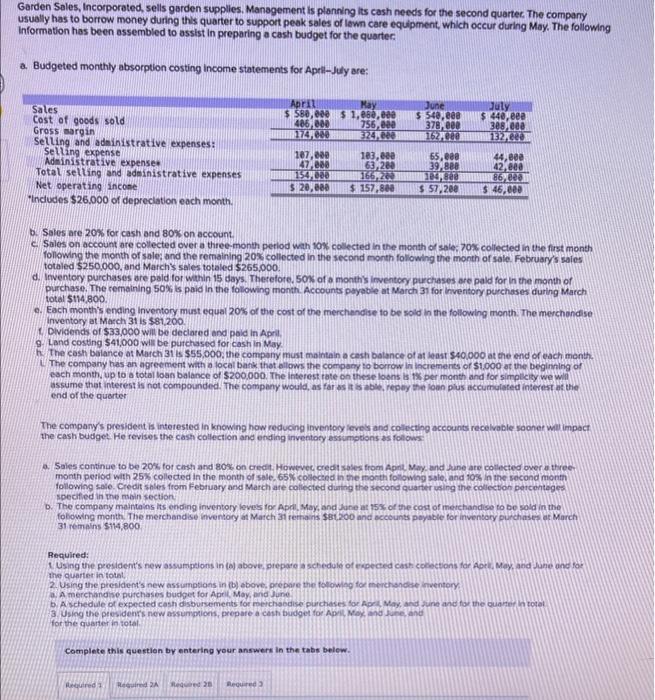

Garden Sales, Incorporated, sells garden supplies, Management is planning its cash needs for the second quartec, The company usually has to borrow money during this quarter to support peak sales of lown care equipment, which occur during May. The following Information has been assembled to assist in preparing a cash budget for the quartec: a. Budgeted monthly absorption costing income statements for April-Jily are: b. Soles are 20% for cash and 80% on account. C. Sales on account are collected over a three-month period wath 1os collected in the month of sale. 705 collected in the first month following the month of sale; and the remaining 205 collected in the second morth following the month of sale. February's saies totaled $250,000, and Marchs sales totaled $265,000. d. Itwentory purchases are peld for werhin 15 days. Therefore, 50s of a month's inventory purchases are pald for in the month of purchase. The remaining 50% is paid in the following month. Accounts payable at March 31 for menentory purchases during March total 5 tri. 800 . e. Each month's ending inventory mist equal 205 of the cost of the merchendise to be sold in the following month. The merchendse Inventory at Masch 31 is $81.200. 4. Divitends of $33,000 will be declared and poid in April, 9. Land costing \$41,000 will be purchased for cash in May. H. The cash balance at March 31 is $55,000, the company must maintain a cash batance of at least 540,000 at the end of each month. 1. The company has an agreement with a local bank thot allows the company to borrow in incremeres of 51,000 ot the beginting of esch month, up to a total loan balance of $200,000. The interest tate on these loons is is per month and for simplicity we wili assume that interest is not compounded. The compeny would, as far os it is abie, repey the loon plus accurnulated interest at the end of the querter The company's president is interested in knowing how reduchg inventoy ieves and colectipe accounts recelvoble sooner will impact the cash budget He revises the cast collection and ending inventory assumptions as follows: momth period with 255 collected in the month of sale, 65x colecend in vhe month followng sale, and tos in the socond month following sale. Credit shles from February and March ate colfected duting the second quarter waing the colecton percentegess specifed in the mbin section b. The company maintains its ending inventory loves tor April. May, and June at 75x of the cost of metchandise to be sold in the folowing month. The merchandise iwventory at March 31 reritans $81,200 and accounts peyable for inventory purchisses at March 31 remoins $114,800 Required: the quarter in totol, 2. Using the president's new assumptions in (b) above, peebore the folowng for merchsndse inventary a. A merchandise purchases bucget for Apeli, May, and June. 3. Using the presidents new assumpions, prepare a cesh bucpet for Apply Mok and Johe, and for the quarter in total. Complete this queetion by entering your answers in the tabs belew