as income from its investment in Temp for each year and the balance in Gant's investment in Temp at the end of each year assuming that Gant uses the fair value option in accounting for its investment in Temp. 20X620X720x8 Income from investment Balance in investment Required A Required B ---------------------- Determine the amounts reported by Gant as income from its investment in Temp for each year and the balance in Gant's investment in Temp at the end of each year assuming that Gant uses the equity method in accounting for its investment in Temp. 2026 2027 2028 Income from investment Balance in investment Gant Company purchased 20 percent of the outstanding shares of Temp Company for $71,000 on January 1, 20X6. The following results are reported for Temp Company: 20x620x720X8 $45,000 $40,000 $62,000 13,000 29,000 18,000 Net income Dividends paid Fair value of shares held by Gant: January 1 December 31 71,000 90,000 90,000 87,000 87,000 98,000 Required: Determine the amounts reported by Gant as income from its investment in Temp for each year and the balance in Gant's investment in Temp at the end of each year assuming that Gant uses the following options in accounting for its investment in Temp: a. Carries the investment at fair value. b. Uses the equity method. Complete this question by entering your answers in the tabs below. Required A Required B Determine the amounts reported by Gant as income from its investment in Temp for each year and the balance in Gant's investment in Temp at the end of each year assuming that Gant uses the fair value option in accounting for its investment in Temp. 20X620X720x8 Income from investment Balance in investment Required A Required B ---------------------- Determine the amounts reported by Gant as income from its investment in Temp for each year and the balance in Gant's investment in Temp at the end of each year assuming that Gant uses the equity method in accounting for its investment in Temp. 2026 2027 2028 Income from investment Balance in investment