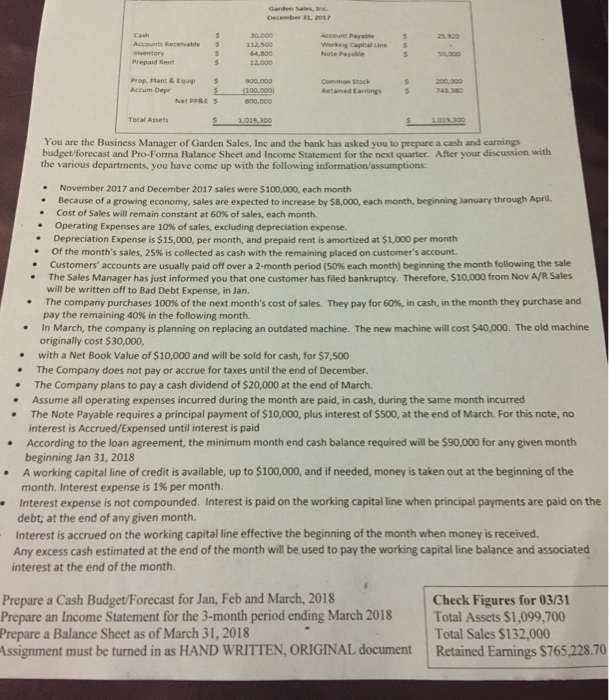

Garden Sales, tric. 25.320 Accounts Receivable S Prepaid Rent Prop, Plant& Equip 112.500 working Capital Line Note Payable 900.000 Accum Depr ketained Earnings 800,000 Total Assets You are the Business Manager of Garden Sales, Inc and the bank has asked you to prepare a cash and carnings budget/forecast and Pro-Forma Balance Sheet and Income Statement for the next quarter. After your discussion with the various departments, you have come up with the following information/assumptions November 2017 and December 2017 sales were $100,000, each month Because of a growing economy, sales are expected to increase by $8,000, each month, beginning January through April. Cost of Sales will remain constant at 60% of sales, each month Operating Expenses are 10% of sales, excluding depreciation expense. Depreciation Expense is $15,000, per month, and prepaid rent is amortized at $1,000 per month Of the month's sales, 25% is collected as cash with the remaining placed on customer's account. . . . -customers' accounts are usually paid off over a 2-month period (50% each month) beginning the month following the sale . The Sales Manager has just informed you that one customer has filed bankruptcy. Therefore, $10,000 from Nov A/R Sales will be written off to Bad Debt Expense, in Jan. The company purchases 100% of the next month's cost of sales. They pay for 60%, in cash, in the month they purchase and pay the remaining 40% in the following month. In March, the company is planning on replacing an outdated machine. The new machine will cost $40,000. The old machine . originally cost $30,000, with a Net Book Value of $10,000 and will be sold for cash, for $7,500 . . . . The Company does not pay or accrue for taxes until the end of December The Company plans to pay a cash dividend of $20,000 at the end of March. Assume all operating expenses incurred during the month are paid, in cash, during the same month incurred The Note Payable requires a principal payment of $10,000, plus interest of $500, at the end of March. For this note, no . interest is Accrued/Expensed until interest is paid .According to the loan agreement, the minimum month end cash balance required will be $90,000 for any given month beginning Jan 31, 2018 A working capital line of credit is available, up to $100,000, and if needed, money is taken out at the beginning of the month. Interest expense is 1% per month. Interest expense is not compounded. Interest is paid on the working capital line when principal payments are paid on the debt; at the end of any given month. Interest is accrued on the working capital line effective the beginning of the month when money is received. Any excess cash estimated at the end of the month will be used to pay the working capital line balance and associated interest at the end of the month. Prepare a Cash Budget/Forecast for Jan, Feb and March, 2018 Prepare an Income Statement for the 3-month period ending March 2018 Prepare a Balance Sheet as of March 31, 2018 Assignment must be turned in as HAND WRITTEN, ORIGINAL document Check Figures for 03/31 Total Assets $1,099,700 Total Sales $132,000 Retained Earnings $765,228.70