Question

Gary Sofer wants to estimate the market value of the Wabash Oaks Apartments, a 12-unit building with 6 one-bedroom units and 6 two-bedroom units. The

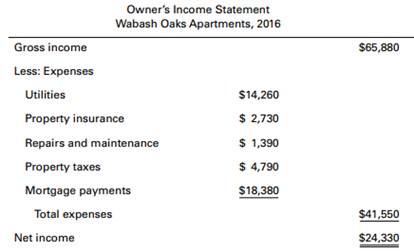

Gary Sofer wants to estimate the market value of the Wabash Oaks Apartments, a 12-unit building with 6 one-bedroom units and 6 two-bedroom units. The present owner of Wabash Oaks provided Gary with the following annual income statement. Todays date is March 1, 2016.

Current rental rates of properties similar to Wabash Oaks typically run from $425 to $450 per month for one-bedroom units and $500 to $550 per month for two-bedroom units. From a study of the market, Gary determined that a reasonable required rate of return for Wabash Oaks would be 9.62% and that vacancy rates for comparable apartment buildings are running around 4%.

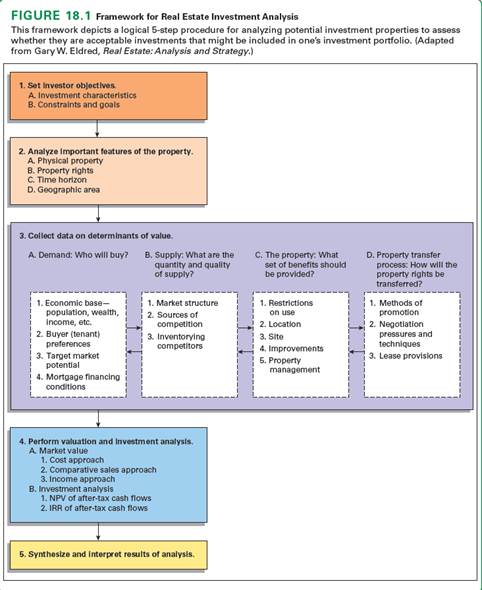

a. Using Figure below, discuss how you might go about evaluating the features of this property.

b. Gary has studied economics and knows about demand and supply, yet he doesnt understand how to apply them to an investment analysis. Advise Gary in a practical way how he might incorporate demand and supply into an investment analysis of the Wabash Oaks Apartments.

c. Should Gary accept the owners income statement as the basis for an income appraisal of Wabash Oaks? Why or why not?

d. In your opinion, what is a reasonable estimate of the market value for the Wabash Oaks?

e. If Gary could buy Wabash Oaks for $10,000 less than its market value, would it be a good investment for him? Explain.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started