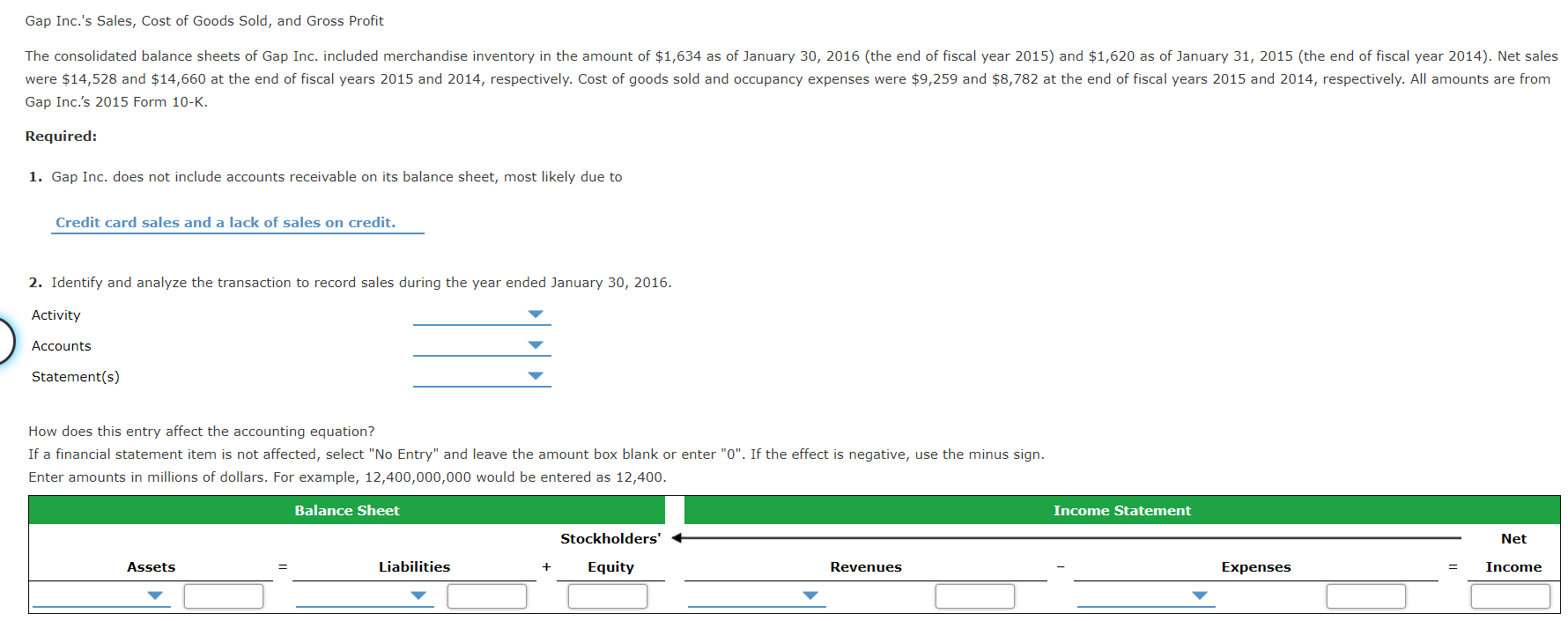

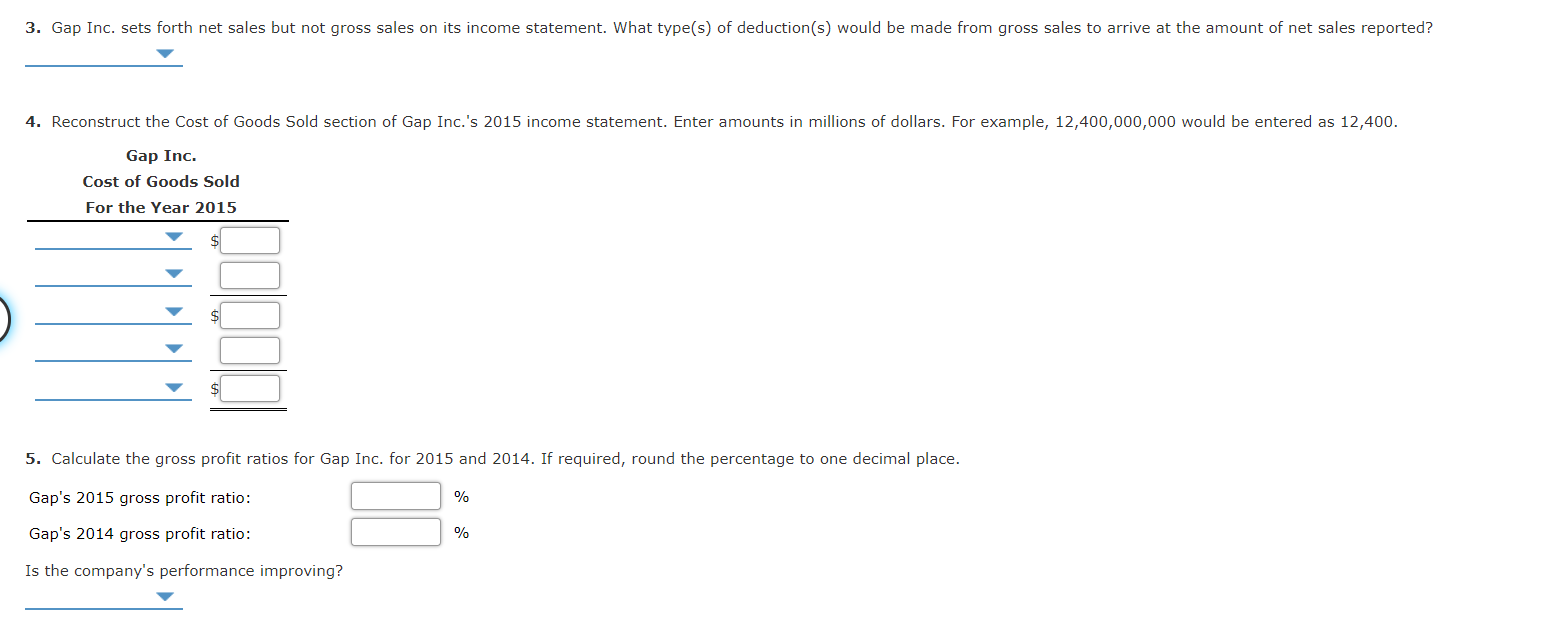

Gap Inc.'s Sales, Cost of Goods Sold, and Gross Profit The consolidated balance sheets of Gap Inc. included merchandise inventory in the amount of $1,634 as of January 30, 2016 (the end of fiscal year 2015) and $1,620 as of January 31, 2015 (the end of fiscal year 2014). Net sales were $14,528 and $14,660 at the end of fiscal years 2015 and 2014, respectively. Cost of goods sold and occupancy expenses were $9,259 and $8,782 at the end of fiscal years 2015 and 2014, respectively. All amounts are from Gap Inc.'s 2015 Form 10-K. Required: 1. Gap Inc. does not include accounts receivable on its balance sheet, most likely due to Credit card sales and a lack of sales on credit. 2. Identify and analyze the transaction to record sales during the year ended January 30, 2016. Activity Accounts Statement(s) How does this entry affect the accounting equation? If a financial statement item is not affected, select "No Entry" and leave the amount box blank or enter "0". If the effect is negative, use the minus sign. Enter amounts in millions of dollars. For example, 12,400,000,000 would be entered as 12,400. Balance Sheet Income Statement Stockholders' Net Assets Liabilities + Equity Revenues Expenses Income 3. Gap Inc. sets forth net sales but not gross sales on its income statement. What type(s) of deduction(s) would be made from gross sales to arrive at the amount of net sales reported? 4. Reconstruct the cost of Goods Sold section of Gap Inc.'s 2015 income statement. Enter amounts in millions of dollars. For example, 12,400,000,000 would be entered as 12,400. Gap Inc. Cost of Goods Sold For the Year 2015 5. Calculate the gross profit ratios for Gap Inc. for 2015 and 2014. If required, round the percentage to one decimal place. Gap's 2015 gross profit ratio: % Gap's 2014 gross profit ratio: % Is the company's performance improving? Gap Inc.'s Sales, Cost of Goods Sold, and Gross Profit The consolidated balance sheets of Gap Inc. included merchandise inventory in the amount of $1,634 as of January 30, 2016 (the end of fiscal year 2015) and $1,620 as of January 31, 2015 (the end of fiscal year 2014). Net sales were $14,528 and $14,660 at the end of fiscal years 2015 and 2014, respectively. Cost of goods sold and occupancy expenses were $9,259 and $8,782 at the end of fiscal years 2015 and 2014, respectively. All amounts are from Gap Inc.'s 2015 Form 10-K. Required: 1. Gap Inc. does not include accounts receivable on its balance sheet, most likely due to Credit card sales and a lack of sales on credit. 2. Identify and analyze the transaction to record sales during the year ended January 30, 2016. Activity Accounts Statement(s) How does this entry affect the accounting equation? If a financial statement item is not affected, select "No Entry" and leave the amount box blank or enter "0". If the effect is negative, use the minus sign. Enter amounts in millions of dollars. For example, 12,400,000,000 would be entered as 12,400. Balance Sheet Income Statement Stockholders' Net Assets Liabilities + Equity Revenues Expenses Income 3. Gap Inc. sets forth net sales but not gross sales on its income statement. What type(s) of deduction(s) would be made from gross sales to arrive at the amount of net sales reported? 4. Reconstruct the cost of Goods Sold section of Gap Inc.'s 2015 income statement. Enter amounts in millions of dollars. For example, 12,400,000,000 would be entered as 12,400. Gap Inc. Cost of Goods Sold For the Year 2015 5. Calculate the gross profit ratios for Gap Inc. for 2015 and 2014. If required, round the percentage to one decimal place. Gap's 2015 gross profit ratio: % Gap's 2014 gross profit ratio: % Is the company's performance improving