Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Garden Soles, Incorporsted, sels garden supplies. Mansgement is planning its cash needs for the second quarter. The compony usublly hes to borrow money during this

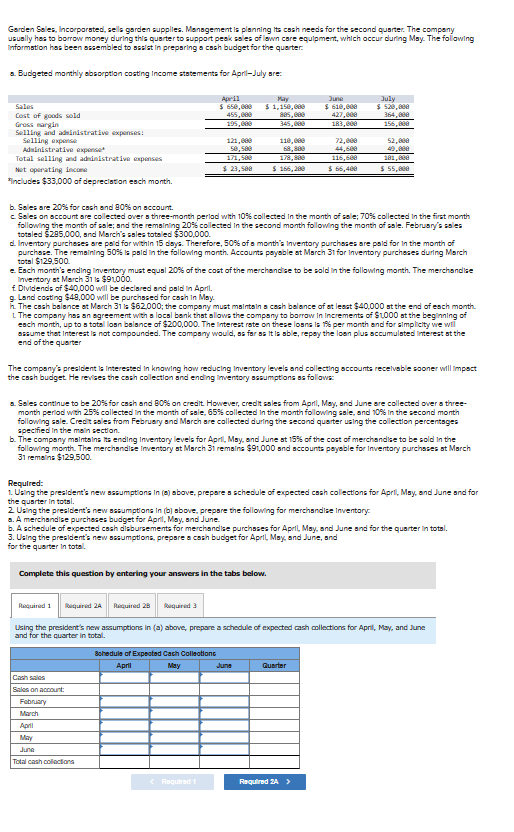

Garden Soles, Incorporsted, sels garden supplies. Mansgement is planning its cash needs for the second quarter. The compony usublly hes to borrow money during this quarter to support pesk ssles of lewn care equlpment, which occur during Msy. The following informstion has been assembled to ssalst in prepsrling cash budget for the querter. a. Budgeted monthly absorption costing income statements for April-July sre: b. Soles are 20% for cosh and 90% on sccount. c. Soles on sccount are colected over s three-manth perlad with 10% collected in the month of sale; 70% collected in the first month following the month of sale; snd the remaining 20% colected In the second month following the month of sale. February's sales totsled $295,000, snd March's sales totaled $300,000. d. Inventory purchases are poid for within 15 dsyz. Therefore, 50% of a month's liventory purchases are poid for in the month of purchsse. The remsining 50% is poid in the following month. Accounts poysble at Msrch 31 for lnventory purcheses during March totgl $129,500 e. Esch month's ending Inventory must equal 20% of the cost of the merchandse to be sold in the following month. The merchandise inventory st March 31 is $90000 f Dividends of $40,000 will be declared and psid in April. g. Land cocting $49,000 will be purchssed for cash in May. h The cash balance ot March 31 is $62000; the compsny must maintain s cech belance of et leact $40,000 st the end of esch month. L. The compsny has an egreement with s locsl benk that alows the compony to borrow in increments of $1000 st the beginning of each month, up to statal losn belance of $200,000. The interest rate on these losnc is 1% per manth and for simplicity we will sszume that interest is not compounded. The compsny would, ss for ss it is sble, repoy the loen plus sccumulsted interest st the and of the quarter The compony's president is interested in knowing how reducing inventory levels and collecting sccounts recelvable sooner will impoct the cssh budget. He revises the cash colection snd ending imventory ssaumptions as follaws: a. Soles continue to be 20% for cash and 90% on credlt. However, credit sales from April, May, and June are collected over a threemonth period wth 25% collected in the manth of sale, 65% collected in the month following sale, and 10% in the second month following sale. Credit sales from February and March are collected during the second quarter using the collection percentages specified in the main section. b. The company maintains lts ending Inventory levels for Apri, Msy, and June st 15% of the coat of merchandise to be sold in the following month. The merchsndise inventory st March 31 remains $91,000 snd sccounts poyyble for Inventory purchases st March 31 remeine $129,500 Required: 1. Using the president's new sszumptions in (a) sbove, prepore s schedule of expected cash collections for Aprit, Msy, and June snd for the quarter in totsl. 2 Using the president's new sasumptions in (b) sbove, prepsre the following for merchsndise inventory- a. A merchsndise purcheses budget for April, Moy, snd June- b. A schedule of expected cash disbursements for merchandise purchsses for April, Msy, and June snd for the quirter in totsl. 3. Using the president's new ssumptions, prepsre a cash buoget for Aprlb, Moy, and June, snd for the quarter in tote. Complete this question by entering your answers in the tabs below. Uaing the president's new assumptions in (a) above, prepare a schedule of expected cash mollectiona for April, Msy, and June and for the quarter in total. Garden Soles, Incorporsted, sels garden supplies. Mansgement is planning its cash needs for the second quarter. The compony usublly hes to borrow money during this quarter to support pesk ssles of lewn care equlpment, which occur during Msy. The following informstion has been assembled to ssalst in prepsrling cash budget for the querter. a. Budgeted monthly absorption costing income statements for April-July sre: b. Soles are 20% for cosh and 90% on sccount. c. Soles on sccount are colected over s three-manth perlad with 10% collected in the month of sale; 70% collected in the first month following the month of sale; snd the remaining 20% colected In the second month following the month of sale. February's sales totsled $295,000, snd March's sales totaled $300,000. d. Inventory purchases are poid for within 15 dsyz. Therefore, 50% of a month's liventory purchases are poid for in the month of purchsse. The remsining 50% is poid in the following month. Accounts poysble at Msrch 31 for lnventory purcheses during March