Please as soon as possible.

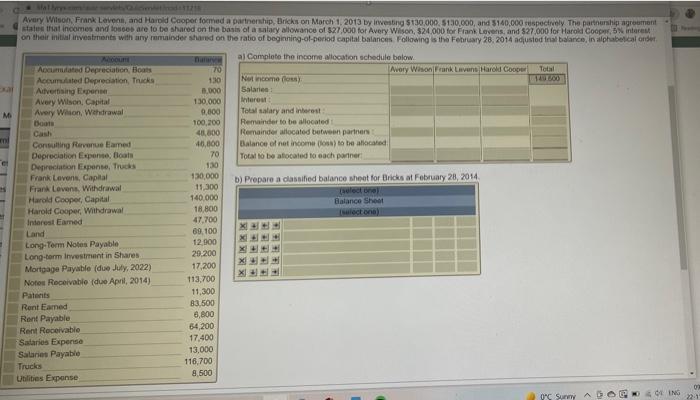

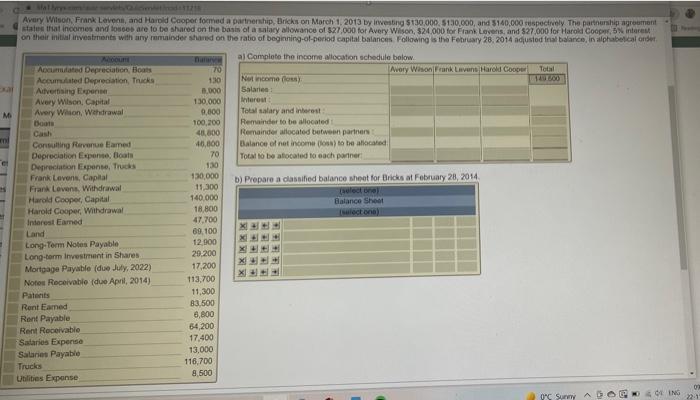

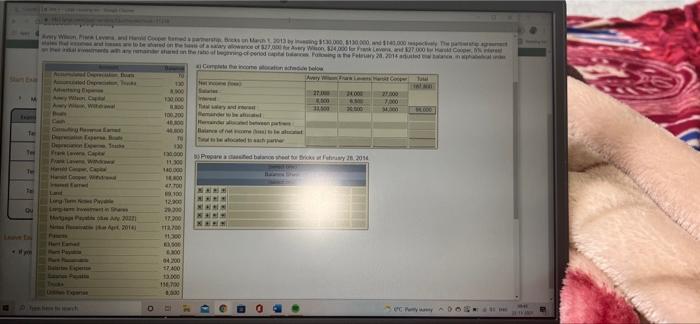

Avary Wilson, Frank Laven, and Harold Cooper formed a partnership, Bricks on March 1, 2013 by investing $130,000, 5130.000, and 3140,000 respectively. The partnership agreement stated that incomes and loucos are to be shared on the basis of a salary wlowance of $27,000 for Avery Wilson, 524000 for Frank Lovers, and $27.000 for Harold Coopwonterem on their init investments with any orainder shared on the ratio of beginning-of-period capital balances. Following is the February 20, 2014 adjusted in balance in alphabetical onder al Complete the income location schedule below. Accumulated Depreciation Boats 70 Wory Wison Frank Lavan Harold Cooper Total Accumulated Depreciation Tracks 130 No como less wa Atvertising Expense 2.000 Salaries Avery Wilson, Capital 130.000 interest . Avery Wilson, Withdrawal 9,000 Total salary and interest Boots 100,200 Remainder to be allocated 40,000 Remainder located between partners Consulting Revenue Eamed 40,000 Balance of net income to be allocated Depreciation Experte Boat 70 Total to be allocated to each partner Depreciation Expense, Trucks 130 Frank Levens, Capital 130,000 b) Prepare a classified balance sheet for Bricks at February 28, 2014 Frank Lovens Withdrawal 11,300 elect Harold Cooper, Capital 140.000 Balance Shoot Harold Cooper Withdrawal 18.800 lectone) Interest Eamed 47.700 Land 89.100 Long-Term Notes Payable 12.900 Long-term investment in Shares 20.200 Mortgage Payable (due July, 2022) 17,200 Not Receivable due April, 2014) 113,700 Patents 11,300 Rent Earned 83.500 Rent Payable 6,800 Rent Receivable 54,200 Salaries Expense 17.400 Salaries Payable 13,000 Trucks 116,700 Utilities Expense 8.500 X X X X X : 0C Sunny ING Wien 13.000, 130.000 1.000 Www to be of 700 W 4.000 kn 100 Carmen 130 00 200 CI 27.00 100 11.500 000 w 200 1.000 100 300 Meme DO 400 Best Tes Deus Cape Prebericht 2014 000 DEI DOCH DOOR How FERO COL Puan 2011 12,200 2000 17.20 1270 110 O 0400 17400 3.000 116 D . Avary Wilson, Frank Laven, and Harold Cooper formed a partnership, Bricks on March 1, 2013 by investing $130,000, 5130.000, and 3140,000 respectively. The partnership agreement stated that incomes and loucos are to be shared on the basis of a salary wlowance of $27,000 for Avery Wilson, 524000 for Frank Lovers, and $27.000 for Harold Coopwonterem on their init investments with any orainder shared on the ratio of beginning-of-period capital balances. Following is the February 20, 2014 adjusted in balance in alphabetical onder al Complete the income location schedule below. Accumulated Depreciation Boats 70 Wory Wison Frank Lavan Harold Cooper Total Accumulated Depreciation Tracks 130 No como less wa Atvertising Expense 2.000 Salaries Avery Wilson, Capital 130.000 interest . Avery Wilson, Withdrawal 9,000 Total salary and interest Boots 100,200 Remainder to be allocated 40,000 Remainder located between partners Consulting Revenue Eamed 40,000 Balance of net income to be allocated Depreciation Experte Boat 70 Total to be allocated to each partner Depreciation Expense, Trucks 130 Frank Levens, Capital 130,000 b) Prepare a classified balance sheet for Bricks at February 28, 2014 Frank Lovens Withdrawal 11,300 elect Harold Cooper, Capital 140.000 Balance Shoot Harold Cooper Withdrawal 18.800 lectone) Interest Eamed 47.700 Land 89.100 Long-Term Notes Payable 12.900 Long-term investment in Shares 20.200 Mortgage Payable (due July, 2022) 17,200 Not Receivable due April, 2014) 113,700 Patents 11,300 Rent Earned 83.500 Rent Payable 6,800 Rent Receivable 54,200 Salaries Expense 17.400 Salaries Payable 13,000 Trucks 116,700 Utilities Expense 8.500 X X X X X : 0C Sunny ING Wien 13.000, 130.000 1.000 Www to be of 700 W 4.000 kn 100 Carmen 130 00 200 CI 27.00 100 11.500 000 w 200 1.000 100 300 Meme DO 400 Best Tes Deus Cape Prebericht 2014 000 DEI DOCH DOOR How FERO COL Puan 2011 12,200 2000 17.20 1270 110 O 0400 17400 3.000 116 D