Question

Garfield Enterprises employs 3 employees and run their payroll on 25th of each month. Employees are paid via magnetic tape. The EMP201 return is submitted

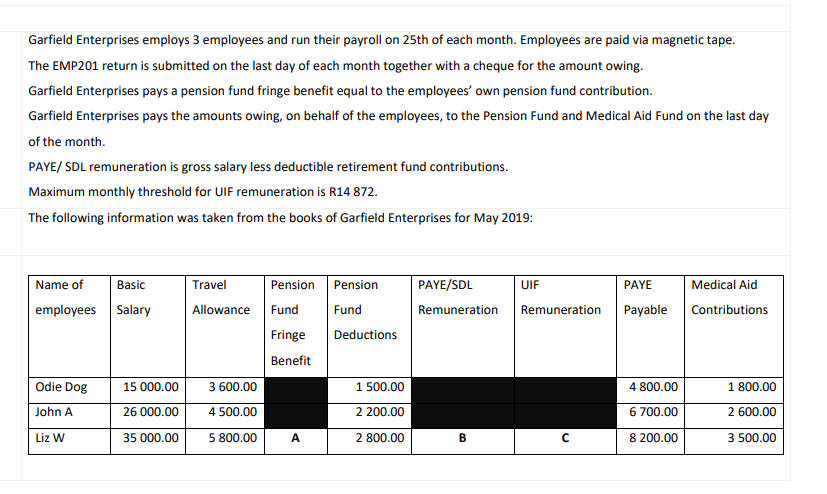

Garfield Enterprises employs 3 employees and run their payroll on 25th of each month. Employees are paid via magnetic tape. The EMP201 return is submitted on the last day of each month together with a cheque for the amount owing. Garfield Enterprises pays a pension fund fringe benefit equal to the employees own pension fund contribution. Garfield Enterprises pays the amounts owing, on behalf of the employees, to the Pension Fund and Medical Aid Fund on the last day of the month.

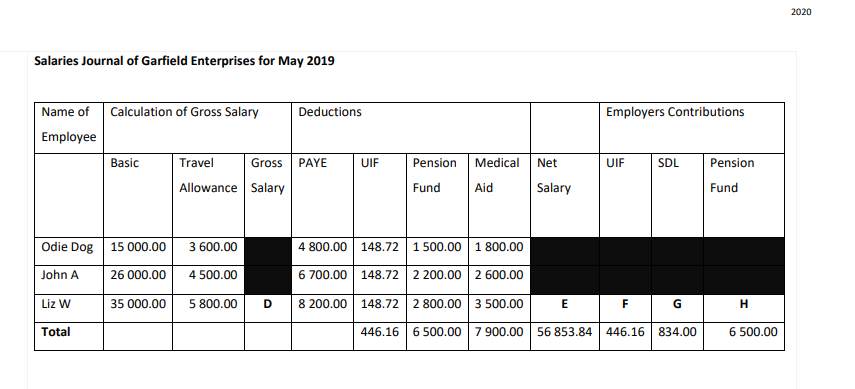

Required: Q.5.1 Complete the Salaries Journal for May 2019 by completing the missing amounts A H. In your answer booklet write down your answer and applicable workings next to the corresponding letter. (10) Q.5.2 Post the May Salaries Journal to the following accounts in the General Ledger of Garfield Enterprises for May 2019: (Balancing not required) Q.5.2.1 EMP201 Control (include payment to SARS and show your workings) (13) Q.5.2.2 Pension Fund Contribution (2)

Required: Q.5.1 Complete the Salaries Journal for May 2019 by completing the missing amounts A H. In your answer booklet write down your answer and applicable workings next to the corresponding letter. (10) Q.5.2 Post the May Salaries Journal to the following accounts in the General Ledger of Garfield Enterprises for May 2019: (Balancing not required) Q.5.2.1 EMP201 Control (include payment to SARS and show your workings) (13) Q.5.2.2 Pension Fund Contribution (2)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started