Answered step by step

Verified Expert Solution

Question

1 Approved Answer

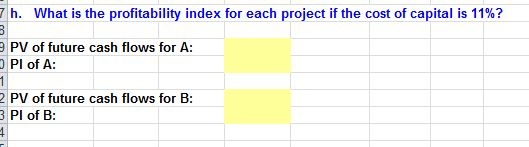

Gardial Fisheries is considering two mutually exclusive investments. The projects' expected net cash flows are as follows: Expected Net Cash Flows Time Project A Project

Gardial Fisheries is considering two mutually exclusive investments. The projects' expected net cash flows are as follows:

Expected Net Cash Flows

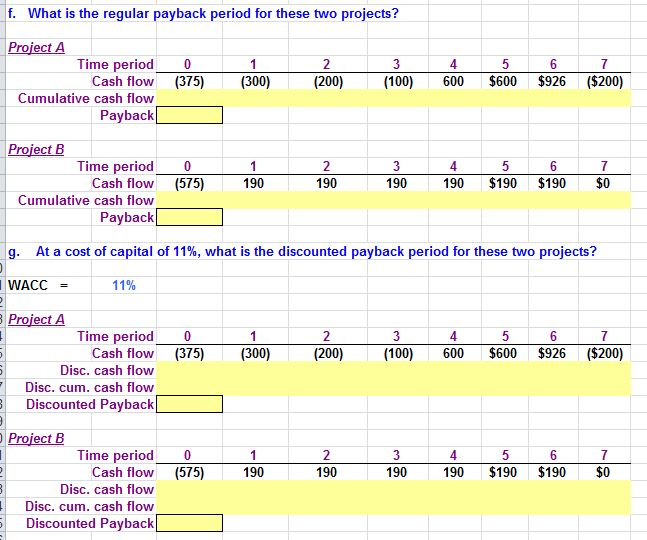

| Time | Project A | Project B |

| 0 | -$375 | -$575 |

| 1 | -$300 | $190 |

| 2 | -$200 | $190 |

| 3 | -$100 | $190 |

| 4 | $600 | $190 |

| 5 | $600 | $190 |

| 6 | $926 | $190 |

| 7 | -$200 | $0 |

I really appreciate all of your help for this! I am so incredibly lost, so please post the working file so I can see how you got to the answer! Again, thank you for your help!

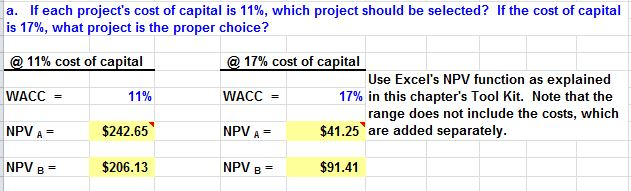

a. If each project's cost of capital is 11%, which project should be selected? If the cost of capital is 17%, what project is the proper choice? @ 11% cost of capital WACC = NPV A = @ 17% cost of capital Use Excel's NPV function as explained 17% in this chapter's Tool Kit. Note that the 11% $242.65" $206.13 WACC = NPV A = NPV B= range does not include the costs, which $41.25 are added separately VA= $91.41 NPV BStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started