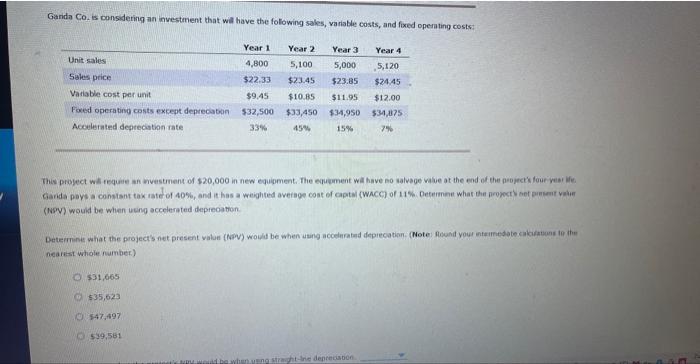

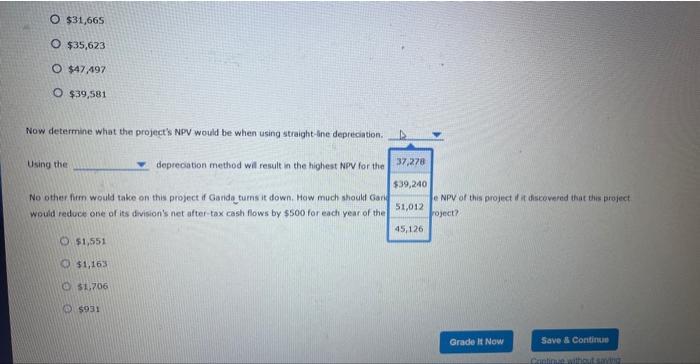

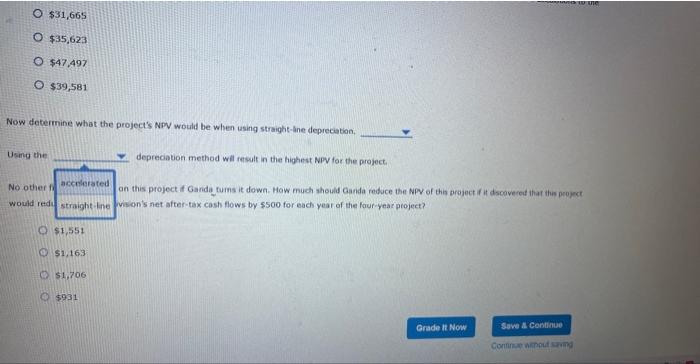

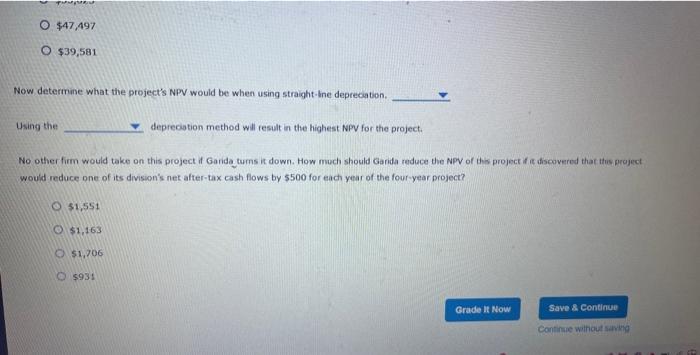

Garida Co. is considering an investment that will have the folowing sales, variable costs, and fixed operating costs: (Nov) would be when ueng accelerated deprecaton. nearest whole number.) $31,665$35,623$47,497$79,581 $31,665$35,623$47,497$39,581 Now determine what the project's NPV would be when using straight-line depreciation. Using the deprecation method wil result in the highest NPV for the 37,278 No other firm would take on this project if Ganda turns it down. How much should Garn Would reduce one of its division's net after-tax cash flows by $500 for each year of the $39,240 51,012 e NPV of this project if if discovered that this project 45,126 $1,551 roject? $1,551$1,169$1,706$931 $31,665$35,623$47,497$39,581 Now determine what the project's NPV would be when using straight-line depreciabon. Using the depreciation method will result in the highest NFV for the project. No other 1 an this project if Ganda furns it down. How much should Ganda reduce the NPV of this project if it dscavered that the proyet would red vison's net after-tax cash flows by $500 for each year of the faur year project? $1,551$1,163$1,706$931 $47,497 $39,581 Now determine what the project's NPV would be when using straight-lne depreciation. Using the depreciation method will result in the highest NPV for the project. No other firm would take on this project if Garide turns it down. How much should Ganda reduce the NPV of thes project if if discovered that itus project would reduce one of its division's net after-tax cash flows by $500 for each year of the four-year project? $1,551$1,163$1,706$931 Garida Co. is considering an investment that will have the folowing sales, variable costs, and fixed operating costs: (Nov) would be when ueng accelerated deprecaton. nearest whole number.) $31,665$35,623$47,497$79,581 $31,665$35,623$47,497$39,581 Now determine what the project's NPV would be when using straight-line depreciation. Using the deprecation method wil result in the highest NPV for the 37,278 No other firm would take on this project if Ganda turns it down. How much should Garn Would reduce one of its division's net after-tax cash flows by $500 for each year of the $39,240 51,012 e NPV of this project if if discovered that this project 45,126 $1,551 roject? $1,551$1,169$1,706$931 $31,665$35,623$47,497$39,581 Now determine what the project's NPV would be when using straight-line depreciabon. Using the depreciation method will result in the highest NFV for the project. No other 1 an this project if Ganda furns it down. How much should Ganda reduce the NPV of this project if it dscavered that the proyet would red vison's net after-tax cash flows by $500 for each year of the faur year project? $1,551$1,163$1,706$931 $47,497 $39,581 Now determine what the project's NPV would be when using straight-lne depreciation. Using the depreciation method will result in the highest NPV for the project. No other firm would take on this project if Garide turns it down. How much should Ganda reduce the NPV of thes project if if discovered that itus project would reduce one of its division's net after-tax cash flows by $500 for each year of the four-year project? $1,551$1,163$1,706$931