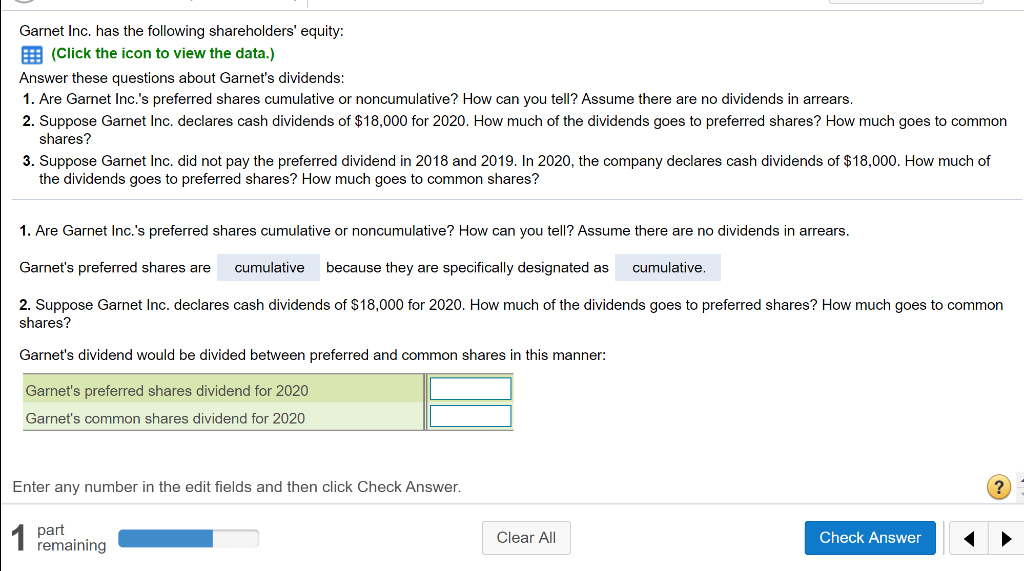

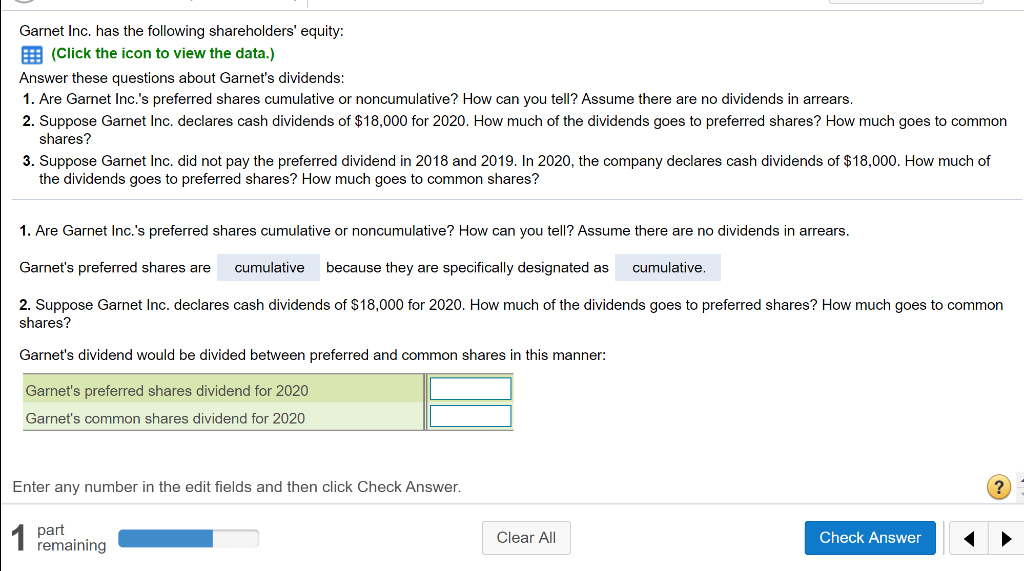

Garnet Inc. has the following shareholders' equity: E (Click the icon to view the data.) Answer these questions about Garnet's dividends: 1. Are Garnet Inc.'s preferred shares cumulative or noncumulative? How can you tell? Assume there are no dividends in arrears. 2. Suppose Garnet Inc. declares cash dividends of $18,000 for 2020. How much of the dividends goes to preferred shares? How much goes to common shares? 3. Suppose Garnet Inc. did not pay the preferred dividend in 2018 and 2019. In 2020, the company declares cash dividends of $18,000. How much of the dividends goes to preferred shares? How much goes to common shares? 1. Are Garnet Inc.'s preferred shares cumulative or noncumulative? How can you tell? Assume there are no dividends in arrears. Garnet's preferred shares are cumulative because they are specifically designated as cumulative. 2. Suppose Garnet Inc. declares cash dividends of $18,000 for 2020. How much of the dividends goes to preferred shares? How much goes to common shares? Garnet's dividend would be divided between preferred and common shares in this manner: Garnet's preferred shares dividend for 2020 Garnet's common shares dividend for 2020 Enter any number in the edit fields and then click Check Answer. ? 1 panta remaining Clear All Check Answer Garnet Inc. has the following shareholders' equity: E (Click the icon to view the data.) Answer these questions about Garnet's dividends: 1. Are Garnet Inc.'s preferred shares cumulative or noncumulative? How can you tell? Assume there are no dividends in arrears. 2. Suppose Garnet Inc. declares cash dividends of $18,000 for 2020. How much of the dividends goes to preferred shares? How much goes to common shares? 3. Suppose Garnet Inc. did not pay the preferred dividend in 2018 and 2019. In 2020, the company declares cash dividends of $18,000. How much of the dividends goes to preferred shares? How much goes to common shares? 1. Are Garnet Inc.'s preferred shares cumulative or noncumulative? How can you tell? Assume there are no dividends in arrears. Garnet's preferred shares are cumulative because they are specifically designated as cumulative. 2. Suppose Garnet Inc. declares cash dividends of $18,000 for 2020. How much of the dividends goes to preferred shares? How much goes to common shares? Garnet's dividend would be divided between preferred and common shares in this manner: Garnet's preferred shares dividend for 2020 Garnet's common shares dividend for 2020 Enter any number in the edit fields and then click Check Answer. ? 1 panta remaining Clear All Check