Answered step by step

Verified Expert Solution

Question

1 Approved Answer

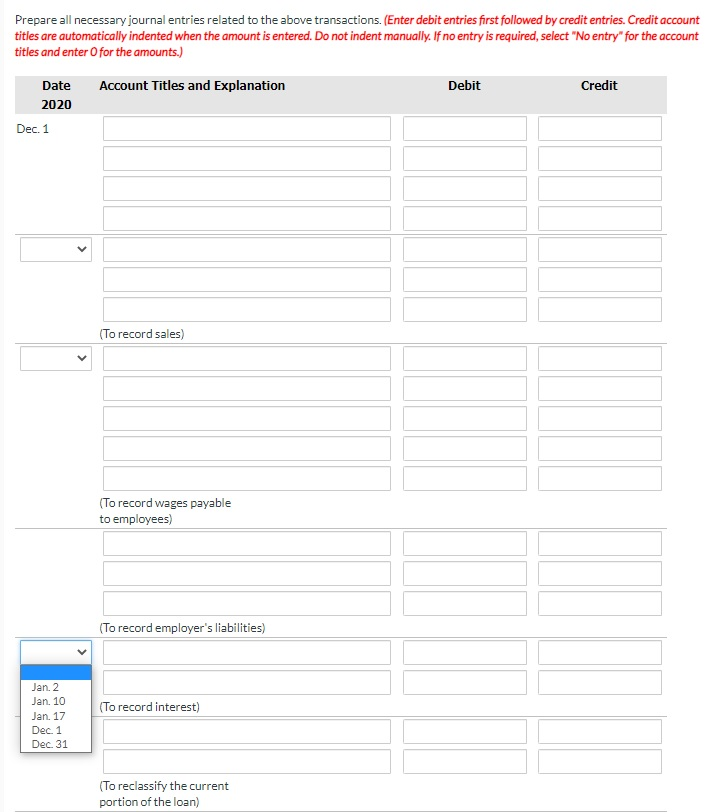

Gargoyle Ltd., which has a December 31 year end, had the following transactions in December 2020 and January 2021: 2020 Dec. 1 Paid the first

Gargoyle Ltd., which has a December 31 year end, had the following transactions in December 2020 and January 2021:

| 2020 | ||

| Dec. 1 | Paid the first instalment on a five-year $4,000 bank loan. The terms of the loan stipulate that Gargoyle must repay 1/5 of the principal every December 1 plus the interest accrued to that date. The loan bears interest at 6% per annum and has been outstanding for 12 months. | |

| Dec. 31 | Recorded the 2% Garbucks granted to customers as part of a loyalty program to be used on future purchases. The Garbucks was granted on eligible purchases of $420,000. Management expects that 20% of the Garbucks awarded to customers will never be redeemed. | |

| Dec. 31 | Recorded employee wages for the last two days in December following the last payday. The wages earned by employees amounted to $2,200 per day and the company recorded CPP of $110, EI of $35, and income taxes of $550. Gargoyles employer contributions were $110 for CPP and $49 for EI. | |

| Dec. 31 | Recorded the adjusting entry to record the interest incurred on the bank loan during December. | |

| Dec. 31 | Recorded the entry to reclassify the current portion of the bank loan. | |

| 2021 | ||

| Jan. 2 | Paid the wages recorded on December 31. | |

| Jan. 10 | A customer used the loyalty program to make a purchase of $8,800. The cost of goods sold to the customer amounted to $4,500. | |

| Jan. 17 | Made the remittance to the government related to the December 31 payroll. |

List of Accounts

- Accounts Payable

- Advertising Revenue

- Bank Loan Payable

- Cash

- Cost of Goods Sold

- CPP Payable

- Current Portion of Long-Term Debt

- Customer Loyalty Provision

- Dividends Payable

- EI Payable

- Employee Income Taxes Payable

- Equipment

- Gift Card Liability

- Interest Expense

- Interest Payable

- Inventory

- Long-Term Loan Payable

- Membership Revenue

- Miscellaneous Expense

- No Entry

- Operating Expenses

- Parts Inventory

- Prepaid Rent

- Registration Revenue

- Rent Expense

- Rent Payable

- Sales Revenue

- Service Revenue

- Subscription Revenue

- Unearned Revenue

- Unearned Warranty Revenue

- Union Dues Payable

- Wages Expense

- Wages Payable

- Warranty Expense

- Warranty Provision

- Warranty Revenue

- WCB Expense

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started