Question

Garvey Companys unadjusted trial balance includes the following account balances as of December 31, 2022: Debits Credits Cash $ 69,030 Accounts Receivable 116,900 Interest Receivable

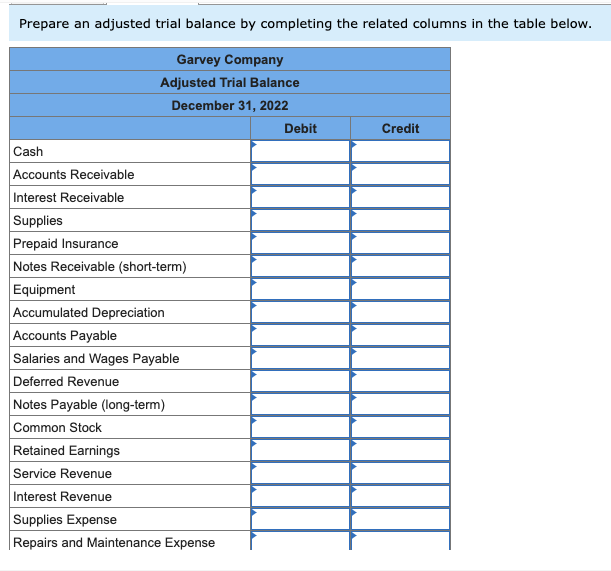

Garvey Companys unadjusted trial balance includes the following account balances as of December 31, 2022:

| Debits | Credits | |

|---|---|---|

| Cash | $ 69,030 | |

| Accounts Receivable | 116,900 | |

| Interest Receivable | 1,320 | |

| Supplies | 139,300 | |

| Prepaid Insurance | 8,750 | |

| Notes Receivable (short-term) | 50,300 | |

| Equipment | 279,200 | |

| Accumulated Depreciation | $ 64,800 | |

| Accounts Payable | 104,600 | |

| Salaries and Wages Payable | 21,700 | |

| Deferred Revenue | 9,300 | |

| Notes Payable (long-term) | 87,800 | |

| Common Stock | 217,200 | |

| Retained Earnings | 144,200 | |

| Service Revenue | 40,700 | |

| Interest Revenue | 22,000 | |

| Supplies Expense | ||

| Repairs and Maintenance Expense | 26,550 | |

| Rent Expense | 17,900 | |

| Depreciation Expense | ||

| Insurance Expense | ||

| Salaries and Wages Expense | 3,050 | |

| Totals | $ 712,300 | $ 712,300 |

The following data are available to determine adjusting entries:

- A) Insurance purchased at the beginning of July for $8,750 provided coverage for twelve months (July 2022 through June 2023). The insurance coverage for July through December totaling $4,375 has now been used.

- B) The company estimates $8,200 in depreciation each year.

- C) A count showed $86,200 of supplies on hand at the end of the year.

- D) An additional $270 of interest has been earned but has not yet been uncollected on the outstanding notes receivable.

- E) Services in the amount of $5,650 were performed for customers who had previously paid in advance.

- F) Services in the amount of $2,100 were performed; these services have not yet been billed or recorded.

Required:

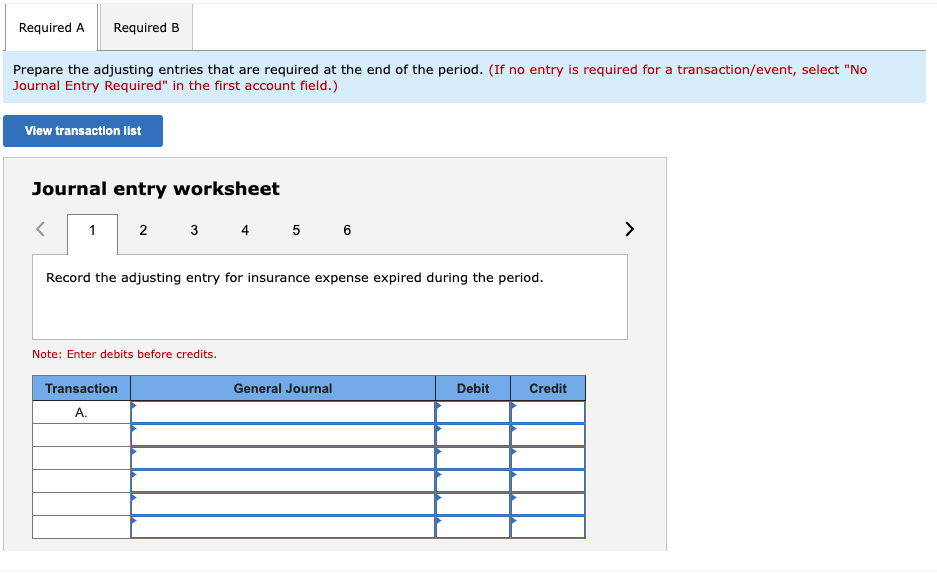

- Prepare the adjusting entries that are required at the end of the period.

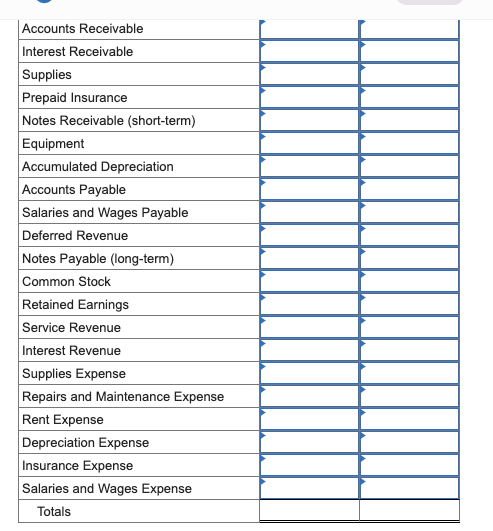

- Prepare an adjusted trial balance by completing the related columns in the table below.

TRANSACTION LIST FOR PART A:

-

1. Record the adjusting entry for insurance expense expired during the period.

-

2. Record the adjusting entry for depreciation expense for the period.

-

3. Record the adjusting entry for supplies used during the period.

-

4. Record the adjusting entry for interest earned and receivable on the outstanding notes receivable for the period.

-

5. Record the adjusting entry for services performed, for which customers had previously paid in advance.

-

6. Record the adjusting entry for services performed, which are not yet billed or recorded.

PART 2:

PART 2:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started