totgl $129,500 e. Esch month's ending Inventory must equal 20% of the cost of the merchandse to be sold in the following month. The merchandise inventory st March 31 is $90000 f Dividends of $40,000 will be declared and psid in April. g. Land cocting $49,000 will be purchssed for cash in May. h The cash balance ot March 31 is $62000; the compsny must maintain s cech belance of et leact $40,000 st the end of esch month. L. The compsny has an egreement with s locsl benk that alows the compony to borrow in increments of $1000 st the beginning of each month, up to statal losn belance of $200,000. The interest rate on these losnc is 1% per manth and for simplicity we will sszume that interest is not compounded. The compsny would, ss for ss it is sble, repoy the loen plus sccumulsted interest st the and of the quarter The compony's president is interested in knowing how reducing inventory levels and collecting sccounts recelvable sooner will impoct the cssh budget. He revises the cash colection snd ending imventory ssaumptions as follaws: a. Soles continue to be 20% for cash and 90% on credlt. However, credit sales from April, May, and June are collected over a threemonth period wth 25% collected in the manth of sale, 65% collected in the month following sale, and 10% in the second month following sale. Credit sales from February and March are collected during the second quarter using the collection percentages specified in the main section. b. The company maintains lts ending Inventory levels for Apri, Msy, and June st 15% of the coat of merchandise to be sold in the following month. The merchsndise inventory st March 31 remains $91,000 snd sccounts poyyble for Inventory purchases st March 31 remeine $129,500 Required: 1. Using the president's new sszumptions in (a) sbove, prepore s schedule of expected cash collections for Aprit, Msy, and June snd for the quarter in totsl. 2 Using the president's new sasumptions in (b) sbove, prepsre the following for merchsndise inventory- a. A merchsndise purcheses budget for April, Moy, snd June- b. A schedule of expected cash disbursements for merchandise purchsses for April, Msy, and June snd for the quirter in totsl. 3. Using the president's new ssumptions, prepsre a cash buoget for Aprlb, Moy, and June, snd for the quarter in tote. Complete this question by entering your answers in the tabs below. Uaing the president's new assumptions in (a) above, prepare a schedule of expected cash mollectiona for April, Msy, and June and for the quarter in total

Garden Soles, Incorporsted, sels garden supplies. Mansgement is planning its cash needs for the second quarter. The compony usublly hes to borrow money during this quarter to support pesk ssles of lewn care equlpment, which occur during Msy. The following informstion has been assembled to ssalst in prepsrling cash budget for the querter. a. Budgeted monthly absorption costing income statements for April-July sre: b. Soles are 20% for cosh and 90% on sccount. c. Soles on sccount are colected over s three-manth perlad with 10% collected in the month of sale; 70% collected in the first month following the month of sale; snd the remaining 20% colected In the second month following the month of sale. February's sales totsled $295,000, snd March's sales totaled $300,000. d. Inventory purchases are poid for within 15 dsyz. Therefore, 50% of a month's liventory purchases are poid for in the month of purchsse. The remsining 50% is poid in the following month. Accounts poysble at Msrch 31 for lnventory purcheses during March totgl $129,500 e. Esch month's ending Inventory must equal 20% of the cost of the merchandse to be sold in the following month. The merchandise inventory st March 31 is $90000 f Dividends of $40,000 will be declared and psid in April. g. Land cocting $49,000 will be purchssed for cash in May. h The cash balance ot March 31 is $62000; the compsny must maintain s cech belance of et leact $40,000 st the end of esch month. L. The compsny has an egreement with s locsl benk that alows the compony to borrow in increments of $1000 st the beginning of each month, up to statal losn belance of $200,000. The interest rate on these losnc is 1% per manth and for simplicity we will sszume that interest is not compounded. The compsny would, ss for ss it is sble, repoy the loen plus sccumulsted interest st the and of the quarter The compony's president is interested in knowing how reducing inventory levels and collecting sccounts recelvable sooner will impoct the cssh budget. He revises the cash colection snd ending imventory ssaumptions as follaws: a. Soles continue to be 20% for cash and 90% on credlt. However, credit sales from April, May, and June are collected over a threemonth period wth 25% collected in the manth of sale, 65% collected in the month following sale, and 10% in the second month following sale. Credit sales from February and March are collected during the second quarter using the collection percentages specified in the main section. b. The company maintains lts ending Inventory levels for Apri, Msy, and June st 15% of the coat of merchandise to be sold in the following month. The merchsndise inventory st March 31 remains $91,000 snd sccounts poyyble for Inventory purchases st March 31 remeine $129,500 Required: 1. Using the president's new sszumptions in (a) sbove, prepore s schedule of expected cash collections for Aprit, Msy, and June snd for the quarter in totsl. 