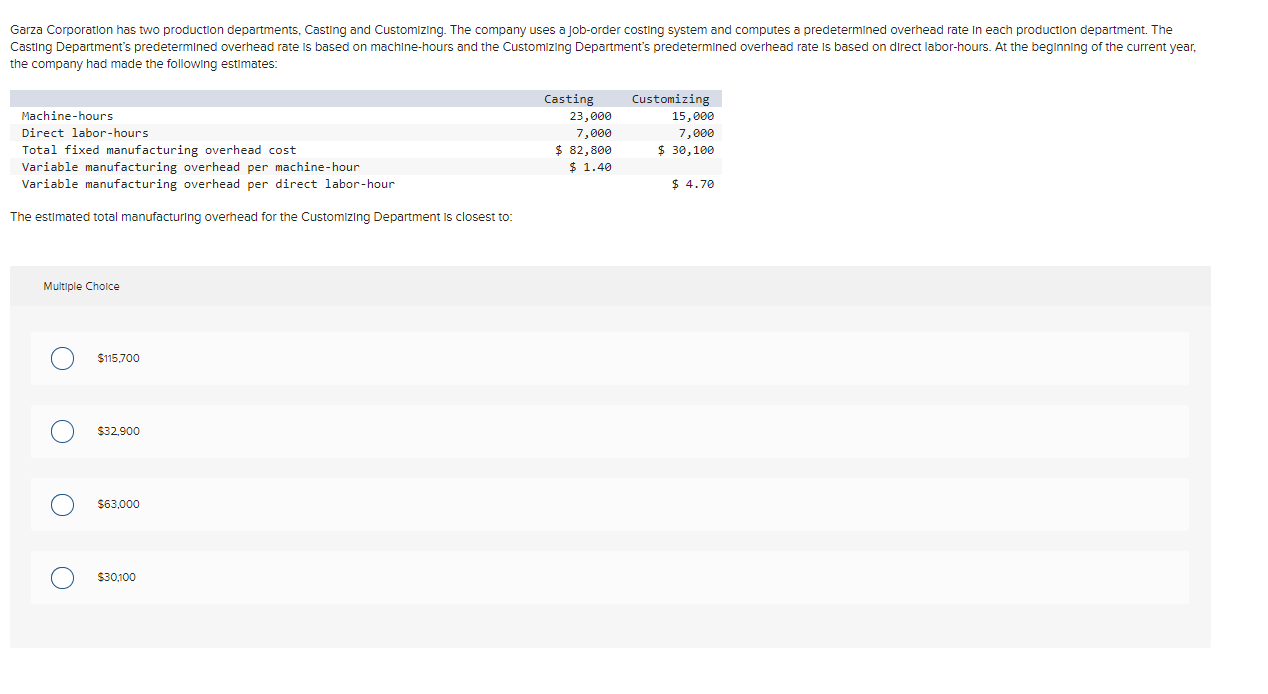

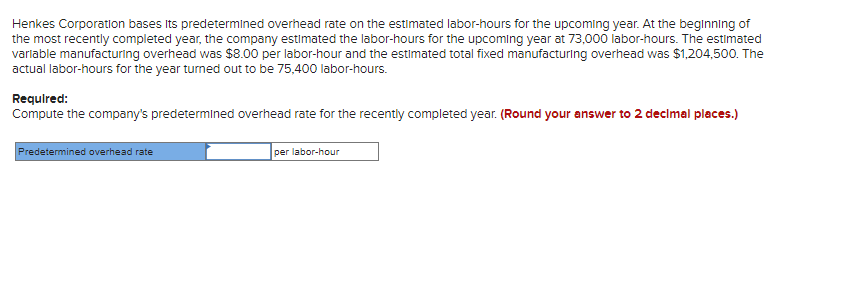

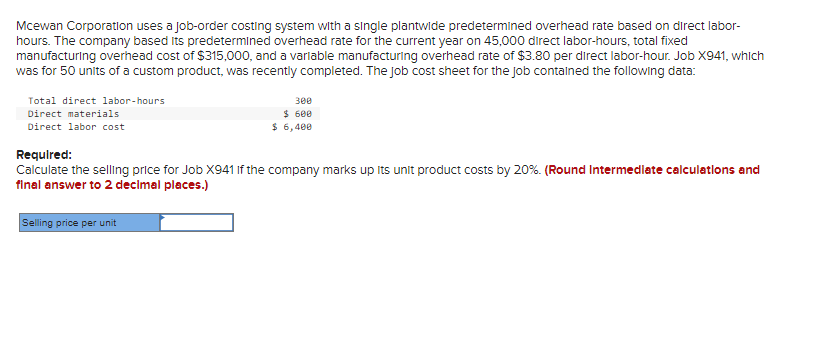

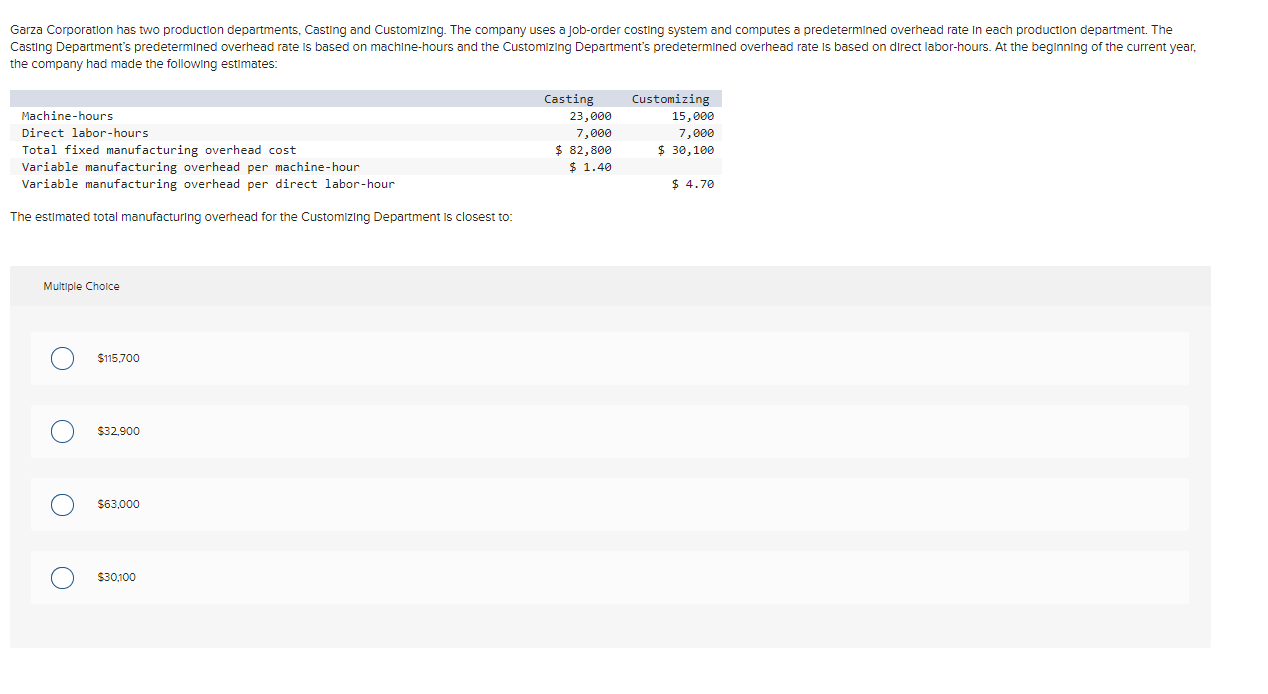

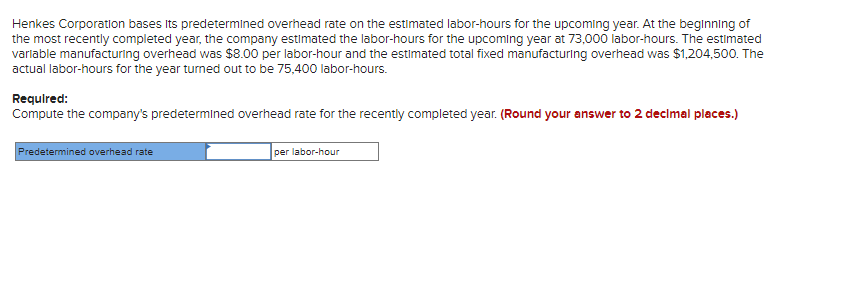

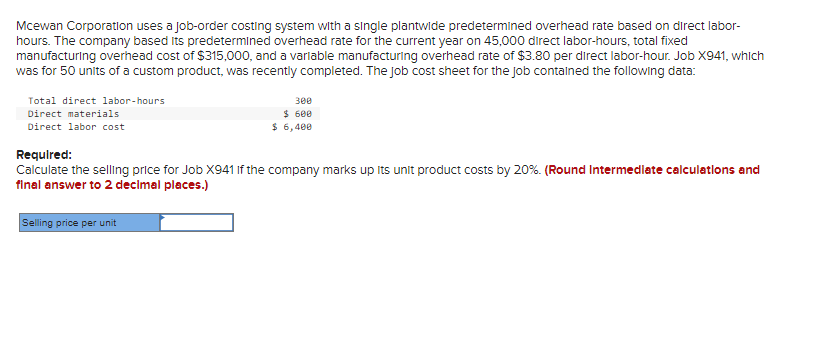

Garza Corporation has two production departments, Casting and Customizing. The company uses a job-order costing system and computes a predetermined overhead rate in each production department. The Casting Department's predetermined overhead rate is based on machine-hours and the Customizing Department's predetermined overhead rate is based on direct labor-hours. At the beginning of the current year, the company had made the following estimates: Machine-hours Direct labor-hours Total fixed manufacturing overhead cost Variable manufacturing overhead per machine-hour Variable manufacturing overhead per direct labor-hour Casting 23,000 7,000 $ 82,800 $ 1.40 Customizing 15,000 7,000 $ 30,100 $ 4.70 The estimated total manufacturing overhead for the Customizing Department is closest to: Multiple Choice O $115.700 d $32.900 O $63.000 $30.100 Henkes Corporation bases its predetermined overhead rate on the estimated labor-hours for the upcoming year. At the beginning of the most recently completed year, the company estimated the labor-hours for the upcoming year at 73,000 labor-hours. The estimated variable manufacturing overhead was $8.00 per labor-hour and the estimated total fixed manufacturing overhead was $1,204,500. The actual labor-hours for the year turned out to be 75,400 labor-hours. Required: Compute the company's predetermined overhead rate for the recently completed year. (Round your answer to 2 decimal places.) Predetermined overhead rate per labor-hour Mcewan Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on direct labor- hours. The company based its predetermined overhead rate for the current year on 45,000 direct labor-hours, total fixed manufacturing overhead cost of $315,000, and a variable manufacturing overhead rate of $3.80 per direct labor-hour. Job X941, which was for 50 units of a custom product, was recently completed. The job cost sheet for the job contained the following data: Total direct labor-hours 3ee Direct materials $ 600 Direct labor cost $ 6,40 Required: Calculate the selling price for Job X941 If the company marks up its unit product costs by 20%. (Round Intermediate calculations and final answer to 2 decimal places.) Selling price per unit