Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Gargoyle Ltd., which has a December 31 year end, had the following transactions in December 2020 and January 2021: 2020 Dec. 1 Paid the first

Gargoyle Ltd., which has a December 31 year end, had the following transactions in December 2020 and January 2021:

| 2020 | ||

| Dec. 1 | Paid the first instalment on a five-year $4,000 bank loan. The terms of the loan stipulate that Gargoyle must repay 1/5 of the principal every December 1 plus the interest accrued to that date. The loan bears interest at 6% per annum and has been outstanding for 12 months. | |

| Dec. 31 | Recorded the 2% Garbucks granted to customers as part of a loyalty program to be used on future purchases. The Garbucks was granted on eligible purchases of $420,000. Management expects that 20% of the Garbucks awarded to customers will never be redeemed. | |

| Dec. 31 | Recorded employee wages for the last two days in December following the last payday. The wages earned by employees amounted to $2,200 per day and the company recorded CPP of $110, EI of $35, and income taxes of $550. Gargoyles employer contributions were $110 for CPP and $49 for EI. | |

| Dec. 31 | Recorded the adjusting entry to record the interest incurred on the bank loan during December. | |

| Dec. 31 | Recorded the entry to reclassify the current portion of the bank loan. | |

| 2021 | ||

| Jan. 2 | Paid the wages recorded on December 31. | |

| Jan. 10 | A customer used the loyalty program to make a purchase of $8,800. The cost of goods sold to the customer amounted to $4,500. | |

| Jan. 17 | Made the remittance to the government related to the December 31 payroll. |

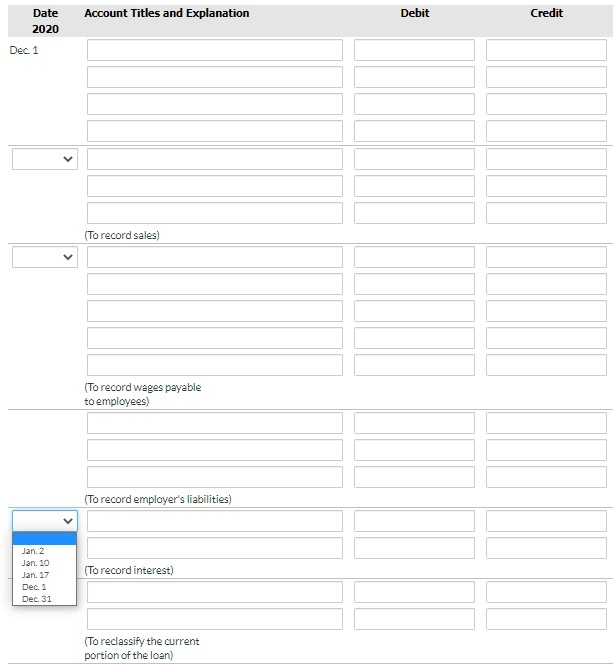

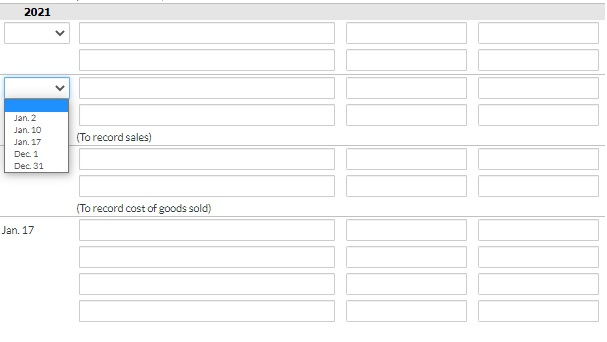

Prepare all necessary journal entries related to the above transactions. (Enter debit entries first followed by credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter 0 for the amounts.)

List of Accounts

- Accounts Payable

- Advertising Revenue

- Bank Loan Payable

- Cash

- Cost of Goods Sold

- CPP Payable

- Current Portion of Long-Term Debt

- Customer Loyalty Provision

- Dividends Payable

- EI Payable

- Employee Income Taxes Payable

- Equipment

- Gift Card Liability

- Interest Expense

- Interest Payable

- Inventory

- Long-Term Loan Payable

- Membership Revenue

- Miscellaneous Expense

- No Entry

- Operating Expenses

- Parts Inventory

- Prepaid Rent

- Registration Revenue

- Rent Expense

- Rent Payable

- Sales Revenue

- Service Revenue

- Subscription Revenue

- Unearned Revenue

- Unearned Warranty Revenue

- Union Dues Payable

- Wages Expense

- Wages Payable

- Warranty Expense

- Warranty Provision

- Warranty Revenue

- WCB Expense

Account Titles and Explanation Debit Date 2020 Credit Dec. 1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started