2 Using the president's new sasumptions in (b) sbove, prepsre the following for merchsndise inventory- a. A merchsndise purcheses budget for April, Moy, snd June- b. A schedule of expected cash disbursements for merchandise purchsses for April, Msy, and June snd for the quirter in totsl. 3. Using the president's new ssumptions, prepsre a cash buoget for Aprlb, Moy, and June, snd for the quarter in tote. Complete this question by entering your answers in the tabs below. Uaing the president's new assumptions in (a) above, prepare a schedule of expected cash mollectiona for April, Msy, and June and for the quarter in total. Garden Soles, Incorporsted, sels garden supplies. Mansgement is planning its cash needs for the second quarter. The compony usublly hes to borrow money during this quarter to support pesk ssles of lewn care equlpment, which occur during Msy. The following informstion has been assembled to ssalst in prepsrling cash budget for the querter. a. Budgeted monthly absorption costing income statements for April-July sre: b. Soles are 20% for cosh and 90% on sccount. c. Soles on sccount are colected over s three-manth perlad with 10% collected in the month of sale; 70% collected in the first month following the month of sale; snd the remaining 20% colected In the second month following the month of sale. February's sales totsled $295,000, snd March's sales totaled $300,000. d. Inventory purchases are poid for within 15 dsyz. Therefore, 50% of a month's liventory purchases are poid for in the month of purchsse. The remsining 50% is poid in the following month. Accounts poysble at Msrch 31 for lnventory purcheses during March totgl $129,500 e. Esch month's ending Inventory must equal 20% of the cost of the merchandse to be sold in the following month. The merchandise inventory st March 31 is $90000 f Dividends of $40,000 will be declared and psid in April. g. Land cocting $49,000 will be purchssed for cash in May. h The cash balance ot March 31 is $62000; the compsny must maintain s cech belance of et leact $40,000 st the end of esch month. L. The compsny has an egreement with s locsl benk that alows the compony to borrow in increments of $1000 st the beginning of each month, up to statal losn belance of $200,000. The interest rate on these losnc is 1% per manth and for simplicity we will sszume that interest is not compounded. The compsny would, ss for ss it is sble, repoy the loen plus sccumulsted interest st the and of the quarter The compony's president is interested in knowing how reducing inventory levels and collecting sccounts recelvable sooner will impoct the cssh budget. He revises the cash colection snd ending imventory ssaumptions as follaws: a. Soles continue to be 20% for cash and 90% on credlt. However, credit sales from April, May, and June are collected over a threemonth period wth 25% collected in the manth of sale, 65% collected in the month following sale, and 10% in the second month following sale. Credit sales from February and March are collected during the second quarter using the collection percentages specified in the main section. b. The company maintains lts ending Inventory levels for Apri, Msy, and June st 15% of the coat of merchandise to be sold in the following month. The merchsndise inventory st March 31 remains $91,000 snd sccounts poyyble for Inventory purchases st March 31 remeine $129,500 Required: 1. Using the president's new sszumptions in (a) sbove, prepore s schedule of expected cash collections for Aprit, Msy, and June snd for the quarter in totsl. 2 Using the president's new sasumptions in (b) sbove, prepsre the following for merchsndise inventory- a. A merchsndise purcheses budget for April, Moy, snd June- b. A schedule of expected cash disbursements for merchandise purchsses for April, Msy, and June snd for the quirter in totsl. 3. Using the president's new ssumptions, prepsre a cash buoget for Aprlb, Moy, and June, snd for the quarter in tote. Complete this question by entering your answers in the tabs below. Uaing the president's new assumptions in (a) above, prepare a schedule of expected cash mollectiona for April, Msy, and June and for the quarter in total Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started